Form Rpd-41291 - Licensed Residential Care Facility Tax Credit Claim Form - New Mexico Taxation And Revenue Department

ADVERTISEMENT

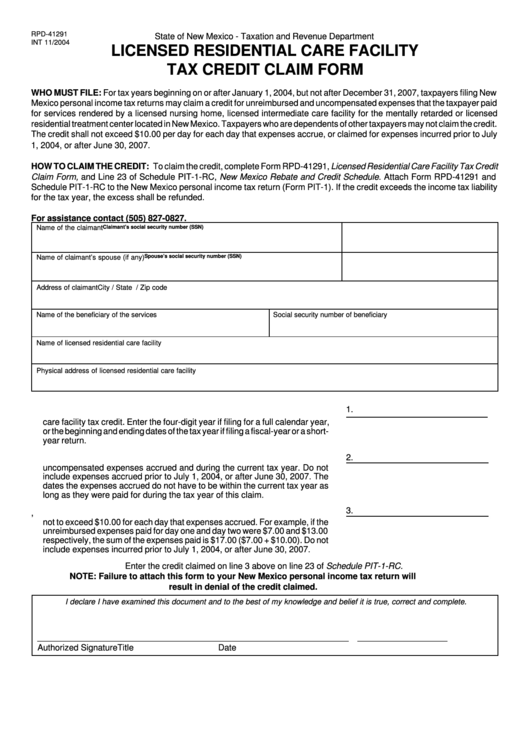

RPD-41291

State of New Mexico - Taxation and Revenue Department

INT 11/2004

LICENSED RESIDENTIAL CARE FACILITY

TAX CREDIT CLAIM FORM

WHO MUST FILE: For tax years beginning on or after January 1, 2004, but not after December 31, 2007, taxpayers filing New

Mexico personal income tax returns may claim a credit for unreimbursed and uncompensated expenses that the taxpayer paid

for services rendered by a licensed nursing home, licensed intermediate care facility for the mentally retarded or licensed

residential treatment center located in New Mexico. Taxpayers who are dependents of other taxpayers may not claim the credit.

The credit shall not exceed $10.00 per day for each day that expenses accrue, or claimed for expenses incurred prior to July

1, 2004, or after June 30, 2007.

HOW TO CLAIM THE CREDIT: To claim the credit, complete Form RPD-41291, Licensed Residential Care Facility Tax Credit

Claim Form, and Line 23 of Schedule PIT-1-RC, New Mexico Rebate and Credit Schedule. Attach Form RPD-41291 and

Schedule PIT-1-RC to the New Mexico personal income tax return (Form PIT-1). If the credit exceeds the income tax liability

for the tax year, the excess shall be refunded.

For assistance contact (505) 827-0827.

Name of the claimant

Claimant’s social security number (SSN)

Spouse’s social security number (SSN)

Name of claimant’s spouse (if any)

Address of claimant

City / State / Zip code

Name of the beneficiary of the services

Social security number of beneficiary

Name of licensed residential care facility

Physical address of licensed residential care facility

1.

1. Enter the tax year of the return for which you are taking the licensed residential

care facility tax credit. Enter the four-digit year if filing for a full calendar year,

or the beginning and ending dates of the tax year if filing a fiscal-year or a short-

year return.

2.

2. Enter the total number of days for which you paid qualified unreimbursed and

uncompensated expenses accrued and during the current tax year. Do not

include expenses accrued prior to July 1, 2004, or after June 30, 2007. The

dates the expenses accrued do not have to be within the current tax year as

long as they were paid for during the tax year of this claim.

3.

3. Enter the sum of the qualified unreimbursed and uncompensated expenses,

not to exceed $10.00 for each day that expenses accrued. For example, if the

unreimbursed expenses paid for day one and day two were $7.00 and $13.00

respectively, the sum of the expenses paid is $17.00 ($7.00 + $10.00). Do not

include expenses incurred prior to July 1, 2004, or after June 30, 2007.

Enter the credit claimed on line 3 above on line 23 of Schedule PIT-1-RC.

NOTE: Failure to attach this form to your New Mexico personal income tax return will

result in denial of the credit claimed.

I declare I have examined this document and to the best of my knowledge and belief it is true, correct and complete.

________________________________________________ __________________ ___________________

Authorized Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1