Form Ptt-173 Instructions - Property Transfer Tax Payment Voucher

ADVERTISEMENT

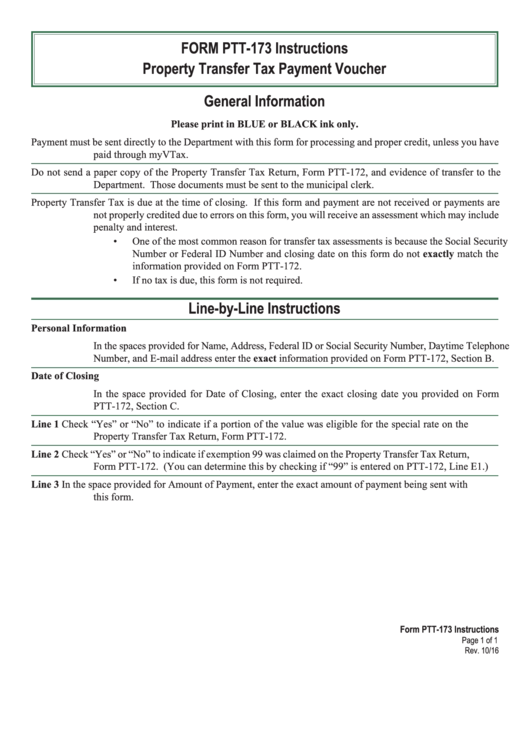

FORM PTT-173 Instructions

Property Transfer Tax Payment Voucher

General Information

Please print in BLUE or BLACK ink only.

Payment must be sent directly to the Department with this form for processing and proper credit, unless you have

paid through myVTax.

Do not send a paper copy of the Property Transfer Tax Return, Form PTT-172, and evidence of transfer to the

Department. Those documents must be sent to the municipal clerk.

Property Transfer Tax is due at the time of closing. If this form and payment are not received or payments are

not properly credited due to errors on this form, you will receive an assessment which may include

penalty and interest.

•

One of the most common reason for transfer tax assessments is because the Social Security

Number or Federal ID Number and closing date on this form do not exactly match the

information provided on Form PTT-172.

•

If no tax is due, this form is not required.

Line-by-Line Instructions

Personal Information

In the spaces provided for Name, Address, Federal ID or Social Security Number, Daytime Telephone

Number, and E-mail address enter the exact information provided on Form PTT-172, Section B.

Date of Closing

In the space provided for Date of Closing, enter the exact closing date you provided on Form

PTT-172, Section C.

Line 1

Check “Yes” or “No” to indicate if a portion of the value was eligible for the special rate on the

Property Transfer Tax Return, Form PTT-172.

Line 2

Check “Yes” or “No” to indicate if exemption 99 was claimed on the Property Transfer Tax Return,

Form PTT-172. (You can determine this by checking if “99” is entered on PTT-172, Line E1.)

Line 3

In the space provided for Amount of Payment, enter the exact amount of payment being sent with

this form.

Form PTT-173 Instructions

Page 1 of 1

Rev. 10/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1