S

N

J

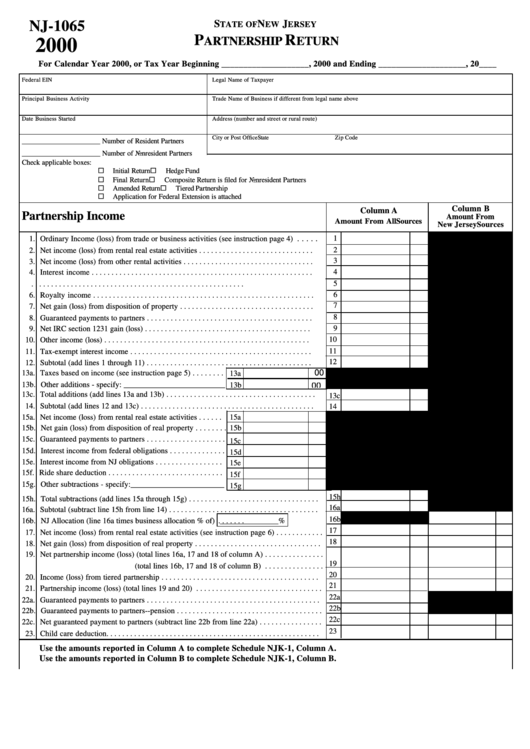

NJ-1065

TATE OF

EW

ERSEY

P

R

ARTNERSHIP

ETURN

2000

For Calendar Year 2000, or Tax Year Beginning ____________________, 2000 and Ending ____________________, 20____

Federal EIN

Legal Name of Taxpayer

Principal Business Activity

Trade Name of Business if different from legal name above

Date Business Started

Address (number and street or rural route)

City or Post Office

State

Zip Code

______________________ Number of Resident Partners

______________________ Number of Nonresident Partners

Check applicable boxes:

¨

¨

Initial Return

Hedge Fund

¨

¨

Final Return

Composite Return is filed for Nonresident Partners

¨

¨

Amended Return

Tiered Partnership

¨

Application for Federal Extension is attached

Column B

Column A

Partnership Income

Amount From

Amount From All Sources

New Jersey Sources

1

. . . . .

1. Ordinary Income (loss) from trade or business activities (see instruction page 4)

2

2. Net income (loss) from rental real estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Net income (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6. Royalty income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7. Net gain (loss) from disposition of property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8. Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9. Net IRC section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10. Other income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11. Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12. Subtotal (add lines 1 through 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

13a. Taxes based on income (see instruction page 5) . . . . . . . .

13a

13b. Other additions - specify: __________________________

00

13b

13c. Total additions (add lines 13a and 13b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13c

14. Subtotal (add lines 12 and 13c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15a. Net income (loss) from rental real estate activities . . . . . .

15a

15b. Net gain (loss) from disposition of real property . . . . . . . .

15b

15c. Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . .

15c

15d. Interest income from federal obligations . . . . . . . . . . . . . .

15d

15e. Interest income from NJ obligations . . . . . . . . . . . . . . . . .

15e

15f. Ride share deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15f

15g. Other subtractions - specify:________________________

15g

15h

15h. Total subtractions (add lines 15a through 15g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16a

16a. Subtotal (subtract line 15h from line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

16b. NJ Allocation (line 16a times business allocation % of

_______________%

) . . . . . . .

17

17. Net income (loss) from rental real estate activities (see instruction page 6) . . . . . . . . . . . .

18

18. Net gain (loss) from disposition of real property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Net partnership income (loss) (total lines 16a, 17 and 18 of column A) . . . . . . . . . . . . . . .

19

(total lines 16b, 17 and 18 of column B) . . . . . . . . . . . . . . .

20

20. Income (loss) from tiered partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

21. Partnership income (loss) (total lines 19 and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22a

22a. Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22b

22b. Guaranteed payments to partners--pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22c

22c. Net guaranteed payment to partners (subtract line 22b from line 22a) . . . . . . . . . . . . . . . .

23

23. Child care deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Use the amounts reported in Column A to complete Schedule NJK-1, Column A.

Use the amounts reported in Column B to complete Schedule NJK-1, Column B.

1

1 2

2