Form Ct-1120hr - Historic Rehabilitation Tax Credits - 2007

ADVERTISEMENT

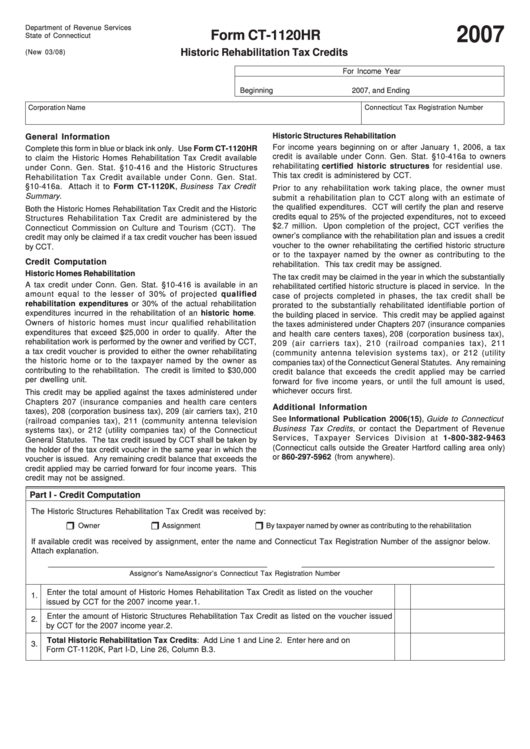

Department of Revenue Services

2007

Form CT-1120HR

State of Connecticut

Historic Rehabilitation Tax Credits

(New 03/08)

For Income Year

Beginning

2007, and Ending

Connecticut Tax Registration Number

Corporation Name

Historic Structures Rehabilitation

General Information

For income years beginning on or after January 1, 2006, a tax

Complete this form in blue or black ink only. Use Form CT-1120HR

credit is available under Conn. Gen. Stat. §10-416a to owners

to claim the Historic Homes Rehabilitation Tax Credit available

rehabilitating certified historic structures for residential use.

under Conn. Gen. Stat. §10-416 and the Historic Structures

This tax credit is administered by CCT.

Rehabilitation Tax Credit available under Conn. Gen. Stat.

§10-416a. Attach it to Form CT-1120K, Business Tax Credit

Prior to any rehabilitation work taking place, the owner must

Summary.

submit a rehabilitation plan to CCT along with an estimate of

the qualified expenditures. CCT will certify the plan and reserve

Both the Historic Homes Rehabilitation Tax Credit and the Historic

credits equal to 25% of the projected expenditures, not to exceed

Structures Rehabilitation Tax Credit are administered by the

$2.7 million. Upon completion of the project, CCT verifies the

Connecticut Commission on Culture and Tourism (CCT). The

owner’s compliance with the rehabilitation plan and issues a credit

credit may only be claimed if a tax credit voucher has been issued

voucher to the owner rehabilitating the certified historic structure

by CCT.

or to the taxpayer named by the owner as contributing to the

Credit Computation

rehabilitation. This tax credit may be assigned.

Historic Homes Rehabilitation

The tax credit may be claimed in the year in which the substantially

A tax credit under Conn. Gen. Stat. §10-416 is available in an

rehabilitated certified historic structure is placed in service. In the

amount equal to the lesser of 30% of projected qualified

case of projects completed in phases, the tax credit shall be

rehabilitation expenditures or 30% of the actual rehabilitation

prorated to the substantially rehabilitated identifiable portion of

expenditures incurred in the rehabilitation of an historic home.

the building placed in service. This credit may be applied against

Owners of historic homes must incur qualified rehabilitation

the taxes administered under Chapters 207 (insurance companies

expenditures that exceed $25,000 in order to qualify. After the

and health care centers taxes), 208 (corporation business tax),

rehabilitation work is performed by the owner and verified by CCT,

209 (air carriers tax), 210 (railroad companies tax), 211

a tax credit voucher is provided to either the owner rehabilitating

(community antenna television systems tax), or 212 (utility

the historic home or to the taxpayer named by the owner as

companies tax) of the Connecticut General Statutes. Any remaining

contributing to the rehabilitation. The credit is limited to $30,000

credit balance that exceeds the credit applied may be carried

per dwelling unit.

forward for five income years, or until the full amount is used,

whichever occurs first.

This credit may be applied against the taxes administered under

Chapters 207 (insurance companies and health care centers

Additional Information

taxes), 208 (corporation business tax), 209 (air carriers tax), 210

See Informational Publication 2006(15), Guide to Connecticut

(railroad companies tax), 211 (community antenna television

Business Tax Credits, or contact the Department of Revenue

systems tax), or 212 (utility companies tax) of the Connecticut

Services, Taxpayer Services Division at 1-800-382-9463

General Statutes. The tax credit issued by CCT shall be taken by

(Connecticut calls outside the Greater Hartford calling area only)

the holder of the tax credit voucher in the same year in which the

or 860-297-5962 (from anywhere).

voucher is issued. Any remaining credit balance that exceeds the

credit applied may be carried forward for four income years. This

credit may not be assigned.

Part I - Credit Computation

The Historic Structures Rehabilitation Tax Credit was received by:

Owner

Assignment

By taxpayer named by owner as contributing to the rehabilitation

If available credit was received by assignment, enter the name and Connecticut Tax Registration Number of the assignor below.

Attach explanation.

__________________________________________________

____________________________________________

Assignor’s Name

Assignor’s Connecticut Tax Registration Number

Enter the total amount of Historic Homes Rehabilitation Tax Credit as listed on the voucher

1.

issued by CCT for the 2007 income year.

1.

Enter the amount of Historic Structures Rehabilitation Tax Credit as listed on the voucher issued

2.

by CCT for the 2007 income year.

2.

Total Historic Rehabilitation Tax Credits: Add Line 1 and Line 2. Enter here and on

3.

Form CT-1120K, Part I-D, Line 26, Column B.

3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2