Form 35-003a - Construction Contract Claim For Refund

ADVERTISEMENT

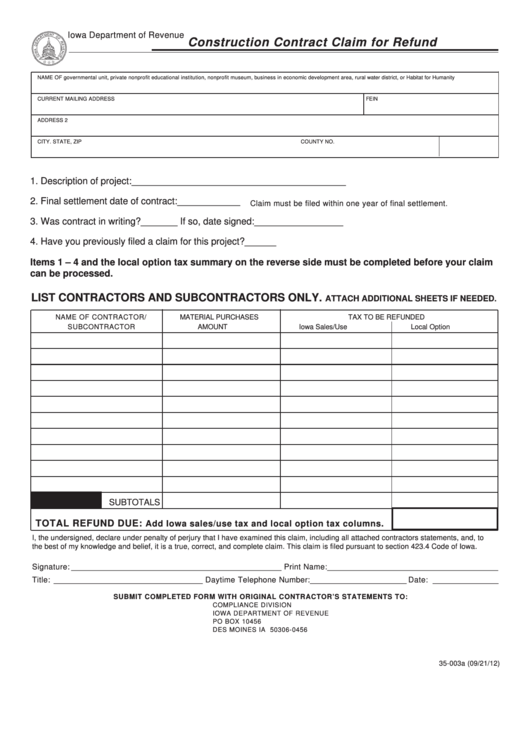

Iowa Department of Revenue

Construction Contract Claim for Refund

NAME OF governmental unit, private nonprofit educational institution, nonprofit museum, business in economic development area, rural water district, or Habitat for Humanity

CURRENT MAILING ADDRESS

FEIN

ADDRESS 2

CITY. STATE, ZIP

COUNTY NO.

1. Description of project: _________________________________________

2. Final settlement date of contract: ____________

Claim must be filed within one year of final settlement.

3. Was contract in writing? _______ If so, date signed: _________________

4. Have you previously filed a claim for this project? ______

Items 1 – 4 and the local option tax summary on the reverse side must be completed before your claim

can be processed.

LIST CONTRACTORS AND SUBCONTRACTORS ONLY.

ATTACH ADDITIONAL SHEETS IF NEEDED.

NAME OF CONTRACTOR/

MATERIAL PURCHASES

TAX TO BE REFUNDED

SUBCONTRACTOR

AMOUNT

Iowa Sales/Use

Local Option

SUBTOTALS

TOTAL REFUND DUE:

Add Iowa sales/use tax and local option tax columns.

I, the undersigned, declare under penalty of perjury that I have examined this claim, including all attached contractors statements, and, to

the best of my knowledge and belief, it is a true, correct, and complete claim. This claim is filed pursuant to section 423.4 Code of Iowa.

Signature: ________________________________________________ Print Name: _______________________________________

Title: __________________________________ Daytime Telephone Number: ______________________ Date: _______________

SUBMIT COMPLETED FORM WITH ORIGINAL CONTRACTOR’S STATEMENTS TO:

COMPLIANCE DIVISION

IOWA DEPARTMENT OF REVENUE

PO BOX 10456

DES MOINES IA 50306-0456

35-003a (09/21/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2