Employer'S Quarterly Wage And Contribution C-101 Report Item-By-Item Instructions - Vermont Department Of Labor

ADVERTISEMENT

Vermont Department of Labor

Employer’s Quarterly Wage and Contribution C-101 Report

ITEM-BY-ITEM INSTRUCTIONS

Quarterly reports must be filed every quarter, EVEN if no wages are paid. Reports can be filed via paper or on the Internet. All

reports must be filed by the due date and in accordance with the specifications indicated below to avoid a penalty being

assessed.

INTERNET FILING: Our on-line application can be found on our website under “Businesses” and “UI Internet Reporting”. The

first time you use this application, you will be required to register. Once your registration has been confirmed, you will be

provided with a password by mail. Instructions and help menus are available when using the on-line application.

FILING BY PAPER: When filing via paper you must use the department’s form or an approved facsimile with scan line, typed

or printed clearly with all items completed. DO NOT send a photocopy.

REQUIRED FORMAT: When submitting additional wage information, you can download Form C-147 or use paper that is

8 1/2" x 11" with print NO LESS THAN 1/8" HIGH, SPACED VERTICALLY NO MORE THAN 3 OR 4 LINES PER INCH, and

TYPED or BLOCK PRINTED in DARK BLUE OR BLACK INK ONLY. Each sheet must be headed with your 7-digit employer

number, employer name and quarter-ending date. Your format must include six columns in this order: SS#, name (last, first,

middle initial), total gross wages paid, H/S (hourly/salary), hourly rate and gender, M/F. If you are using a company printout,

any additional columns must be crossed out. Make only one entry per employee. Each page must end with the page number

and a subtotal of the wages on that page. Additional report pages need not be individually signed and dated, but they must be

returned with a properly signed and dated C-101 report. If the original C-101 report is misplaced or destroyed, a duplicate form

can be requested by calling (802) 828-4344, or you have the option to file your report in our on-line application.

MAGNETIC MEDIA REPORTING: Employers previously authorized to submit magnetic media, begin with item 8. If you are

interested in submitting wage information via computerized magnetic media at this time or in the future, please download the

specifications and authorization form C-19 from our website under “Unemployment Insurance & Wages”, “Forms and

Publications” links or contact the Magnetic Media Specialist at (802) 828-4253.

ITEM 1, 2 & 3: For each subject employee enter: 1. SSN, 2. employee’s last name, full first name, middle initial and, 3. The

total GROSS WAGES PAID the employee during the quarter. Negative wages are not accepted. Employees include ALL

individuals who perform services for wages. See “General information” for further information on reportable gross wages.

ITEM 4: Enter “H” if hourly worker or “S” if salaried worker. If “S”, skip to item 6.

ITEM 5 & 6: Enter hourly rate. If worker is receiving multiple rates, enter the predominant rate. (Ex. If a worker works 15

hours at $7.00 an hour and 25 hours at $8.00 an hour, enter $8.00). Enter “F” for Female or “M” for Male.

ITEM 7: Enter page number. TOTAL WAGES THIS PAGE. All subsequent pages would reflect the total gross wages for

EACH individual page. (The total gross wages paid for all pages should agree with Item 10.)

ITEM 8: Enter the monthly employment data for Item 10. This is a count of all full-time and part-time workers in covered

employment who perform services during or received pay for the payroll period which includes the 12th of each month. If no

employment occurred during the payroll period, enter zero. Do not leave any box blank.

ITEM 9: Check the appropriate box when a change in the business name or ownership, and/or if you no longer have

employees and wish to inactivate your account.

ITEM 10: Enter total gross wages “PAID” to all employees.

Non-profit or Governmental Reimbursable employers, OMIT Items 11 through 15.

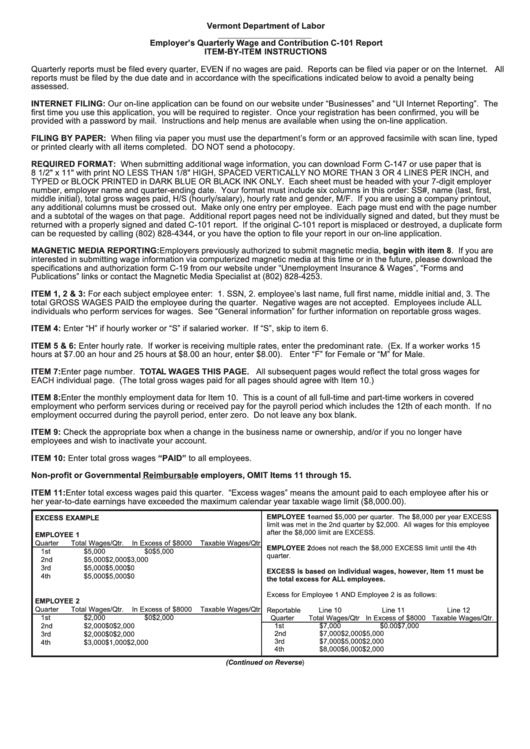

ITEM 11: Enter total excess wages paid this quarter. “Excess wages” means the amount paid to each employee after his or

her year-to-date earnings have exceeded the maximum calendar year taxable wage limit ($8,000.00).

EMPLOYEE 1 earned $5,000 per quarter. The $8,000 per year EXCESS

EXCESS EXAMPLE

limit was met in the 2nd quarter by $2,000. All wages for this employee

after the $8,000 limit are EXCESS.

EMPLOYEE 1

Quarter

Total Wages/Qtr.

In Excess of $8000

Taxable Wages/Qtr.

EMPLOYEE 2 does not reach the $8,000 EXCESS limit until the 4th

1st

$5,000

$0

$5,000

quarter.

2nd

$5,000

$2,000

$3,000

3rd

$5,000

$5,000

$0

EXCESS is based on individual wages, however, Item 11 must be

4th

$5,000

$5,000

$0

the total excess for ALL employees.

Excess for Employee 1 AND Employee 2 is as follows:

EMPLOYEE 2

Quarter

Total Wages/Qtr.

In Excess of $8000

Taxable Wages/Qtr.

Reportable

Line 10

Line 11

Line 12

1st

$2,000

$0

$2,000

Quarter

Total Wages/Qtr In Excess of $8000 Taxable Wages/Qtr.

2nd

$2,000

$0

$2,000

1st

$7,000

$0.00

$7,000

2nd

$7,000

$2,000

$5,000

3rd

$2,000

$0

$2,000

3rd

$7,000

$5,000

$2,000

4th

$3,000

$1,000

$2,000

4th

$8,000

$6,000

$2,000

(Continued on Reverse)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5