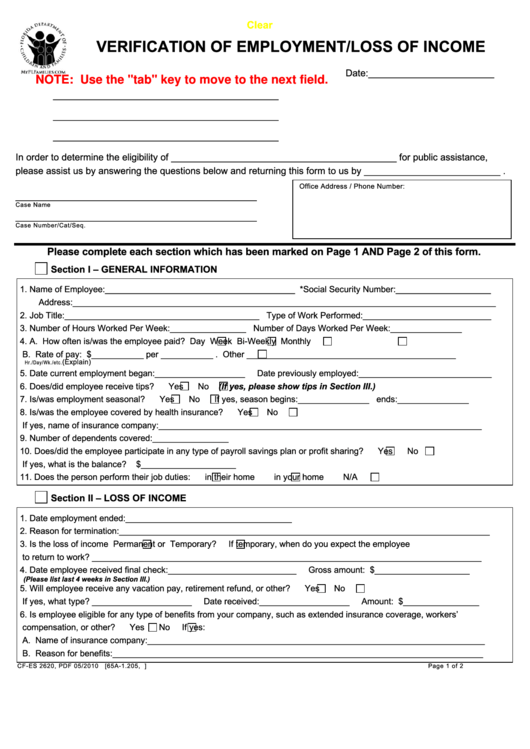

Clear

VERIFICATION OF EMPLOYMENT/LOSS OF INCOME

Date:________________________

NOTE: Use the "tab" key to move to the next field.

___________________________________________

___________________________________________

___________________________________________

In order to determine the eligibility of ___________________________________________ for public assistance,

please assist us by answering the questions below and returning this form to us by __________________________ .

Office Address / Phone Number:

______________________________________________

Case Name

______________________________________________

Case Number/Cat/Seq.

Please complete each section which has been marked on Page 1 AND Page 2 of this form.

Section I – GENERAL INFORMATION

1. Name of Employee:________________________________________ *Social Security Number:____________________

Address:_________________________________________________________________________________________

2. Job Title:_________________________________________ Type of Work Performed:___________________________

3. Number of Hours Worked Per Week:________________ Number of Days Worked Per Week:_______________

4. A. How often is/was the employee paid?

Day

Week

Bi-Weekly

Monthly

B. Rate of pay: $___________ per ___________ .

Other ____________________________________________

(Explain)

Hr./Day/Wk./etc.

5. Date current employment began:___________________

Date previously employed:____________________________

6. Does/did employee receive tips?

Yes

No

(If yes, please show tips in Section III.)

7. Is/was employment seasonal?

Yes

No

If yes, season begins:_______________ ends:_______________

8. Is/was the employee covered by health insurance?

Yes

No

If yes, name of insurance company:____________________________________________________________________

9. Number of dependents covered:________________

10. Does/did the employee participate in any type of payroll savings plan or profit sharing?

Yes

No

If yes, what is the balance?

$____________________

11. Does the person perform their job duties:

in their home

in your home

N/A

Section II – LOSS OF INCOME

1. Date employment ended:___________________________________

2. Reason for termination:______________________________________________________________________________

3. Is the loss of income

Permanent or

Temporary?

If temporary, when do you expect the employee

to return to work? __________________________________________________________________________________

4. Date employee received final check:___________________________

Gross amount: $____________________

(Please list last 4 weeks in Section III.)

5. Will employee receive any vacation pay, retirement refund, or other?

Yes

No

If yes, what type? _____________________

Date received:___________________

Amount: $________________

6. Is employee eligible for any type of benefits from your company, such as extended insurance coverage, workers’

compensation, or other?

Yes

No

If yes:

A. Name of insurance company:_______________________________________________________________________

B. Reason for benefits:______________________________________________________________________________

CF-ES 2620, PDF 05/2010

[65A-1.205, F.A.C.]

Page 1 of 2

1

1 2

2