Instructions For Form St-388 - State Sales, Use, And Accommodations Tax Return

ADVERTISEMENT

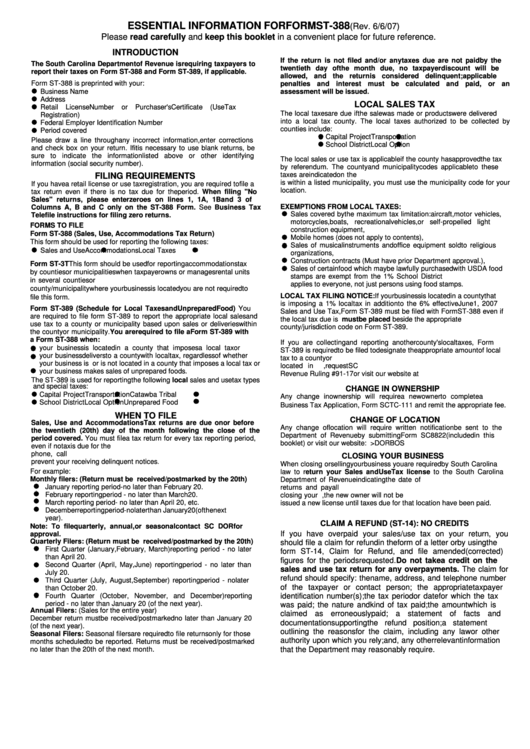

ESSENTIAL INFORMATION FOR FORM ST-388

(Rev. 6/6/07)

Please read carefully and keep this booklet in a convenient place for future reference.

INTRODUCTION

If the return is not filed and/or any taxes due are not paid by the

The South Carolina Department of Revenue is requiring taxpayers to

twentieth day of the month due, no taxpayer discount will be

report their taxes on Form ST-388 and Form ST-389, if applicable.

allowed, and the return is considered delinquent; applicable

Form ST-388 is preprinted with your:

penalties and interest must be calculated and paid, or an

Business Name

assessment will be issued.

Address

LOCAL SALES TAX

Retail

License

Number

or

Purchaser's

Certificate

(Use

Tax

The local taxes are due if the sale was made or products were delivered

Registration)

into a local tax county. The local taxes authorized to be collected by

Federal Employer Identification Number

counties include:

Period covered

Capital Project

Transportation

Please draw a line through any incorrect information, enter corrections

School District

Local Option

and check box on your return. If it is necessary to use blank returns, be

sure to indicate the information listed above or other identifying

The local sales or use tax is applicable if the county has approved the tax

information (social security number).

by referendum. The county and municipality codes applicable to these

taxes are indicated on the Form ST-389. If the location of your business

FILING REQUIREMENTS

is within a listed municipality, you must use the municipality code for your

If you have a retail license or use tax registration, you are required to file a

location.

tax return even if there is no tax due for the period. When filing "No

Sales" returns, please enter zeroes on lines 1, 1A, 1B and 3 of

EXEMPTIONS FROM LOCAL TAXES:

Columns A, B and C only on the ST-388 Form. See Business Tax

Sales covered by the maximum tax limitation: aircraft, motor vehicles,

Telefile instructions for filing zero returns.

motorcycles, boats, recreational vehicles, or self-propelled light

FORMS TO FILE

construction equipment,

Form ST-388 (Sales, Use, Accommodations Tax Return)

Mobile homes (does not apply to contents),

This form should be used for reporting the following taxes:

Sales of musical instruments and office equipment sold to religious

Sales and Use

Accommodations

Local Taxes

organizations,

Construction contracts (Must have prior Department approval.),

Form ST-3T This form should be used for reporting accommodations tax

Sales of certain food which may be lawfully purchased with USDA food

by counties or municipalities when taxpayer owns or manages rental units

stamps are exempt from the 1% School District Tax. This exemption

in several counties or municipalities. If you only have rental units in the

applies to everyone, not just persons using food stamps.

