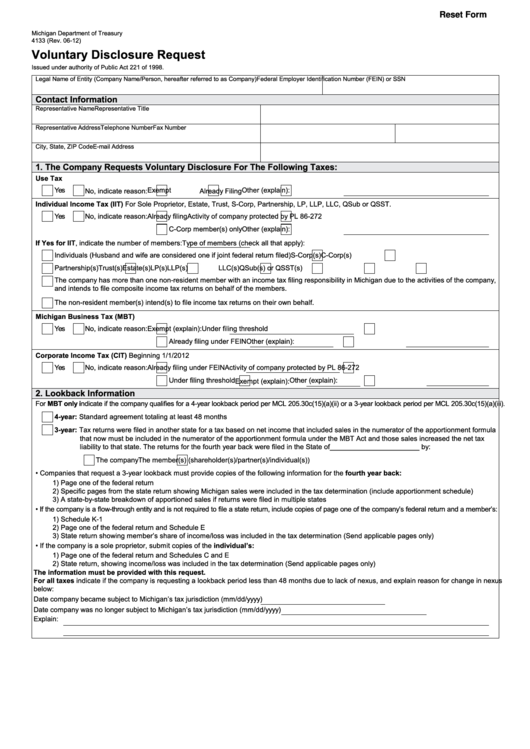

Reset Form

Michigan Department of Treasury

4133 (Rev. 06-12)

Voluntary Disclosure Request

Issued under authority of Public Act 221 of 1998.

Legal Name of Entity (Company Name/Person, hereafter referred to as Company)

Federal Employer Identification Number (FEIN) or SSN

Contact Information

Representative Name

Representative Title

Representative Address

Telephone Number

Fax Number

City, State, ZIP Code

E-mail Address

1. The Company Requests Voluntary Disclosure For The Following Taxes:

Use Tax

Yes

Exempt

Other (explain):

No, indicate reason:

Already Filing

Individual Income Tax (IIT) For Sole Proprietor, Estate, Trust, S-Corp, Partnership, LP, LLP, LLC, QSub or QSST.

Yes

No, indicate reason:

Already filing

Activity of company protected by PL 86-272

C-Corp member(s) only

Other (explain):

If Yes for IIT, indicate the number of members:

Type of members (check all that apply):

Individuals (Husband and wife are considered one if joint federal return filed)

S-Corp(s)

C-Corp(s)

Partnership(s)

Trust(s)

Estate(s)

LP(s)

LLP(s)

LLC(s)

QSub(s) or QSST(s)

The company has more than one non-resident member with an income tax filing responsibility in Michigan due to the activities of the company,

and intends to file composite income tax returns on behalf of the members.

The non-resident member(s) intend(s) to file income tax returns on their own behalf.

Michigan Business Tax (MBT)

Yes

No, indicate reason:

Exempt (explain):

Under filing threshold

Already filing under FEIN

Other (explain):

Corporate Income Tax (CIT) Beginning 1/1/2012

Yes

No, indicate reason:

Already filing under FEIN

Activity of company protected by PL 86-272

Under filing threshold

Other (explain):

Exempt (explain):

2. Lookback Information

For MBT only indicate if the company qualifies for a 4-year lookback period per MCL 205.30c(15)(a)(ii) or a 3-year lookback period per MCL 205.30c(15)(a)(iii).

4-year: Standard agreement totaling at least 48 months

3-year: Tax returns were filed in another state for a tax based on net income that included sales in the numerator of the apportionment formula

that now must be included in the numerator of the apportionment formula under the MBT Act and those sales increased the net tax

liability to that state. The returns for the fourth year back were filed in the State of_______________________ by:

The company

The member(s) (shareholder(s)/partner(s)/individual(s))

• Companies that request a 3-year lookback must provide copies of the following information for the fourth year back:

1) Page one of the federal return

2) Specific pages from the state return showing Michigan sales were included in the tax determination (include apportionment schedule)

3) A state-by-state breakdown of apportioned sales if returns were filed in multiple states

• If the company is a flow-through entity and is not required to file a state return, include copies of page one of the company’s federal return and a member’s:

1) Schedule K-1

2) Page one of the federal return and Schedule E

3) State return showing member’s share of income/loss was included in the tax determination (Send applicable pages only)

• If the company is a sole proprietor, submit copies of the individual’s:

1) Page one of the federal return and Schedules C and E

2) State return, showing income/loss was included in the tax determination (Send applicable pages only)

The information must be provided with this request.

For all taxes indicate if the company is requesting a lookback period less than 48 months due to lack of nexus, and explain reason for change in nexus

below:

Date company became subject to Michigan’s tax jurisdiction (mm/dd/yyyy)

Date company was no longer subject to Michigan’s tax jurisdiction (mm/dd/yyyy)

Explain:

1

1 2

2