Form W-3me - Reconciliation Of Maine Income Tax Withheld - 2005

ADVERTISEMENT

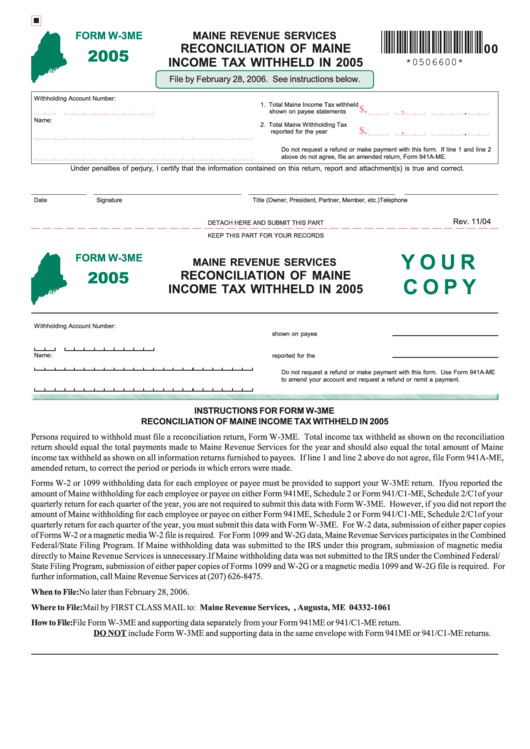

MAINE REVENUE SERVICES

FORM W-3ME

RECONCILIATION OF MAINE

00

2005

INCOME TAX WITHHELD IN 2005

*0506600*

File by February 28, 2006. See instructions below.

Withholding Account Number:

1. Total Maine Income Tax withheld

$

,

,

shown on payee statements

.

Name:

2. Total Maine Withholding Tax

$

,

,

reported for the year

.

Do not request a refund or make payment with this form. If line 1 and line 2

above do not agree, file an amended return, Form 941A-ME.

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Date

Signature

Title (Owner, President, Partner, Member, etc.)

Telephone

Rev. 11/04

DETACH HERE AND SUBMIT THIS PART

KEEP THIS PART FOR YOUR RECORDS

Y O U R

FORM W-3ME

MAINE REVENUE SERVICES

2005

RECONCILIATION OF MAINE

C O P Y

INCOME TAX WITHHELD IN 2005

Withholding Account Number:

1.

Total Maine income tax withheld

shown on payee statements .................... 1.

2.

Total Maine withholding tax

Name:

reported for the year ................................ 2.

Do not request a refund or make payment with this form. Use Form 941A-ME

to amend your account and request a refund or remit a payment.

INSTRUCTIONS FOR FORM W-3ME

RECONCILIATION OF MAINE INCOME TAX WITHHELD IN 2005

Persons required to withhold must file a reconciliation return, Form W-3ME. Total income tax withheld as shown on the reconciliation

return should equal the total payments made to Maine Revenue Services for the year and should also equal the total amount of Maine

income tax withheld as shown on all information returns furnished to payees. If line 1 and line 2 above do not agree, file Form 941A-ME,

amended return, to correct the period or periods in which errors were made.

Forms W-2 or 1099 withholding data for each employee or payee must be provided to support your W-3ME return. If you reported the

amount of Maine withholding for each employee or payee on either Form 941ME, Schedule 2 or Form 941/C1-ME, Schedule 2/C1of your

quarterly return for each quarter of the year, you are not required to submit this data with Form W-3ME. However, if you did not report the

amount of Maine withholding for each employee or payee on either Form 941ME, Schedule 2 or Form 941/C1-ME, Schedule 2/C1of your

quarterly return for each quarter of the year, you must submit this data with Form W-3ME. For W-2 data, submission of either paper copies

of Forms W-2 or a magnetic media W-2 file is required. For Form 1099 and W-2G data, Maine Revenue Services participates in the Combined

Federal/State Filing Program. If Maine withholding data was submitted to the IRS under this program, submission of magnetic media

directly to Maine Revenue Services is unnecessary. If Maine withholding data was not submitted to the IRS under the Combined Federal/

State Filing Program, submission of either paper copies of Forms 1099 and W-2G or a magnetic media 1099 and W-2G file is required. For

further information, call Maine Revenue Services at (207) 626-8475.

When to File:

No later than February 28, 2006.

Where to File:

Mail by FIRST CLASS MAIL to: Maine Revenue Services, P.O. Box 1061, Augusta, ME 04332-1061

How to File:

File Form W-3ME and supporting data separately from your Form 941ME or 941/C1-ME return.

DO NOT include Form W-3ME and supporting data in the same envelope with Form 941ME or 941/C1-ME returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1