Net Profit Tax Return Form - City Of Parma Heights - 2011

ADVERTISEMENT

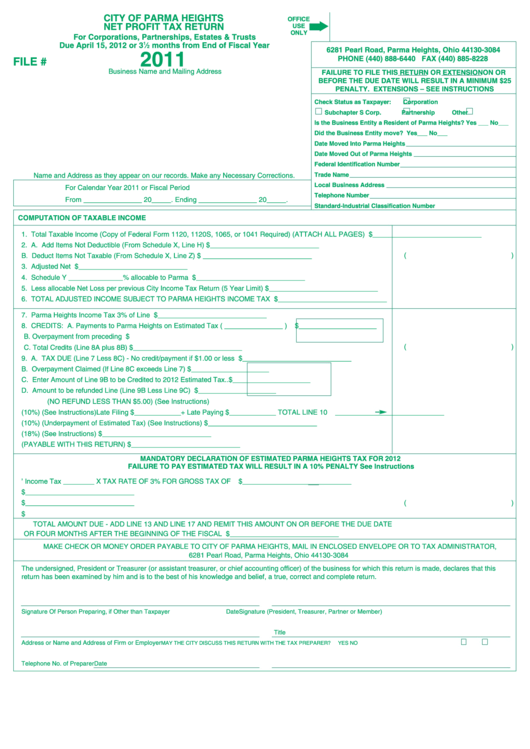

CITY OF PARMA HEIGHTS

OFFICE

NET PROFIT TAX RETURN

USE

ONLY

For Corporations, Partnerships, Estates & Trusts

Due April 15, 2012 or 3

⁄

months from End of Fiscal Year

1

2

6281 Pearl Road, Parma Heights, Ohio 44130-3084

2011

PHONE (440) 888-6440 FAX (440) 885-8228

FILE #

Business Name and Mailing Address

FAILURE TO FILE THIS RETURN OR EXTENSION ON OR

BEFORE THE DUE DATE WILL RESULT IN A MINIMUM $25

PENALTY. EXTENSIONS – SEE INSTRUCTIONS

Check Status as Taxpayer:

Corporation

Subchapter S Corp.

Partnership

Other

Is the Business Entity a Resident of Parma Heights? Yes ___ No___

Did the Business Entity move? Yes___ No___

Date Moved Into Parma Heights

Date Moved Out of Parma Heights

Federal Identification Number

Trade Name

Name and Address as they appear on our records. Make any Necessary Corrections.

Local Business Address

For Calendar Year 2011 or Fiscal Period

Telephone Number

From _______________ 20_____. Ending _______________ 20_____.

Standard-Industrial Classification Number

COMPUTATION OF TAXABLE INCOME

1. Total Taxable Income (Copy of Federal Form 1120, 1120S, 1065, or 1041 Required) (ATTACH ALL PAGES) ..........

$ ____________________________

2. A. Add Items Not Deductible (From Schedule X, Line H) ..........................................................................................

$ ____________________________

(

)

B. Deduct Items Not Taxable (From Schedule X, Line Z) ..........................................................................................

$ ____________________________

3. Adjusted Net Income ....................................................................................................................................................

$ ____________________________

4. Schedule Y ______________% allocable to Parma Heights ......................................................................................

$ ____________________________

5. Less allocable Net Loss per previous City Income Tax Return (5 Year Limit)..............................................................

$ ____________________________

6. TOTAL ADJUSTED INCOME SUBJECT TO PARMA HEIGHTS INCOME TAX ..........................................................

$ ____________________________

7. Parma Heights Income Tax 3% of Line 6 ....................................................................................................................

$ ____________________________

8. CREDITS: A. Payments to Parma Heights on Estimated Tax ( _______________ )

$____________________

B. Overpayment from preceding Year .......................................................... $

(

)

C. Total Credits (Line 8A plus 8B)..............................................................................................................

$ ____________________________

9. A. TAX DUE (Line 7 Less 8C) - No credit/payment if $1.00 or less ..........................................................................

$ ____________________________

B. Overpayment Claimed (If Line 8C exceeds Line 7) ...................... $____________________ ..........................

C. Enter Amount of Line 9B to be Credited to 2012 Estimated Tax .. $____________________ ..........................

D. Amount to be refunded Line (Line 9B Less Line 9C) .................... $____________________ ..........................

(NO REFUND LESS THAN $5.00) (See Instructions)

10. PENALTY (10%) (See Instructions) Late Filing $____________ + Late Paying $____________ TOTAL LINE 10

____________________________

11. PENALTY (10%) (Underpayment of Estimated Tax) (See Instructions) ......................................................................

$ ____________________________

12. INTEREST (18%) (See Instructions)............................................................................................................................

$ ____________________________

13. TOTAL AMOUNT DUE FOR 2011 (PAYABLE WITH THIS RETURN)..........................................................................

$ ____________________________

MANDATORY DECLARATION OF ESTIMATED PARMA HEIGHTS TAX FOR 2012

FAILURE TO PAY ESTIMATED TAX WILL RESULT IN A 10% PENALTY See Instructions

14. Estimated Net Income Subject to Parma Heights’ Income Tax ________ X TAX RATE OF 3% FOR GROSS TAX OF

$ ____________________________

15. AMOUNT DUE WITH ESTIMATE 1/4 of Line 14 ........................................................................................................

$ ____________________________

(

)

16. Less Credit from Line 9C..............................................................................................................................................

$ ____________________________

17. ESTIMATED TAX AMOUNT DUE ................................................................................................................................

$

TOTAL AMOUNT DUE - ADD LINE 13 AND LINE 17 AND REMIT THIS AMOUNT ON OR BEFORE THE DUE DATE

OR FOUR MONTHS AFTER THE BEGINNING OF THE FISCAL YEAR ................................

$ ____________________________

MAKE CHECK OR MONEY ORDER PAYABLE TO CITY OF PARMA HEIGHTS, MAIL IN ENCLOSED ENVELOPE OR TO TAX ADMINISTRATOR,

6281 Pearl Road, Parma Heights, Ohio 44130-3084

The undersigned, President or Treasurer (or assistant treasurer, or chief accounting officer) of the business for which this return is made, declares that this

return has been examined by him and is to the best of his knowledge and belief, a true, correct and complete return.

Signature Of Person Preparing, if Other than Taxpayer

Date

Signature (President, Treasurer, Partner or Member)

Title

Address or Name and Address of Firm or Employer

MAY THE CITY DISCUSS THIS RETURN WITH THE TAX PREPARER?

YES

NO

Telephone No. of Preparer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2