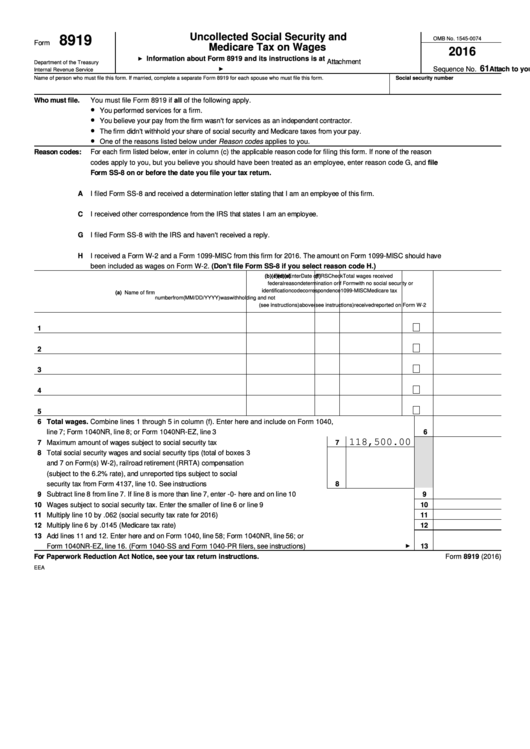

Form 8919 - Uncollected Social Security And Medicare Tax On Wages - 2016

ADVERTISEMENT

Uncollected Social Security and

8919

OMB No. 1545-0074

Form

Medicare Tax on Wages

2016

Information about Form 8919 and its instructions is at

Attachment

Department of the Treasury

61

Attach to your tax return.

Sequence No.

Internal Revenue Service

Name of person who must file this form. If married, complete a separate Form 8919 for each spouse who must file this form.

Social security number

Who must file.

You must file Form 8919 if all of the following apply.

You performed services for a firm.

You believe your pay from the firm wasn't for services as an independent contractor.

The firm didn't withhold your share of social security and Medicare taxes from your pay.

One of the reasons listed below under Reason codes applies to you.

Reason codes:

For each firm listed below, enter in column (c) the applicable reason code for filing this form. If none of the reason

codes apply to you, but you believe you should have been treated as an employee, enter reason code G, and file

Form SS-8 on or before the date you file your tax return.

A

I filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

C

I received other correspondence from the IRS that states I am an employee.

G

I filed Form SS-8 with the IRS and haven't received a reply.

H

I received a Form W-2 and a Form 1099-MISC from this firm for 2016. The amount on Form 1099-MISC should have

been included as wages on Form W-2. (Don't file Form SS-8 if you select reason code H.)

(b)

Firm's

(c)

Enter

(d)

Date of IRS

(e)

Check

(f)

Total wages received

federal

reason

determination or

if Form

with no social security or

identification

code

correspondence

1099-MISC

Medicare tax

(a)

Name of firm

number

from

(MM/DD/YYYY)

was

withholding and not

(see instructions)

above

(see instructions)

received

reported on Form W-2

1

2

3

4

5

6

Total wages. Combine lines 1 through 5 in column (f). Enter here and include on Form 1040,

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

line 7; Form 1040NR, line 8; or Form 1040NR-EZ, line 3

6

118,500.00

. . . . . . . . . . . . . . . .

7

Maximum amount of wages subject to social security tax

7

8

Total social security wages and social security tips (total of boxes 3

and 7 on Form(s) W-2), railroad retirement (RRTA) compensation

(subject to the 6.2% rate), and unreported tips subject to social

. . . . . . . . . . . . . . . . . .

security tax from Form 4137, line 10. See instructions

8

. . . . . . . . . . . . . . . . .

9

Subtract line 8 from line 7. If line 8 is more than line 7, enter -0- here and on line 10

9

. . . . . . . . . . . . . . . . . . . . . . .

10

Wages subject to social security tax. Enter the smaller of line 6 or line 9

10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Multiply line 10 by .062 (social security tax rate for 2016)

11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Multiply line 6 by .0145 (Medicare tax rate)

12

13

Add lines 11 and 12. Enter here and on Form 1040, line 58; Form 1040NR, line 56; or

. . . . . . . . . . . . . . .

Form 1040NR-EZ, line 16. (Form 1040-SS and Form 1040-PR filers, see instructions)

13

For Paperwork Reduction Act Notice, see your tax return instructions.

Form 8919 (2016)

EEA

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1