county/municipality where your business is located you are not required to

LOCAL TAX FILING NOTICE: If your business is located in a county that

file this form.

is imposing a 1% local tax in addition to the 6% effective June 1, 2007

Form ST-389 (Schedule for Local Taxes and Unprepared Food) You

Sales and Use Tax, Form ST-389 must be filed with Form ST-388 even if

are required to file form ST-389 to report the appropriate local sales and

the local tax due is zero. The zero must be placed beside the appropriate

use tax to a county or municipality based upon sales or deliveries within

county/jurisdiction code on Form ST-389.

the county or municipality. You are required to file a Form ST-389 with

a Form ST-388 when:

If you are collecting and reporting another county's local taxes, Form

your business is located in a county that imposes a local tax or

ST-389 is required to be filed to designate the appropriate amount of local

your business delivers to a county with local tax, regardless of whether

tax to a county or jurisdiction. Instructions for completing Form ST-389 are

your business is or is not located in a county that imposes a local tax or

located in this booklet. For more detailed information, request SC

your business makes sales of unprepared foods.

Revenue Ruling #91-17 or visit our website at

The ST-389 is used for reporting the following local sales and use tax types

and special taxes:

CHANGE IN OWNERSHIP

Capital Project

Transportation

Catawba Tribal

Any change in ownership will require a new owner to complete a

School District

Local Option

Unprepared Food

Business Tax Application, Form SCTC-111 and remit the appropriate fee.

WHEN TO FILE

CHANGE OF LOCATION

Sales, Use and Accommodations Tax returns are due on or before

Any change of location will require written notification be sent to the

the twentieth (20th) day of the month following the close of the

Department of Revenue by submitting Form SC8822 (included in this

period covered. You must file a tax return for every tax reporting period,

booklet) or visit our website: sctax.org>DORBOS

even if no tax is due for the period. To file your zero gross sales return by

phone, call 1-803-898-5918. This will keep your account current and

CLOSING YOUR BUSINESS

prevent your receiving delinquent notices.

When closing or selling your business you are required by South Carolina

For example:

law to return your Sales and Use Tax license to the South Carolina

Monthly filers: (Return must be received/postmarked by the 20th)

Department of Revenue indicating the date of closing. You must file all

January reporting period - no later than February 20.

returns and pay all taxes due. Complete enclosed Form C-278 when

February reporting period - no later than March 20.

closing your business. If you sell your business, the new owner will not be

March reporting period - no later than April 20, etc.

issued a new license until taxes due for that location have been paid.

December reporting period - no later than January 20 (of the next

year).

CLAIM A REFUND (ST-14): NO CREDITS

Note: To file quarterly, annual, or seasonal contact SC DOR for

If you have overpaid your sales/use tax on your return, you

approval.

Quarterly Filers: (Return must be received/postmarked by the 20th)

should file a claim for refund in the form of a letter or by using the

First Quarter (January, February, March) reporting period - no later

form ST-14, Claim for Refund, and file amended (corrected)

than April 20.

figures for the periods requested. Do not take a credit on the

Second Quarter (April, May, June) reporting period - no later than

sales and use tax return for any overpayments. The claim for

July 20.

refund should specify: the name, address, and telephone number

Third Quarter (July, August, September) reporting period - no later

of the taxpayer or contact person; the appropriate taxpayer

than October 20.

Fourth Quarter (October, November, and December) reporting

identification number(s); the tax period or date for which the tax

period - no later than January 20 (of the next year).

was paid; the nature and kind of tax paid; the amount which is

Annual Filers: (Sales for the entire year)

claimed as erroneously paid; a statement of facts and

December return must be received/postmarked no later than January 20

documentation supporting the refund position; a statement

(of the next year).

outlining the reasons for the claim, including any law or other

Seasonal Filers: Seasonal filers are required to file returns only for those

authority upon which you rely; and, any other relevant information

months scheduled to be reported. Returns must be received/postmarked

no later than the 20th of the next month.

that the Department may reasonably require.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7