SD EForm -

1308

V4

HELP

Complete and use the button at the end to print for mailing.

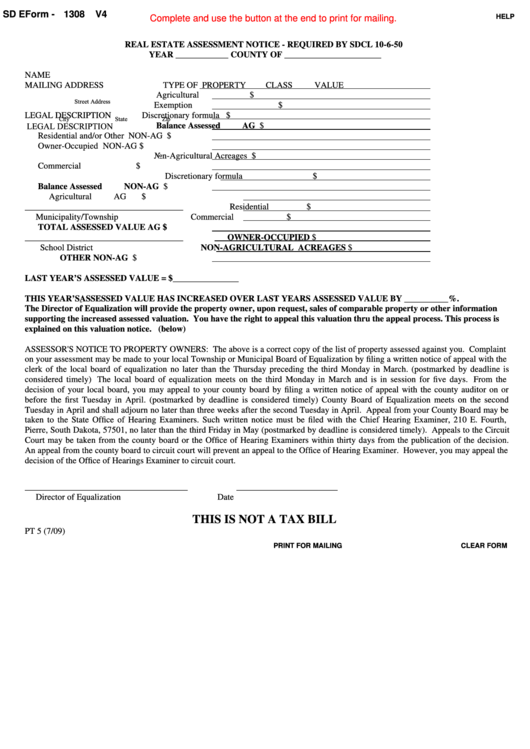

REAL ESTATE ASSESSMENT NOTICE - REQUIRED BY SDCL 10-6-50

YEAR ____________ COUNTY OF ______________________

NAME

MAILING ADDRESS

TYPE OF PROPERTY

CLASS

VALUE

Agricultural

$

Street Address

Exemption

$

LEGAL DESCRIPTION

Discretionary formula

$

City

State

Zip

LEGAL DESCRIPTION

Balance Assessed

AG

$

Residential and/or Other NON-AG

$

Owner-Occupied

NON-AG

$

Non-Agricultural Acreages

$

Commercial

$

Discretionary formula

$

Balance Assessed

NON-AG

$

Agricultural

AG

$

____________________________________

Residential

$

Municipality/Township

Commercial

$

TOTAL ASSESSED VALUE

AG

$

____________________________________

OWNER-OCCUPIED $

School District

NON-AGRICULTURAL ACREAGES $

OTHER NON-AG $

LAST YEAR’S ASSESSED VALUE = $_______________

THIS YEAR’S ASSESSED VALUE HAS INCREASED OVER LAST YEARS ASSESSED VALUE BY __________%.

The Director of Equalization will provide the property owner, upon request, sales of comparable property or other information

supporting the increased assessed valuation. You have the right to appeal this valuation thru the appeal process. This process is

explained on this valuation notice. (below)

ASSESSOR'S NOTICE TO PROPERTY OWNERS: The above is a correct copy of the list of property assessed against you. Complaint

on your assessment may be made to your local Township or Municipal Board of Equalization by filing a written notice of appeal with the

clerk of the local board of equalization no later than the Thursday preceding the third Monday in March. (postmarked by deadline is

considered timely) The local board of equalization meets on the third Monday in March and is in session for five days. From the

decision of your local board, you may appeal to your county board by filing a written notice of appeal with the county auditor on or

before the first Tuesday in April. (postmarked by deadline is considered timely) County Board of Equalization meets on the second

Tuesday in April and shall adjourn no later than three weeks after the second Tuesday in April. Appeal from your County Board may be

taken to the State Office of Hearing Examiners. Such written notice must be filed with the Chief Hearing Examiner, 210 E. Fourth,

Pierre, South Dakota, 57501, no later than the third Friday in May (postmarked by deadline is considered timely). Appeals to the Circuit

Court may be taken from the county board or the Office of Hearing Examiners within thirty days from the publication of the decision.

An appeal from the county board to circuit court will prevent an appeal to the Office of Hearing Examiner. However, you may appeal the

decision of the Office of Hearings Examiner to circuit court.

_____________________________________

_______________________

Director of Equalization

Date

THIS IS NOT A TAX BILL

PT 5 (7/09)

PRINT FOR MAILING

CLEAR FORM

1

1