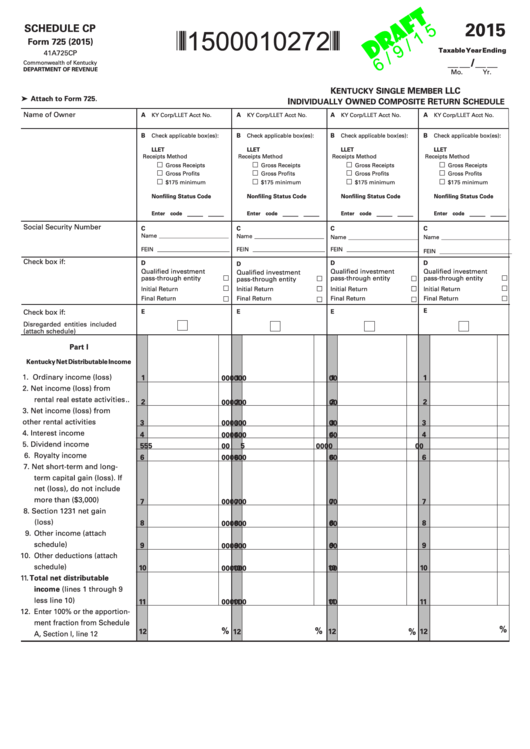

Form 725 Draft - Schedule Cp - Individually Owned Composite Return - 2015

ADVERTISEMENT

2015

SCHEDULE CP

*1500010272*

Form 725 (2015)

Taxable Year Ending

41A725CP

__ __ / __ __

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Mo.

Yr.

K

S

M

LLC

ENTUCKY

INGLE

EMBER

➤ Attach to Form 725.

I

O

C

R

S

NDIVIDUALLY

WNED

OMPOSITE

ETURN

CHEDULE

Name of Owner

A

A

A

A

KY Corp/LLET Acct No.

KY Corp/LLET Acct No.

KY Corp/LLET Acct No.

KY Corp/LLET Acct No.

B

B

B

B

Check applicable box(es):

Check applicable box(es):

Check applicable box(es):

Check applicable box(es):

LLET

LLET

LLET

LLET

Receipts Method

Receipts Method

Receipts Method

Receipts Method

Gross Receipts

Gross Receipts

Gross Receipts

Gross Receipts

Gross Profits

Gross Profits

Gross Profits

Gross Profits

$175 minimum

$175 minimum

$175 minimum

$175 minimum

Nonfiling Status Code

Nonfiling Status Code

Nonfiling Status Code

Nonfiling Status Code

___ ___

___ ___

___ ___

___ ___

Enter code

Enter code

Enter code

Enter code

Social Security Number

C

C

C

C

Name

__________________________

Name

__________________________

Name

Name

__________________________

__________________________

FEIN

FEIN

FEIN

___________________________

___________________________

___________________________

FEIN

___________________________

Check box if:

D

D

D

D

Qualified investment

Qualified investment

Qualified investment

Qualified investment

pass-through entity

pass-through entity

pass-through entity

pass-through entity

Initial Return

Initial Return

Initial Return

Initial Return

Final Return

Final Return

Final Return

Final Return

E

Check box if:

E

E

E

Disregarded entities included

(attach schedule)

Part I

Kentucky Net Distributable Income

1. Ordinary income (loss) .......

1

00

1

00

1

00

1

00

2. Net income (loss) from

rental real estate activities ..

2

2

2

00

2

00

00

00

3. Net income (loss) from

other rental activities .........

3

3

3

00

3

00

00

00

4. Interest income ....................

4

4

4

00

4

00

00

00

5. Dividend income .................

5

00

5

00

5

00

5

00

6. Royalty income ....................

6

6

6

00

6

00

00

00

7. Net short-term and long-

term capital gain (loss). If

net (loss), do not include

more than ($3,000) ..............

7

00

7

00

7

00

7

00

8. Section 1231 net gain

(loss) .....................................

8

8

8

8

00

00

00

00

9. Other income (attach

schedule) ..............................

9

9

9

9

00

00

00

00

10. Other deductions (attach

schedule) ..............................

10

10

10

00

10

00

00

00

11. Total net distributable

income (lines 1 through 9

less line 10)

..............................

11

11

11

11

00

00

00

00

12. Enter 100% or the apportion-

ment fraction from Schedule

%

%

%

12

12

%

12

12

A, Section I, line 12 ................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2