Form Pro-9703 - Certificate Of Continuing Eligibility For Commercial Revitalization/expansion Abatement And Commercial Rent Tax Special Reduction - Nyc Department Of Finance

ADVERTISEMENT

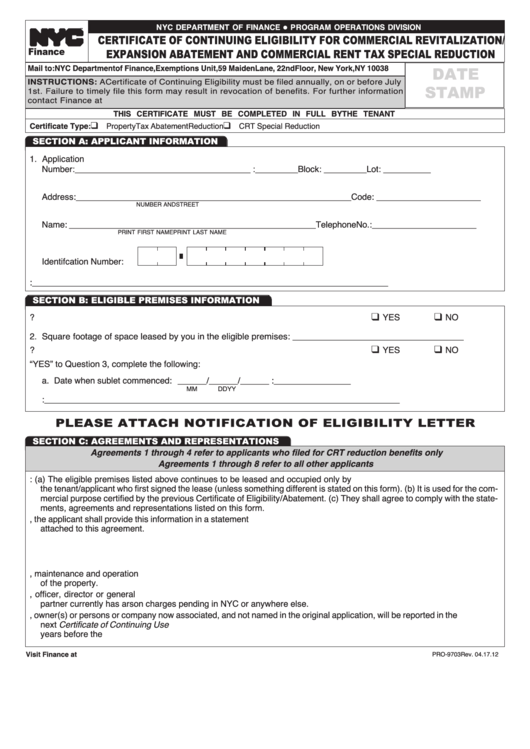

NYC DEPARTMENT OF FINANCE

PROGRAM OPERATIONS DIVISION

G

CERTIFICATE OF CONTINUING ELIGIBILITY FOR COMMERCIAL REVITALIZATION/

TM

EXPANSION ABATEMENT AND COMMERCIAL RENT TAX SPECIAL REDUCTION

Finance

DATE

Mail to: NYC Department of Finance, Exemptions Unit, 59 Maiden Lane, 22nd Floor, New York, NY 10038

INSTRUCTIONS: A Certificate of Continuing Eligibility must be filed annually, on or before July

STAMP

1st. Failure to timely file this form may result in revocation of benefits. For further information

contact Finance at commercialexemptions@finance.nyc.gov

THIS CERTIFICATE MUST BE COMPLETED IN FULL BY THE TENANT

Certificate Type:

Property Tax Abatement Reduction

CRT Special Reduction

K

K

SECTION A: APPLICANT INFORMATION

1. Application

Number:_____________________________________

2. Borough:_________ Block: _________ Lot: __________

3. Property

4. Zip

Address: __________________________________________________________

Code: ______________________

NUMBER AND STREET

5. Tenantʼs

6. Tenantʼs

Name: ____________________________________________________

Telephone No.: ______________________

PRINT FIRST NAME

PRINT LAST NAME

6. Tenantʼs Employer

Identifcation Number:

7. Tenantʼs email address: ___________________________________________________________________________

SECTION B: ELIGIBLE PREMISES INFORMATION

1. Are you using the premises for the same purposes?

YES

NO

K

K

2. Square footage of space leased by you in the eligible premises: ___________________________________

3. Are any areas of your space subleased or occupied by other entities?

YES

NO

K

K

4. If you answered “YES” to Question 3, complete the following:

a. Date when sublet commenced: ______/______/______

b. Sublet Square Footage:________________

MM

DD

YY

c. Explain Relationship:__________________________________________________________________________

PLEASE ATTACH NOTIFICATION OF ELIGIBILITY LETTER

SECTION C: AGREEMENTS AND REPRESENTATIONS

Agreements 1 through 4 refer to applicants who filed for CRT reduction benefits only

Agreements 1 through 8 refer to all other applicants

1. The applicant certifies the following: (a) The eligible premises listed above continues to be leased and occupied only by

the tenant/applicant who first signed the lease (unless something different is stated on this form). (b) It is used for the com-

mercial purpose certified by the previous Certificate of Eligibility/Abatement. (c) They shall agree to comply with the state-

ments, agreements and representations listed on this form.

2. If this building has been apportioned or merged in the past year, the applicant shall provide this information in a statement

attached to this agreement.

3. The applicant will provide additional information when necessary.

4. The applicant will comply with any changes to the rules of the Property Abatement/CRT Special Reduction Program.

5. The applicant has paid all taxes and charges due on the property.

6. The applicant will comply with all sections of law and regulations relating to the construction, maintenance and operation

of the property.

7. Information will be plainly disclosed in an attachment to this form if the applicant or owner, officer, director or general

partner currently has arson charges pending in NYC or anywhere else.

8. Any new, owner(s) or persons or company now associated, and not named in the original application, will be reported in the

next Certificate of Continuing Use filed. These companies or persons shall not have been found guilty of arson within seven

years before the application. A detailed statement will be attached to this application if charges or arson are pending.

Visit Finance at nyc.gov/finance

PRO-9703 Rev. 04.17.12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2