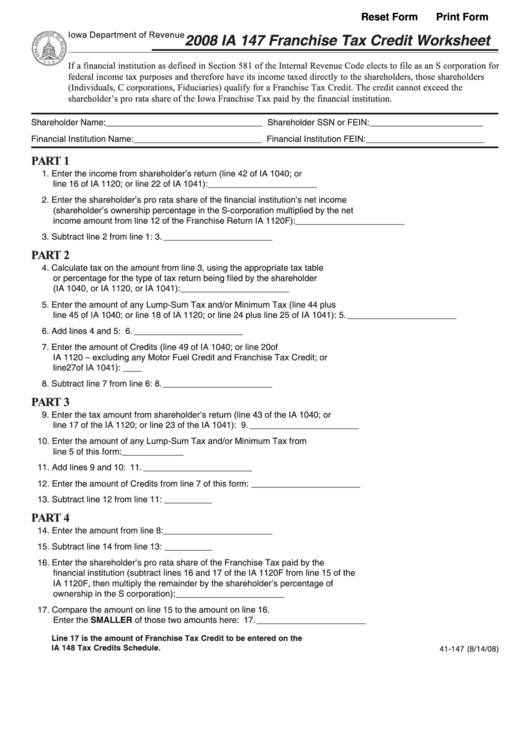

Reset Form

Print Form

Iowa Department of Revenue

2008 IA 147 Franchise Tax Credit Worksheet

If a financial institution as defined in Section 581 of the Internal Revenue Code elects to file as an S corporation for

federal income tax purposes and therefore have its income taxed directly to the shareholders, those shareholders

(Individuals, C corporations, Fiduciaries) qualify for a Franchise Tax Credit. The credit cannot exceed the

shareholder’s pro rata share of the Iowa Franchise Tax paid by the financial institution.

Shareholder Name: _________________________________ Shareholder SSN or FEIN: ________________________

Financial Institution Name: ___________________________ Financial Institution FEIN: _________________________

PART 1

1. Enter the income from shareholder’s return (line 42 of IA 1040; or

line 16 of IA 1120; or line 22 of IA 1041): ............................................................ 1. _______________________

2. Enter the shareholder’s pro rata share of the financial institution’s net income

(shareholder’s ownership percentage in the S-corporation multiplied by the net

income amount from line 12 of the Franchise Return IA 1120F): ........................ 2. _______________________

3. Subtract line 2 from line 1: ................................................................................... 3. _______________________

PART 2

4. Calculate tax on the amount from line 3, using the appropriate tax table

or percentage for the type of tax return being filed by the shareholder

(IA 1040, or IA 1120, or IA 1041): ....................................................................... 4. _______________________

5. Enter the amount of any Lump-Sum Tax and/or Minimum Tax (line 44 plus

line 45 of IA 1040; or line 18 of IA 1120; or line 24 plus line 25 of IA 1041): ....... 5. _______________________

6. Add lines 4 and 5: ................................................................................................ 6. _______________________

7. Enter the amount of Credits (line 49 of IA 1040; or line 20 of

IA 1120 – excluding any Motor Fuel Credit and Franchise Tax Credit; or

line 27 of IA 1041): .............................................................................................. 7. _______________________

8. Subtract line 7 from line 6: ................................................................................... 8. _______________________

PART 3

9. Enter the tax amount from shareholder’s return (line 43 of the IA 1040; or

line 17 of the IA 1120; or line 23 of the IA 1041): ................................................ 9. _______________________

10. Enter the amount of any Lump-Sum Tax and/or Minimum Tax from

line 5 of this form: .............................................................................................. 10. _______________________

11. Add lines 9 and 10: ............................................................................................ 11. _______________________

12. Enter the amount of Credits from line 7 of this form: ......................................... 12. _______________________

13. Subtract line 12 from line 11: ............................................................................. 13. _______________________

PART 4

14. Enter the amount from line 8: ............................................................................ 14. _______________________

15. Subtract line 14 from line 13: ............................................................................. 15. _______________________

16. Enter the shareholder’s pro rata share of the Franchise Tax paid by the

financial institution (subtract lines 16 and 17 of the IA 1120F from line 15 of the

IA 1120F, then multiply the remainder by the shareholder’s percentage of

ownership in the S corporation): ....................................................................... 16. _______________________

17. Compare the amount on line 15 to the amount on line 16.

Enter the SMALLER of those two amounts here: ............................................. 17. _______________________

Line 17 is the amount of Franchise Tax Credit to be entered on the

IA 148 Tax Credits Schedule.

41-147 (8/14/08)

1

1