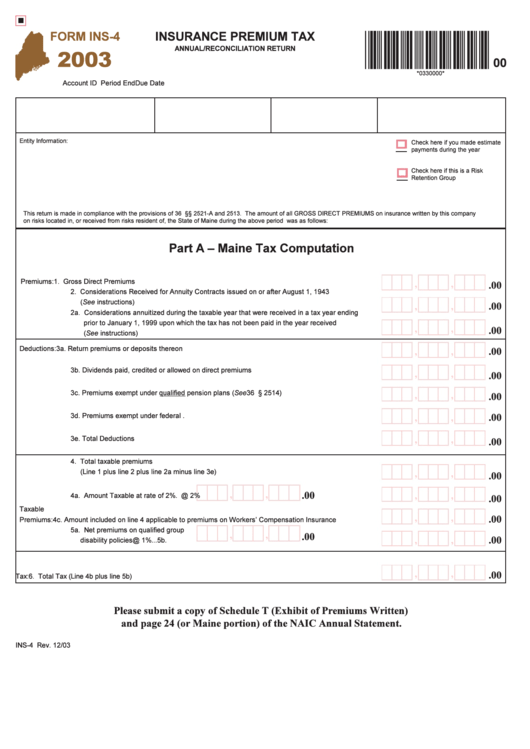

Form Ins-4 - Insurance Premium Tax Annual/reconciliation Return - 2003

ADVERTISEMENT

*0330000*

FORM INS-4

INSURANCE PREMIUM TAX

ANNUAL/RECONCILIATION RETURN

2003

00

*0330000*

Account ID No.

Period Begin

Period End

Due Date

Entity Information:

Check here if you made estimate

payments during the year

Check here if this is a Risk

Retention Group

This return is made in compliance with the provisions of 36 M.R.S.A. §§ 2521-A and 2513. The amount of all GROSS DIRECT PREMIUMS on insurance written by this company

on risks located in, or received from risks resident of, the State of Maine during the above period was as follows:

Part A – Maine Tax Computation

Premiums:

1. Gross Direct Premiums ................................................................................................................ 1.

,

,

.00

2. Considerations Received for Annuity Contracts issued on or after August 1, 1943

(See instructions) ......................................................................................................................... 2.

.00

,

,

2a. Considerations annuitized during the taxable year that were received in a tax year ending

prior to January 1, 1999 upon which the tax has not been paid in the year received

,

,

.00

(See instructions) ...................................................................................................................... 2a.

Deductions:

3a. Return premiums or deposits thereon ...................................................................................... 3a.

.00

,

,

3b. Dividends paid, credited or allowed on direct premiums .......................................................... 3b.

,

,

.00

3c. Premiums exempt under qualified pension plans (See 36 M.R.S.A. § 2514) .......................... 3c.

,

,

.00

.00

,

,

3d. Premiums exempt under federal law ........................................................................................ 3d.

,

,

3e. Total Deductions ........................................................................................................................ 3e.

.00

4. Total taxable premiums

(Line 1 plus line 2 plus line 2a minus line 3e) .............................................................................. 4.

,

,

.00

,

,

.00

,

,

4a. Amount Taxable at rate of 2% . 4a.

Tax @ 2% .... 4b.

.00

Taxable

,

,

.00

Premiums:

4c. Amount included on line 4 applicable to premiums on Workers’ Compensation Insurance .... 4c.

5a. Net premiums on qualified group

,

,

.00

,

,

.00

disability policies ....................... 5a.

Tax @ 1%...5b.

,

,

.00

Tax:

6. Total Tax (Line 4b plus line 5b) ..................................................................................................... 6.

Please submit a copy of Schedule T (Exhibit of Premiums Written)

and page 24 (or Maine portion) of the NAIC Annual Statement.

INS-4 Rev. 12/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2