Continued ...

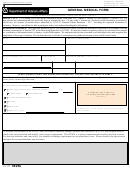

Section IV - Previous Calendar Year Gross Annual Income of Veteran, Spouse and Dependent Children.

Report:

•

Gross annual income from employment, except for income from your farm, ranch, property or business. Include your wages,

bonuses, tips, severance pay and other accrued benefits and your child's income information if it could have been used to pay your

household expenses.

•

Net income from your farm, ranch, property, or business.

•

Other income amounts, including retirement and pension income, Social Security Retirement and Social Security Disability

income, compensation benefits such as VA disability, unemployment, Workers Compensation and Black Lung, cash gifts, interest

and dividends, including tax exempt earnings and distributions from Individual Retirement Accounts (IRAs) or annuities.

Do Not Report:

Donations from public or private relief, welfare or charitable organizations; Supplemental Security Income (SSI) and need-based

payments from a government agency; profit from the occasional sale of property; income tax refunds, reinvested interest on

Individual Retirement Accounts (IRAs); scholarships and grants for school attendance; disaster relief payments; reimbursement for

casualty loss; loans; Radiation Compensation Exposure Act payments; Agent Orange settlement payments; Alaska Native Claims

Settlement Acts Income, payments to foster parent; amounts in joint accounts in banks and similar institutions acquired by reason of

death of the other joint owner; Japanese ancestry restitution under Public Law 100-383; cash surrender value of life insurance; lump-

sum proceeds of life insurance policy on a Veteran; and payments received under the Medicare transitional assistance program.

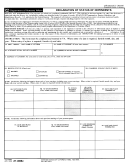

Section V - Previous Calendar Year Deductible Expenses.

Report non-reimbursed medical expenses paid by you or your spouse. Include expenses for medical and dental care, medications,

eyeglasses, Medicare, medical insurance premiums and other health care expenses paid by you for dependents and persons for whom

you have a legal or moral obligation to support. Do not list expenses if you expect to receive reimbursement from insurance or other

sources. Report last illness and burial expenses, e.g., prepaid burial, paid by the Veteran for spouse or dependent(s).

Section VI and Section VII - Submitting your update.

1. Read Paperwork Reduction and Privacy Act Information, Section VII Consent to Copays and Assignment of Benefits.

2. Sign and Date the form. You or an individual to whom you have delegated your Power of Attorney must sign and date the form.

If you sign with an "X", 2 people you know must witness you as you sign. They must sign the form and print their names. If the

form is not signed and dated appropriately, VA will return it for you to complete.

3. Attach any continuation sheets, a copy of supporting materials or your Power of Attorney documents to your application.

Where do I mail my update?

Mail the completed VA Form 10-10EZR and any supporting materials to the Health Eligibility Center, 2957 Clairmont Road, Suite

200, Atlanta, GA 30329.

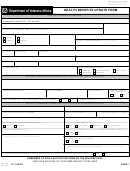

PAPERWORK REDUCTION ACT AND PRIVACY ACT INFORMATION

The Paperwork Reduction Act of 1995 requires us to notify you that this information collection is in accordance with the clearance

requirements of Section 3507 of the Paperwork Reduction Act of 1995. We may not conduct or sponsor, and you are not required to

respond to, a collection of information unless it displays a valid OMB number. We anticipate that the time expended by all individuals

who must complete this form will average 15 minutes. This includes the time it will take to read instructions, gather the necessary facts

and fill out the form.

Privacy Act Information: VA is asking you to provide the information on this form under 38 U.S.C. Sections 1710, 1712, and 1722 in

order for VA to determine your eligibility for medical benefits.

Information you supply may be verified from initial submission forward

through a computer matching

program. VA may disclose the information that you put on the form as permitted by law. VA may make a

"routine use" disclosure of the information as outlined in the Privacy Act systems of records notices and in accordance with the Notice of

Privacy Practices. Providing the requested information is voluntary, but if any or all of the requested information is not provided, it may

delay or result in denial of your request for health care benefits. Failure to furnish the information will not have any effect on any other

benefits to which you may be entitled. If you provide VA your Social Security Number, VA will use it to administer your VA benefits.

VA may also use this information to identify veterans and persons claiming or receiving VA benefits and their records, and for other

purposes authorized or required by law.

VA FORM

10-10EZR

APR 2017

1

1 2

2 3

3 4

4