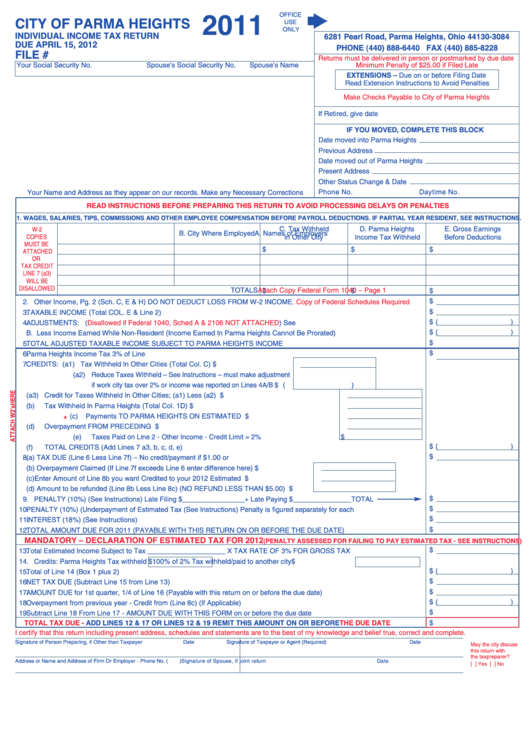

Individual Income Tax Return Form - City Of Parma Heights - 2011

ADVERTISEMENT

2011

OFFICE

CITY OF PARMA HEIGHTS

USE

ONLY

INDIVIDUAL INCOME TAX RETURN

6281 Pearl Road, Parma Heights, Ohio 44130-3084

DUE APRIL 15, 2012

PHONE (440) 888-6440 FAX (440) 885-8228

FILE #

Returns must be delivered in person or postmarked by due date

Minimum Penalty of $25.00 if Filed Late

Your Social Security No.

Spouse’s Social Security No.

Spouse’s Name

EXTENSIONS – Due on or before Filing Date

Read Extension Instructions to Avoid Penalties

Make Checks Payable to City of Parma Heights

If Retired, give date

IF YOU MOVED, COMPLETE THIS BLOCK

Date moved into Parma Heights

Previous Address

Date moved out of Parma Heights

Present Address

Other Status Change & Date

Phone No.

Daytime No.

Your Name and Address as they appear on our records. Make any Necessary Corrections

READ INSTRUCTIONS BEFORE PREPARING THIS RETURN TO AVOID PROCESSING DELAYS OR PENALTIES

1. WAGES, SALARIES, TIPS, COMMISSIONS AND OTHER EMPLOYEE COMPENSATION BEFORE PAYROLL DEDUCTIONS. IF PARTIAL YEAR RESIDENT, SEE INSTRUCTIONS.

C. Tax Withheld

D. Parma Heights

E. Gross Earnings

W-2

A. Names of Employers

B. City Where Employed

COPIES

In Other City

Income Tax Withheld

Before Deductions

MUST BE

$

$

$

ATTACHED

OR

TAX CREDIT

LINE 7 (a3)

WILL BE

DISALLOWED

Attach Copy Federal Form 1040 – Page 1

TOTALS

$

$

$

$

2.

Other Income, Pg. 2 (Sch. C, E & H) DO NOT DEDUCT LOSS FROM W-2 INCOME.

Copy of Federal Schedules Required

........

$

3.

TAXABLE INCOME (Total COL. E & Line 2) ....................................................................................................................................

$ (

)

4.

ADJUSTMENTS: A. Business Expense

(Disallowed if Federal 1040, Sched A & 2106 NOT

ATTACHED) See Instructions ......

$ (

)

B. Less Income Earned While Non-Resident (Income Earned In Parma Heights Cannot Be Prorated) ..........

$

5.

TOTAL ADJUSTED TAXABLE INCOME SUBJECT TO PARMA HEIGHTS INCOME TAX..............................................................

$

6.

Parma Heights Income Tax 3% of Line 5 ........................................................................................................................................

7.

CREDITS: (a1) Tax Withheld In Other Cities (Total Col. C) ......................................$

(a2) Reduce Taxes Withheld – See Instructions – must make adjustment

if work city tax over 2% or income was reported on Lines 4A/B..........$ (

)

(a3) Credit for Taxes Withheld In Other Cities; (a1) Less (a2) ...................................... $

(b)

Tax Withheld In Parma Heights (Total Col. 1D)...................................................... $

(c)

Payments TO PARMA HEIGHTS ON ESTIMATED TAX ........................................ $

*

(d)

Overpayment FROM PRECEDING YEAR ............................................................ $

(e)

Taxes Paid on Line 2 - Other Income - Credit Limit = 2% ........................................ $

$ (

)

(f)

TOTAL CREDITS (Add Lines 7 a3, b, c, d, e) ....................................................................................................

$

8.

(a) TAX DUE (Line 6 Less Line 7f) – No credit/payment if $1.00 or less ........................................................................................

(b) Overpayment Claimed (If Line 7f exceeds Line 6 enter difference here) ........................ $

(c) Enter Amount of Line 8b you want Credited to your 2012 Estimated Tax ........................ $

(d) Amount to be refunded (Line 8b Less Line 8c) (NO REFUND LESS THAN $5.00) ........ $

$

9.

PENALTY (10%) (See Instructions) Late Filing $________________ + Late Paying $_______________ TOTAL

$

10.

PENALTY (10%) (Underpayment of Estimated Tax (See Instructions) Penalty is figured separately for each installment ............

$

11.

INTEREST (18%) (See Instructions)................................................................................................................................................

$

12.

TOTAL AMOUNT DUE FOR 2011 (PAYABLE WITH THIS RETURN ON OR BEFORE THE DUE DATE)......................................

MANDATORY – DECLARATION OF ESTIMATED TAX FOR 2012

(PENALTY ASSESSED FOR FAILING TO PAY ESTIMATED TAX - SEE INSTRUCTIONS)

$

13.

Total Estimated Income Subject to Tax ____________________ X TAX RATE OF 3% FOR GROSS TAX OF ............................

14.

Credits: Parma Heights Tax withheld $

100% of 2% Tax withheld/paid to another city $

$ (

)

15.

Total of Line 14 (Box 1 plus 2)..........................................................................................................................................................

$

16.

NET TAX DUE (Subtract Line 15 from Line 13) ..............................................................................................................................

$

17.

AMOUNT DUE for 1st quarter, 1/4 of Line 16 (Payable with this return on or before the due date) ..............................................

$ (

)

18.

Overpayment from previous year - Credit from (Line 8c) (If Applicable)..........................................................................................

$

19.

Subtract Line 18 From Line 17 - AMOUNT DUE WITH THIS FORM on or before the due date ....................................................

TOTAL TAX DUE -

ADD LINES 12 & 17 OR LINES 12 & 19 REMIT THIS AMOUNT ON OR BEFORE

THE DUE DATE

$

I certify that this return including present address, schedules and statements are to the best of my knowledge and belief true, correct and complete.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

May the city discuss

this return with

the taxpreparer?

Address or Name and Address of Firm Or Employer - Phone No. (

)

Signature of Spouse, if joint return

Date

[ ] Yes [ ] No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2