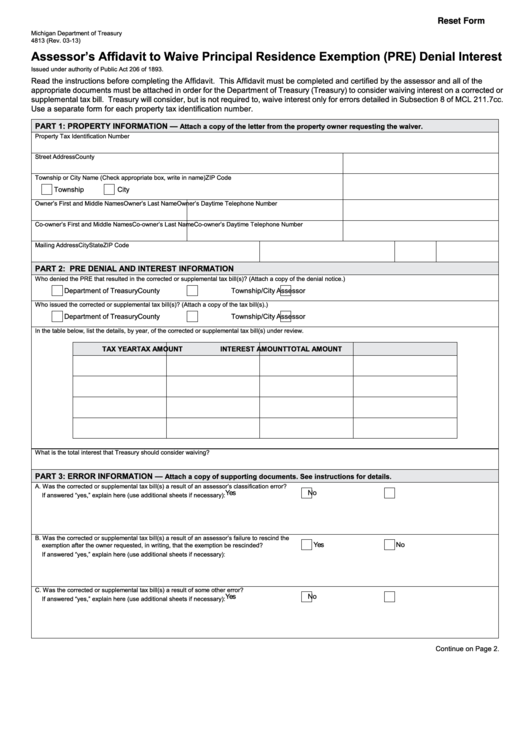

Reset Form

Michigan Department of Treasury

4813 (Rev. 03-13)

Assessor’s Affidavit to Waive Principal Residence Exemption (PRE) Denial Interest

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the Affidavit. This Affidavit must be completed and certified by the assessor and all of the

appropriate documents must be attached in order for the Department of Treasury (Treasury) to consider waiving interest on a corrected or

supplemental tax bill. Treasury will consider, but is not required to, waive interest only for errors detailed in Subsection 8 of MCL 211.7cc.

Use a separate form for each property tax identification number.

PART 1: PROPERTY INFORMATION —

Attach a copy of the letter from the property owner requesting the waiver.

Property Tax Identification Number

Street Address

County

Township or City Name (Check appropriate box, write in name)

ZIP Code

Township

City

Owner’s First and Middle Names

Owner’s Last Name

Owner’s Daytime Telephone Number

Co-owner’s First and Middle Names

Co-owner’s Last Name

Co-owner’s Daytime Telephone Number

Mailing Address

City

State

ZIP Code

PART 2: PRE DENIAL AND INTEREST INFORMATION

Who denied the PRE that resulted in the corrected or supplemental tax bill(s)? (Attach a copy of the denial notice.)

Department of Treasury

County

Township/City Assessor

Who issued the corrected or supplemental tax bill(s)? (Attach a copy of the tax bill(s).)

Department of Treasury

County

Township/City Assessor

In the table below, list the details, by year, of the corrected or supplemental tax bill(s) under review.

TAx YEAR

TAx AMOuNT

INTEREST AMOuNT

TOTAL AMOuNT

What is the total interest that Treasury should consider waiving?

PART 3: ERROR INFORMATION —

Attach a copy of supporting documents. See instructions for details.

A. Was the corrected or supplemental tax bill(s) a result of an assessor’s classification error?

Yes

No

If answered “yes,” explain here (use additional sheets if necessary):

B. Was the corrected or supplemental tax bill(s) a result of an assessor’s failure to rescind the

Yes

No

exemption after the owner requested, in writing, that the exemption be rescinded?

If answered “yes,” explain here (use additional sheets if necessary):

C. Was the corrected or supplemental tax bill(s) a result of some other error?

Yes

No

If answered “yes,” explain here (use additional sheets if necessary):

Continue on Page 2.

1

1 2

2 3

3