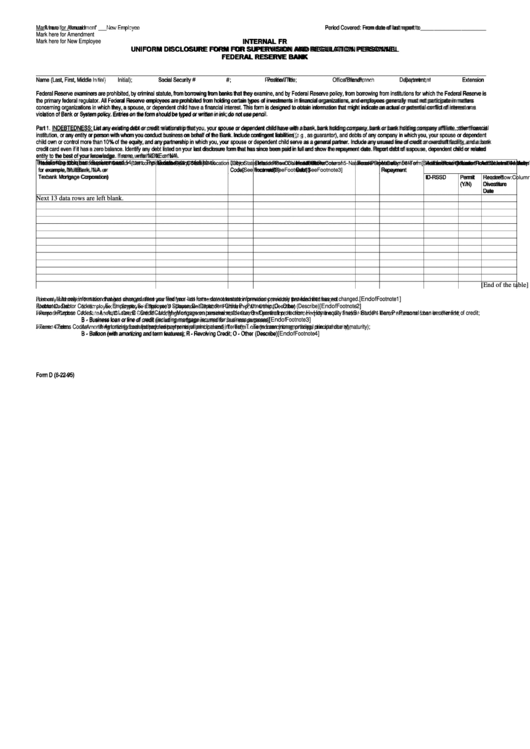

Form D - Internal Fr Uniform Disclosure Form For Supervision And Regulation Personnel

ADVERTISEMENT

Mark here for Annual

Period Covered: From date of last report to

Mark here for Amendment

Mark here for New Employee

INTERNAL FR

UNIFORM DISCLOSURE FORM FOR SUPERVISION AND REGULATION PERSONNEL

FEDERAL RESERVE BANK

Name (Last, First, Middle

Initial);

Social Security

#;

Position/Title;

Office/Branch;

Department;

Extension

Federal Reserve examiners are prohibited, by criminal statute, from borrowing from banks that they examine, and by Federal Reserve policy, from borrowing from institutions for which the Federal Reserve is

the primary federal regulator. All Federal Reserve employees are prohibited from holding certain types of investments in financial organizations, and employees generally must not participate in matters

concerning organizations in which they, a spouse, or dependent child have a financial interest. This form is designed to obtain information that might indicate an actual or potential conflict of interest or a

violation of Bank or System policy. Entries on the form should be typed or written in ink; do not use pencil.

Part 1. INDEBTEDNESS: List any existing debt or credit relationship that you, your spouse or dependent child have with a bank, bank holding company, bank or bank holding company affiliate, other financial

institution, or any entity or person with whom you conduct business on behalf of the Bank. Include contingent liabilities (e.g., as guarantor), and debts of any company in which you, your spouse or dependent

child own or control more than 10% of the equity, and any partnership in which you, your spouse or dependent child serve as a general partner. Include any unused line of credit or overdraft facility, and a bank

credit card even if it has a zero balance. Identify any debt listed on your last disclosure form that has since been paid in full and show the repayment date. Report debt of a spouse, dependent child or related

entity to the best of your knowledge. If none, write NONE or N/A.

The following table has 10 columns and 14 rows. The 13 data rows are left blank.

Header Row: Column 1 - Name of Creditor (List complete name,

Header Row: Column 2 - Location (City, State)

Header Row: Column 3 - Debtor

Header Row: Column 4 - Date

Header Row: Column 5 - Nature or Purpose of

Header Row: Column 6 - Term [See Footnote 4]

Header Row: Column 7 - Maturity/ Date of

Header Row: Column 8 - Administrative Use:

Header Row: Column 9 - Admi

for example, MultiBank, N.A. or

Code[See Footnote 2]

Incurred [See Footnote 1]

Debt [See Footnote 3]

Repayment

Texbank Mortgage Corporation)

ID-RSSD

Permit

Header Row: Column

(Y/N)

Divestiture

Date

Next 13 data rows are left blank.

[End of the table]

Footnote I - - List only information that has changed since you filed your last form - do not restate information previously provided that has not changed. [End of Footnote 1]

Footnote 2-- Debtor Codes:

E - Employee; S - Employee's Spouse; D - Dependent Child; P - Partnership; O - Other (Describe) [End of Footnote 2]

Footnote 3 -- Purpose Codes:

A - Auto Loan; C - Credit Card; M - Mortgage on personal residence; O - Overdraft protection; H - Home equity line; S - Student loan; P - Personal Loan or other line of credit;

B - Business loan or line of credit (including mortgage incurred for business purposes) [End of Footnote 3]

Footnote 4 -- Terms Codes:

A-Amortizing Loan (scheduled payments of principal and interest); T - Term Loan (nonamortizing, principal due at maturity);

B - Balloon (with amortizing and term features); R - Revolving Credit; O - Other (Describe) [End of Footnote 4]

Form D (6-22-95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3