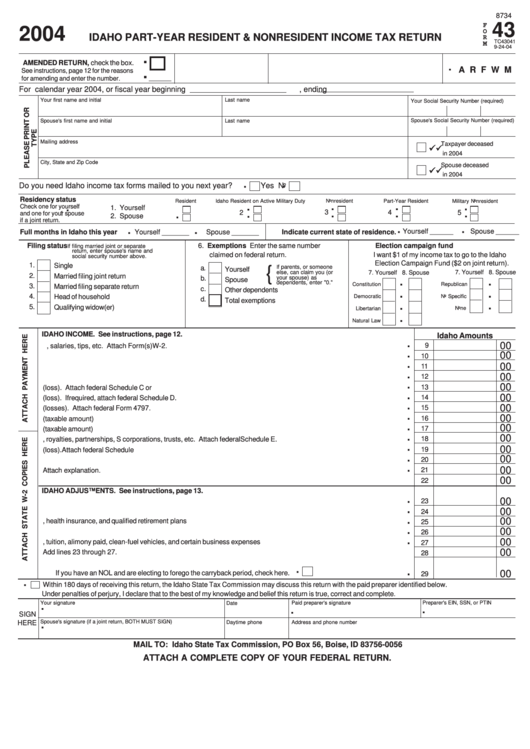

8734

43

F

2004

O

IDAHO PART-YEAR RESIDENT & NONRESIDENT INCOME TAX RETURN

R

TC43041

M

9-24-04

.

.

AMENDED RETURN, check the box.

A R F W M

.

See instructions, page 12 for the reasons

for amending and enter the number.

For calendar year 2004, or fiscal year beginning

, ending

Your first name and initial

Last name

Your Social Security Number (required)

Last name

Spouse's Social Security Number (required)

Spouse's first name and initial

Mailing address

Taxpayer deceased

in 2004

City, State and Zip Code

Spouse deceased

in 2004

.

.

Do you need Idaho income tax forms mailed to you next year?

Yes

No

Residency status

Resident

Idaho Resident on Active Military Duty

Nonresident

. .

Part-Year Resident

. .

Military Nonresident

. .

. .

. .

Check one for yourself

1. Yourself

3

4

5

2

and one for your spouse

1

2. Spouse

if a joint return.

.

.

.

.

Yourself ______

Spouse ______

Full months in Idaho this year

Yourself _______

Spouse _______

Indicate current state of residence.

Filing status

6. Exemptions Enter the same number

Election campaign fund

I

f filing married joint or separate

return, enter spouse's name and

claimed on federal return.

I want $1 of my income tax to go to the Idaho

social security number above.

Election Campaign Fund ($2 on joint return).

1.

Single

f parents, or someone

a.

{

I

Yourself

else, can claim you (or

7. Yourself 8. Spouse

7. Yourself 8. Spouse

2.

Married filing joint return

.

.

b.

your spouse) as

Spouse

dependents, enter "0."

Republican

Constitution

3.

Married filing separate return

c.

.

.

Other dependents

4.

Head of household

Democratic

No Specific

d.

Total exemptions

.

.

5.

Qualifying widow(er)

None

Libertarian

.

Natural Law

IDAHO INCOME. See instructions, page 12.

Idaho Amounts

.

00

9

9. Wages, salaries, tips, etc. Attach Form(s) W-2. .........................................................................................................

.

00

10

10. Taxable interest income ...............................................................................................................................................

.

00

11

11. Dividend income ..........................................................................................................................................................

.

00

12

12. Alimony received .........................................................................................................................................................

.

00

13. Business income or (loss). Attach federal Schedule C or C-EZ. .................................................................................

13

.

00

14

14. Capital gain or (loss). If required, attach federal Schedule D. ......................................................................................

.

00

15

15. Other gains or (losses). Attach federal Form 4797. .....................................................................................................

.

00

16

16. IRA distributions (taxable amount) ...............................................................................................................................

.

00

17

17. Pensions and annuities (taxable amount) .....................................................................................................................

.

00

18

18. Rents, royalties, partnerships, S corporations, trusts, etc. Attach federal Schedule E. ................................................

.

00

19

19. Farm income or (loss). Attach federal Schedule F. .....................................................................................................

.

00

20

20. Unemployment compensation ......................................................................................................................................

.

00

21

21. Other income. Attach explanation. ...............................................................................................................................

00

22

22. TOTAL INCOME. Add lines 9 through 21.

IDAHO ADJUSTMENTS. See instructions, page 13.

.

23. Deductions for IRAs and health savings account .........................................................................................................

00

23

.

00

24. Moving expenses. Attach federal Form 3903. .............................................................................................................

24

.

00

25. Deductions for self-employment tax, health insurance, and qualified retirement plans .................................................

25

.

00

26. Penalty on early withdrawal of savings .........................................................................................................................

26

.

00

27. Deductions for student loan interest, tuition, alimony paid, clean-fuel vehicles, and certain business expenses ...........

27

00

28. TOTAL ADJUSTMENTS. Add lines 23 through 27. ...................................................................................................

28

29. ADJUSTED GROSS INCOME. Subtract line 28 from line 22.

.

.

00

If you have an NOL and are electing to forego the carryback period, check here.

29

.

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

.

Your signature

Paid preparer's signature

Preparer's EIN, SSN, or PTIN

Date

.

.

SIGN

.

Spouse's signature (if a joint return, BOTH MUST SIGN)

HERE

Daytime phone

Address and phone number

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN.

1

1 2

2