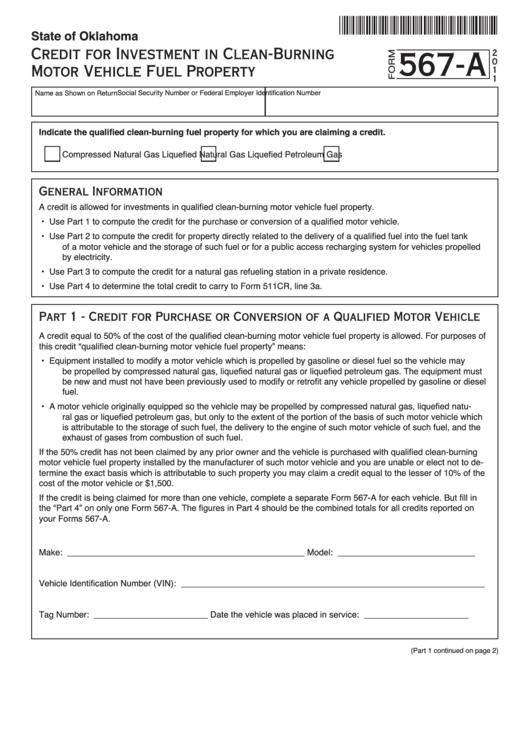

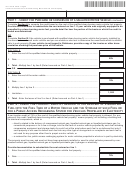

State of Oklahoma

a

Credit for Investment in Clean-Burning

567-

2

0

Motor Vehicle Fuel Property

1

1

Social Security Number or Federal Employer Identification Number

Name as Shown on Return

Indicate the qualified clean-burning fuel property for which you are claiming a credit.

Compressed Natural Gas

Liquefied Natural Gas

Liquefied Petroleum Gas

General Information

A credit is allowed for investments in qualified clean-burning motor vehicle fuel property.

• Use Part 1 to compute the credit for the purchase or conversion of a qualified motor vehicle.

• Use Part 2 to compute the credit for property directly related to the delivery of a qualified fuel into the fuel tank

of a motor vehicle and the storage of such fuel or for a public access recharging system for vehicles propelled

by electricity.

• Use Part 3 to compute the credit for a natural gas refueling station in a private residence.

• Use Part 4 to determine the total credit to carry to Form 511CR, line 3a.

Part 1 - Credit for Purchase or Conversion of a Qualified Motor Vehicle

A credit equal to 50% of the cost of the qualified clean-burning motor vehicle fuel property is allowed. For purposes of

this credit “qualified clean-burning motor vehicle fuel property” means:

• Equipment installed to modify a motor vehicle which is propelled by gasoline or diesel fuel so the vehicle may

be propelled by compressed natural gas, liquefied natural gas or liquefied petroleum gas. The equipment must

be new and must not have been previously used to modify or retrofit any vehicle propelled by gasoline or diesel

fuel.

• A motor vehicle originally equipped so the vehicle may be propelled by compressed natural gas, liquefied natu-

ral gas or liquefied petroleum gas, but only to the extent of the portion of the basis of such motor vehicle which

is attributable to the storage of such fuel, the delivery to the engine of such motor vehicle of such fuel, and the

exhaust of gases from combustion of such fuel.

If the 50% credit has not been claimed by any prior owner and the vehicle is purchased with qualified clean-burning

motor vehicle fuel property installed by the manufacturer of such motor vehicle and you are unable or elect not to de-

termine the exact basis which is attributable to such property you may claim a credit equal to the lesser of 10% of the

cost of the motor vehicle or $1,500.

If the credit is being claimed for more than one vehicle, complete a separate Form 567-A for each vehicle. But fill in

the “Part 4” on only one Form 567-A. The figures in Part 4 should be the combined totals for all credits reported on

your Forms 567-A.

Make: __________________________________________________

Model: _____________________________

Vehicle Identification Number (VIN): ________________________________________________________________

Tag Number: ________________________

Date the vehicle was placed in service: ______________________

(Part 1 continued on page 2)

1

1 2

2 3

3