Instruction For Form Fr-900a - Employer'S Withholding Tax Annual Return

ADVERTISEMENT

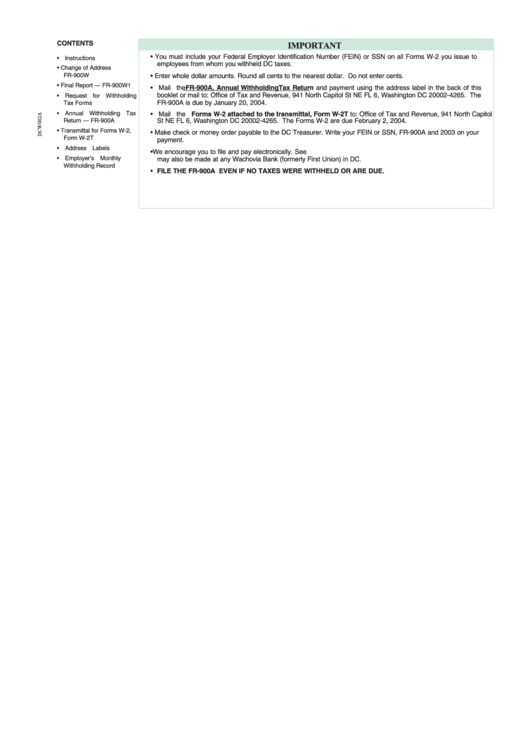

CONTENTS

IMPORTANT

• You must include your Federal Employer Identification Number (FEIN) or SSN on all Forms W-2 you issue to

• Instructions

employees from whom you withheld DC taxes.

• Change of Address

FR-900W

• Enter whole dollar amounts. Round all cents to the nearest dollar. Do not enter cents.

• Final Report — FR-900W1

• Mail the FR-900A, Annual WithholdingTax Return and payment using the address label in the back of this

booklet or mail to: Office of Tax and Revenue, 941 North Capitol St NE FL 6, Washington DC 20002-4265. The

• Request for Withholding

FR-900A is due by January 20, 2004.

Tax Forms

• Annual Withholding Tax

• Mail the Forms W-2 attached to the transmittal, Form W-2T to: Office of Tax and Revenue, 941 North Capitol

Return — FR-900A

St NE FL 6, Washington DC 20002-4265. The Forms W-2 are due February 2, 2004.

• Transmittal for Forms W-2,

• Make check or money order payable to the DC Treasurer. Write your FEIN or SSN, FR-900A and 2003 on your

Form W-2T

payment.

• Address Labels

• We encourage you to file and pay electronically. See for electronic payment options. Payments

• Employer’s Monthly

may also be made at any Wachovia Bank (formerly First Union) in DC.

Withholding Record

• FILE THE FR-900A EVEN IF NO TAXES WERE WITHHELD OR ARE DUE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4