Form 00-750 - Audit Questionnaire

Download a blank fillable Form 00-750 - Audit Questionnaire in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 00-750 - Audit Questionnaire with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

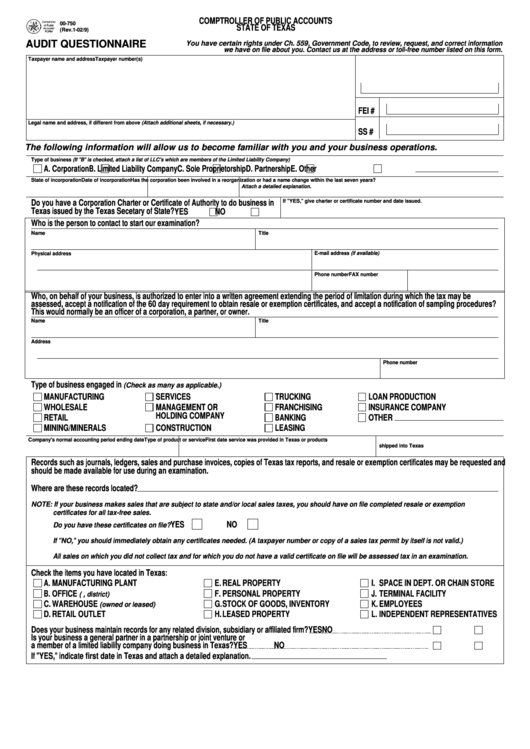

COMPTROLLER OF PUBLIC ACCOUNTS

00-750

STATE OF TEXAS

(Rev.1-02/9)

AUDIT QUESTIONNAIRE

You have certain rights under Ch. 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or toll-free number listed on this form.

Taxpayer name and address

Taxpayer number(s)

FEI #

Legal name and address, if different from above (Attach additional sheets, if necessary.)

SS #

The following information will allow us to become familiar with you and your business operations.

Type of business (If "B" is checked, attach a list of LLC's which are members of the Limited Liability Company)

A. Corporation

B. Limited Liability Company

C. Sole Proprietorship

D. Partnership

E. Other

State of incorporation

Date of incorporation

Has the corporation been involved in a reorganization or had a name change within the last seven years?

Attach a detailed explanation.

Do you have a Corporation Charter or Certificate of Authority to do business in

If "YES," give charter or certificate number and date issued.

Texas issued by the Texas Secetary of State?

YES

NO

Who is the person to contact to start our examination?

Name

Title

E-mail address (if available)

Physical address

Phone number

FAX number

Who, on behalf of your business, is authorized to enter into a written agreement extending the period of limitation during which the tax may be

assessed, accept a notification of the 60 day requirement to obtain resale or exemption certificates, and accept a notification of sampling procedures?

This would normally be an officer of a corporation, a partner, or owner.

Name

Title

Address

Phone number

Type of business engaged in

(Check as many as applicable.)

MANUFACTURING

SERVICES

TRUCKING

LOAN PRODUCTION

WHOLESALE

MANAGEMENT OR

FRANCHISING

INSURANCE COMPANY

HOLDING COMPANY

RETAIL

BANKING

OTHER

MINING/MINERALS

CONSTRUCTION

LEASING

Company's normal accounting period ending date

Type of product or service

First date service was provided in Texas or products

shipped into Texas

Records such as journals, ledgers, sales and purchase invoices, copies of Texas tax reports, and resale or exemption certificates may be requested and

should be made available for use during an examination.

Where are these records located?

NOTE: If your business makes sales that are subject to state and/or local sales taxes, you should have on file completed resale or exemption

certificates for all tax-free sales.

YES

NO

Do you have these certificates on file?

If "NO," you should immediately obtain any certificates needed. (A taxpayer number or copy of a sales tax permit by itself is not valid.)

All sales on which you did not collect tax and for which you do not have a valid certificate on file will be assessed tax in an examination.

Check the items you have located in Texas:

A.

MANUFACTURING PLANT

E.

REAL PROPERTY

I.

SPACE IN DEPT. OR CHAIN STORE

B.

OFFICE

F.

PERSONAL PROPERTY

J.

TERMINAL FACILITY

(e.g., district)

C.

WAREHOUSE

G.

STOCK OF GOODS, INVENTORY

K.

EMPLOYEES

(owned or leased)

D.

RETAIL OUTLET

H.

LEASED PROPERTY

L.

INDEPENDENT REPRESENTATIVES

Does your business maintain records for any related division, subsidiary or affiliated firm?

YES

NO

Is your business a general partner in a partnership or joint venture or

a member of a limited liability company doing business in Texas?

YES

NO

If "YES," indicate first date in Texas and attach a detailed explanation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2