Form 496-Up - Report Of Unclaimed Report - Verification And Checklist - 2017

ADVERTISEMENT

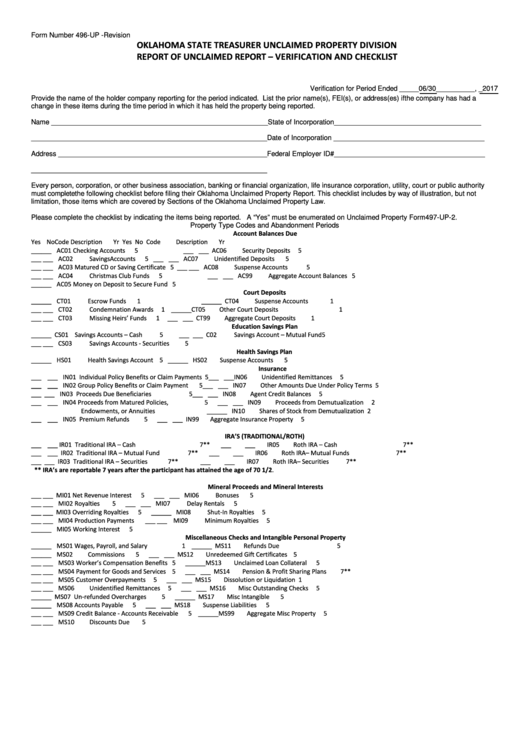

Form Number 496-UP -Revision

OKLAHOMA STATE TREASURER UNCLAIMED PROPERTY DIVISION

REPORT OF UNCLAIMED REPORT – VERIFICATION AND CHECKLIST

Verification for Period Ended _____06/30__________, _2017

Provide the name of the holder company reporting for the period indicated. List the prior name(s), FEI(s), or address(es) if the company has had a

change in these items during the time period in which it has held the property being reported.

Name ________________________________________________________

State of Incorporation______________________________________

_____________________________________________________________

Date of Incorporation _______________________________________

Address ______________________________________________________

Federal Employer ID#_______________________________________

_____________________________________________________________

Every person, corporation, or other business association, banking or financial organization, life insurance corporation, utility, court or public authority

must complete the following checklist before filing their Oklahoma Unclaimed Property Report. This checklist includes by way of illustration, but not

limitation, those items which are covered by Sections of the Oklahoma Unclaimed Property Law.

Please complete the checklist by indicating the items being reported. A “Yes” must be enumerated on Unclaimed Property Form 497-UP-2.

Property Type Codes and Abandonment Periods

Account Balances Due

Yes No

Code Description

Yr

Yes

No

Code

Description

Yr

___ ___ AC01

Checking Accounts

5

___ ___

AC06

Security Deposits

5

___ ___ AC02

Savings Accounts

5

___ ___

AC07

Unidentified Deposits

5

___ ___ AC03

Matured CD or Saving Certificate

5

___ ___

AC08

Suspense Accounts

5

___ ___ AC04

Christmas Club Funds

5

___ ___

AC99

Aggregate Account Balances

5

___ ___ AC05

Money on Deposit to Secure Fund

5

Court Deposits

___ ___ CT01

Escrow Funds

1

___ ___

CT04

Suspense Accounts

1

___ ___ CT02

Condemnation Awards

1

___ ___

CT05

Other Court Deposits

1

___ ___ CT03

Missing Heirs’ Funds

1

___ ___

CT99

Aggregate Court Deposits

1

Education Savings Plan

___ ___ CS01

Savings Accounts – Cash

5

___ ___

C02

Savings Account – Mutual Fund

5

___ ___ CS03

Savings Accounts - Securities

5

Health Savings Plan

___ ___ HS01

Health Savings Account

5

___ ___

HS02

Suspense Accounts

5

Insurance

___ ___ IN01 Individual Policy Benefits or Claim Payments

5

___ ___

IN06

Unidentified Remittances

5

___ ___ IN02 Group Policy Benefits or Claim Payment

5

___ ___

IN07

Other Amounts Due Under Policy Terms

5

___ ___ IN03 Proceeds Due Beneficiaries

5

___ ___

IN08

Agent Credit Balances

5

___ ___ IN04 Proceeds from Matured Policies,

5

___ ___

IN09

Proceeds from Demutualization

2

Endowments, or Annuities

___ ___

IN10

Shares of Stock from Demutualization

2

___ ___ IN05 Premium Refunds

5

___ ___

IN99

Aggregate Insurance Property

5

IRA’S (TRADITIONAL/ROTH)

___ ___ IR01 Traditional IRA – Cash

7**

___

___

IR05

Roth IRA – Cash

7**

___ ___ IR02 Traditional IRA – Mutual Fund

7**

___

___

IR06

Roth IRA– Mutual Funds

7**

___ ___ IR03 Traditional IRA – Securities

7**

___

___

IR07

Roth IRA– Securities

7**

** IRA’s are reportable 7 years after the participant has attained the age of 70 1/2.

Mineral Proceeds and Mineral Interests

___ ___ MI01

Net Revenue Interest

5

___ ___

MI06

Bonuses

5

___ ___ MI02

Royalties

5

___ ___

MI07

Delay Rentals

5

___ ___ MI03

Overriding Royalties

5

___ ___

MI08

Shut-In Royalties

5

___ ___ MI04

Production Payments

___ ___

MI09

Minimum Royalties

5

___ ___ MI05

Working Interest

5

Miscellaneous Checks and Intangible Personal Property

___ ___ MS01

Wages, Payroll, and Salary

1

___ ___

MS11

Refunds Due

5

___ ___ MS02

Commissions

5

___ ___

MS12

Unredeemed Gift Certificates

5

___ ___ MS03

Worker’s Compensation Benefits

5

___ ___

MS13

Unclaimed Loan Collateral

5

___ ___ MS04

Payment for Goods and Services

5

___ ___

MS14

Pension & Profit Sharing Plans

7**

___ ___ MS05

Customer Overpayments

5

___ ___

MS15

Dissolution or Liquidation

1

___ ___ MS06

Unidentified Remittances

5

___ ___

MS16

Misc Outstanding Checks

5

___ ___ MS07

Un-refunded Overcharges

5

___ ___

MS17

Misc Intangible

5

___ ___ MS08

Accounts Payable

5

___ ___

MS18

Suspense Liabilities

5

___ ___ MS09

Credit Balance - Accounts Receivable

5

___ ___

MS99

Aggregate Misc Property

5

___ ___ MS10

Discounts Due

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2