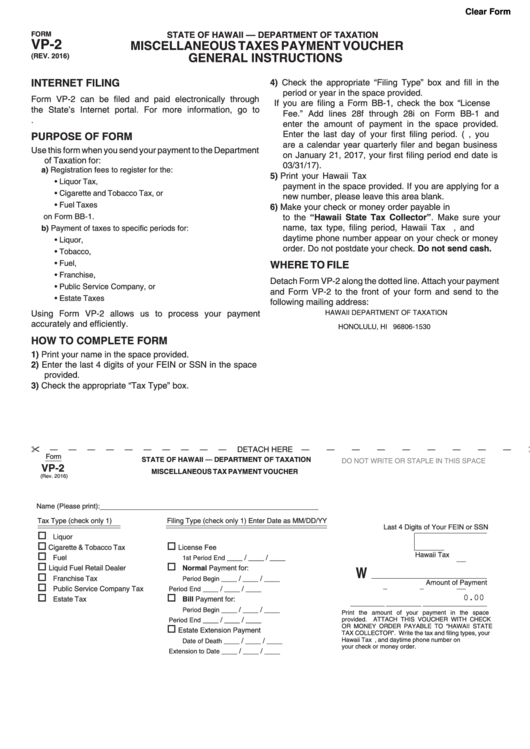

Form Vp-2 - Miscellaneous Taxes Payment Vouchergeneral Instructions

ADVERTISEMENT

Clear Form

STATE OF HAWAII –– DEPARTMENT OF TAXATION

FORM

VP-2

MISCELLANEOUS TAXES PAYMENT VOUCHER

GENERAL INSTRUCTIONS

(REV. 2016)

INTERNET FILING

4) Check the appropriate “Filing Type” box and fill in the

period or year in the space provided.

Form VP-2 can be filed and paid electronically through

If you are filing a Form BB-1, check the box “License

the State’s Internet portal. For more information, go to

Fee.” Add lines 28f through 28i on Form BB-1 and

tax.hawaii.gov/eservices/.

enter the amount of payment in the space provided.

Enter the last day of your first filing period. (e.g., you

PURPOSE OF FORM

are a calendar year quarterly filer and began business

Use this form when you send your payment to the Department

on January 21, 2017, your first filing period end date is

of Taxation for:

03/31/17).

a) Registration fees to register for the:

5) Print your Hawaii Tax I.D. No. and the amount of your

• Liquor Tax,

payment in the space provided. If you are applying for a

• Cigarette and Tobacco Tax, or

new number, please leave this area blank.

• Fuel Taxes

6) Make your check or money order payable in U.S. dollars

on Form BB-1.

to the “Hawaii State Tax Collector”. Make sure your

name, tax type, filing period, Hawaii Tax I.D. No., and

b) Payment of taxes to specific periods for:

daytime phone number appear on your check or money

• Liquor,

order. Do not postdate your check. Do not send cash.

• Tobacco,

• Fuel,

WHERE TO FILE

• Franchise,

Detach Form VP-2 along the dotted line. Attach your payment

• Public Service Company, or

and Form VP-2 to the front of your form and send to the

• Estate Taxes

following mailing address:

Using Form VP-2 allows us to process your payment

HAWAII DEPARTMENT OF TAXATION

P.O. Box 1530

accurately and efficiently.

HONOLULU, HI 96806-1530

HOW TO COMPLETE FORM

1) Print your name in the space provided.

2) Enter the last 4 digits of your FEIN or SSN in the space

provided.

3) Check the appropriate “Tax Type” box.

DETACH HERE

Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

VP-2

MISCELLANEOUS TAX PAYMENT VOUCHER

(Rev. 2016)

Name (Please print):

Tax Type (check only 1)

Filing Type (check only 1) Enter Date as MM/DD/YY

Last 4 Digits of Your FEIN or SSN

o

Liquor

____

o

o

Cigarette & Tobacco Tax

License Fee

o

Hawaii Tax I.D. Number

Fuel

____ / ____ / ____

1st Period End

W

!!!!!!!!-!!

o

o

Normal Payment for:

Liquid Fuel Retail Dealer

o

Franchise Tax

____ / ____ / ____

Period Begin

Amount of Payment

o

Public Service Company Tax

____ / ____ / ____

Period End

!!!,!!!,!!!.!!

o

o

Estate Tax

Bill Payment for:

0.00

____ / ____ / ____

Period Begin

Print the amount of your payment in the space

____ / ____ / ____

Period End

provided. ATTACH THIS VOUCHER WITH CHECK

OR MONEY ORDER PAYABLE TO “HAWAII STATE

o

Estate Extension Payment

TAX COLLECTOR”. Write the tax and filing types, your

____ / ____ / ____

Date of Death

Hawaii Tax I.D. Number, and daytime phone number on

your check or money order.

____ / ____ / ____

Extension to Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1