Instructions For Form M-36 - Combined Claim For Refund Of Fuel Taxes - 2007

ADVERTISEMENT

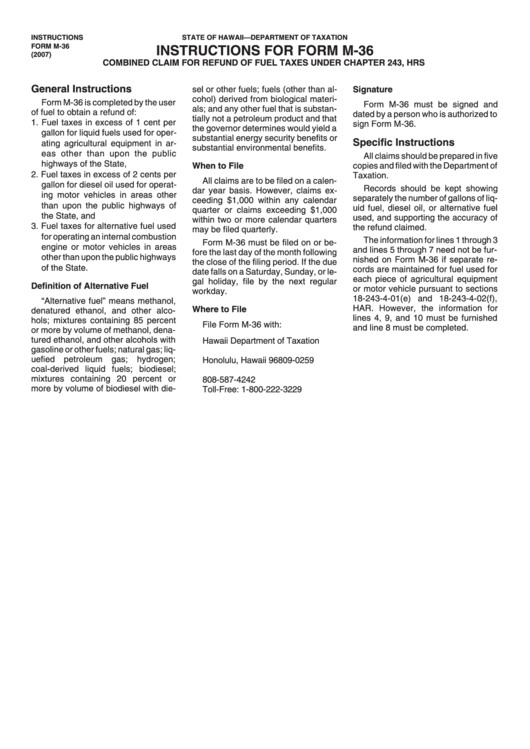

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM M-36

INSTRUCTIONS FOR FORM M-36

(2007)

COMBINED CLAIM FOR REFUND OF FUEL TAXES UNDER CHAPTER 243, HRS

General Instructions

sel or other fuels; fuels (other than al-

Signature

cohol) derived from biological materi-

Form M-36 is completed by the user

Form M-36 must be signed and

als; and any other fuel that is substan-

of fuel to obtain a refund of:

dated by a person who is authorized to

tially not a petroleum product and that

1. Fuel taxes in excess of 1 cent per

sign Form M-36.

the governor determines would yield a

gallon for liquid fuels used for oper-

substantial energy security benefits or

Specific Instructions

ating agricultural equipment in ar-

substantial environmental benefits.

eas other than upon the public

All claims should be prepared in five

highways of the State,

When to File

copies and filed with the Department of

2. Fuel taxes in excess of 2 cents per

Taxation.

All claims are to be filed on a calen-

gallon for diesel oil used for operat-

Records should be kept showing

dar year basis. However, claims ex-

ing motor vehicles in areas other

separately the number of gallons of liq-

ceeding $1,000 within any calendar

than upon the public highways of

uid fuel, diesel oil, or alternative fuel

quarter or claims exceeding $1,000

the State, and

used, and supporting the accuracy of

within two or more calendar quarters

3. Fuel taxes for alternative fuel used

the refund claimed.

may be filed quarterly.

for operating an internal combustion

The information for lines 1 through 3

Form M-36 must be filed on or be-

engine or motor vehicles in areas

and lines 5 through 7 need not be fur-

fore the last day of the month following

other than upon the public highways

nished on Form M-36 if separate re-

the close of the filing period. If the due

of the State.

cords are maintained for fuel used for

date falls on a Saturday, Sunday, or le-

each piece of agricultural equipment

gal holiday, file by the next regular

Definition of Alternative Fuel

or motor vehicle pursuant to sections

workday.

18-243-4-01(e) and 18-243-4-02(f),

“Alternative fuel” means methanol,

HAR. However, the information for

Where to File

denatured ethanol, and other alco-

lines 4, 9, and 10 must be furnished

hols; mixtures containing 85 percent

File Form M-36 with:

and line 8 must be completed.

or more by volume of methanol, dena-

tured ethanol, and other alcohols with

Hawaii Department of Taxation

gasoline or other fuels; natural gas; liq-

P.O. Box 259

uefied

petroleum

gas; hydrogen;

Honolulu, Hawaii 96809-0259

coal-derived liquid fuels; biodiesel;

mixtures containing 20 percent or

808-587-4242

more by volume of biodiesel with die-

Toll-Free: 1-800-222-3229

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1