Form 105 - Colorado Fiduciary Income Tax Return - 2011

ADVERTISEMENT

(11/17/11)

Department Use Only

Vendor ID

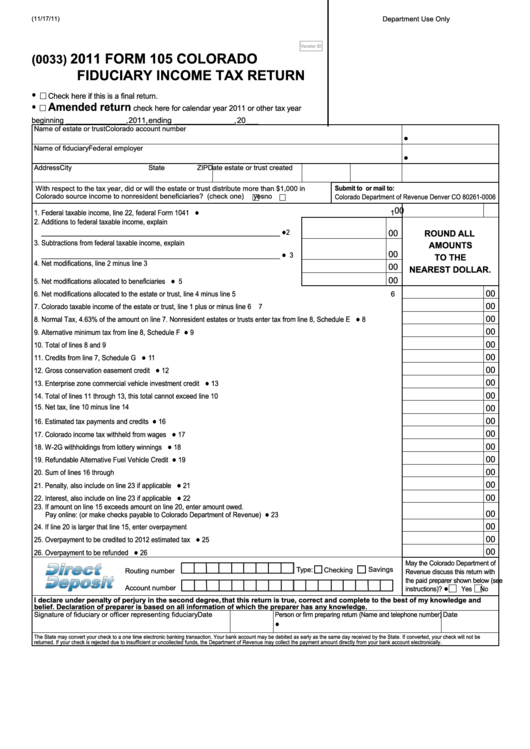

2011 Form 105 colorado

(0033)

Fiduciary income tax return

•

Check here if this is a final return.

•

amended return

check here for calendar year 2011 or other tax year

beginning ______________, 2011, ending ______________, 20___

Name of estate or trust

Colorado account number

•

Name of fiduciary

Federal employer I.D. No.

•

Address

City

State

ZIP

Date estate or trust created

With respect to the tax year, did or will the estate or trust distribute more than $1,000 in

Submit to or mail to:

Colorado source income to nonresident beneficiaries? (check one)

yes

no

Colorado Department of Revenue Denver CO 80261-0006

•

00

1. Federal taxable income, line 22, federal Form 1041 .......................................................................................................

1

2. Additions to federal taxable income, explain

•

00

round all

__________________________________________________________________

2

3. Subtractions from federal taxable income, explain

amountS

•

00

__________________________________________________________________

3

to the

00

4. Net modifications, line 2 minus line 3 ........................................................................... 4

neareSt dollar.

•

00

5. Net modifications allocated to beneficiaries ..............................................................

5

00

6. Net modifications allocated to the estate or trust, line 4 minus line 5 ................................................................................. 6

00

7. Colorado taxable income of the estate or trust, line 1 plus or minus line 6 ........................................................................ 7

•

00

8. Normal Tax, 4.63% of the amount on line 7. Nonresident estates or trusts enter tax from line 8, Schedule E ...............

8

•

00

9. Alternative minimum tax from line 8, Schedule F .............................................................................................................

9

00

10. Total of lines 8 and 9 ..................................................................................................................................................... 10

•

00

11. Credits from line 7, Schedule G ....................................................................................................................................

11

•

00

12. Gross conservation easement credit ...........................................................................................................................

12

•

00

13. Enterprise zone commercial vehicle investment credit ...............................................................................................

13

00

14. Total of lines 11 through 13, this total cannot exceed line 10 ...................................................................................... 14

00

15. Net tax, line 10 minus line 14 ...................................................................................................................................... 15

•

00

16. Estimated tax payments and credits ............................................................................................................................

16

•

00

17. Colorado income tax withheld from wages ..................................................................................................................

17

•

00

18. W-2G withholdings from lottery winnings ....................................................................................................................

18

•

00

19. Refundable Alternative Fuel Vehicle Credit ................................................................................................................

19

00

20. Sum of lines 16 through 19........................................................................................................................................... 20

•

00

21. Penalty, also include on line 23 if applicable ...............................................................................................................

21

•

00

22. Interest, also include on line 23 if applicable ...............................................................................................................

22

23. If amount on line 15 exceeds amount on line 20, enter amount owed.

•

00

Pay online: (or make checks payable to Colorado Department of Revenue) ......

23

00

24. If line 20 is larger that line 15, enter overpayment ....................................................................................................... 24

•

00

25. Overpayment to be credited to 2012 estimated tax .....................................................................................................

25

•

00

26. Overpayment to be refunded .......................................................................................................................................

26

May the Colorado Department of

Savings

Type:

Checking

Routing number

Revenue discuss this return with

the paid preparer shown below (see

•

Account number

instructions)?

Yes

No

i declare under penalty of perjury in the second degree, that this return is true, correct and complete to the best of my knowledge and

belief. declaration of preparer is based on all information of which the preparer has any knowledge.

Signature of fiduciary or officer representing fiduciary

Date

Person or firm preparing return (Name and telephone number)

Date

•

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be

returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4