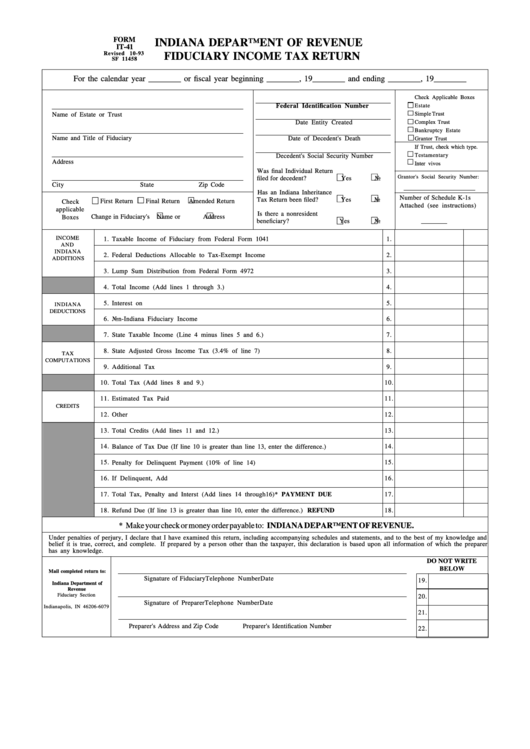

FORM

INDIANA DEPARTMENT OF REVENUE

IT-41

Revised 10-93

FIDUCIARY INCOME TAX RETURN

SF 11458

For the calendar year ________ or fiscal year beginning ________, 19________ and ending ________, 19________

Check Applicable Boxes

Federal Identification Number

Estate

Simple Trust

Name of Estate or Trust

Date Entity Created

Complex Trust

Bankruptcy Estate

Name and Title of Fiduciary

Date of Decedent's Death

Grantor Trust

If Trust, check which type.

Testamentary

Decedent's Social Security Number

Address

Inter vivos

Was final Individual Return

Grantor's Social Security Number:

filed for decedent?

Yes

No

City

State

Zip Code

Has an Indiana Inheritance

Number of Schedule K-1s

Tax Return been filed?

Yes

No

First Return

Final Return

Amended Return

Check

Attached (see instructions)

applicable

Is there a nonresident

Change in Fiduciary's

Name or

Address

Boxes

beneficiary?

Yes

No

INCOME

1.

Taxable Income of Fiduciary from Federal Form 1041 ..................................................................

1.

AND

INDIANA

2.

Federal Deductions Allocable to Tax-Exempt Income ...................................................................

2.

ADDITIONS

3.

Lump Sum Distribution from Federal Form 4972 ...........................................................................

3.

4.

Total Income (Add lines 1 through 3.) ............................................................................................

4.

5.

Interest on U.S. Obligations Reported on Federal Return .............................................................

5.

INDIANA

DEDUCTIONS

6.

Non-Indiana Fiduciary Income .......................................................................................................

6.

7.

State Taxable Income (Line 4 minus lines 5 and 6.) ......................................................................

7.

8.

State Adjusted Gross Income Tax (3.4% of line 7) ........................................................................

8.

TAX

COMPUTATIONS

9.

Additional Tax .................................................................................................................................

9.

10.

Total Tax (Add lines 8 and 9.) ........................................................................................................

10.

11.

Estimated Tax Paid .......................................................................................................................

11.

CREDITS

12.

Other Credits...................................................................................................................................

12.

13.

Total Credits (Add lines 11 and 12.) ...............................................................................................

13.

14.

Balance of Tax Due (If line 10 is greater than line 13, enter the difference.) .................................

14.

15.

15.

Penalty for Delinquent Payment (10% of line 14)............................................................................

16.

If Delinquent, Add Interest...........................................................................................................

16.

17.

Total Tax, Penalty and Interst (Add lines 14 through16)*................................PAYMENT DUE

17.

18.

Refund Due (If line 13 is greater than line 10, enter the difference.) ..............................REFUND

18.

* Make your check or money order payable to: INDIANA DEPARTMENT OF REVENUE.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based upon all information of which the preparer

has any knowledge.

DO NOT WRITE

BELOW

Mail completed return to:

Signature of Fiduciary

Telephone Number

Date

19.

Indiana Department of

Revenue

Fiduciary Section

20.

P.O. Box 6079

Signature of Preparer

Telephone Number

Date

Indianapolis, IN 46206-6079

21.

Preparer's Address and Zip Code

Preparer's Identification Number

22.

1

1