Schedule A (Form 1040me) - Other Tax Credits Worksheet - 2014

ADVERTISEMENT

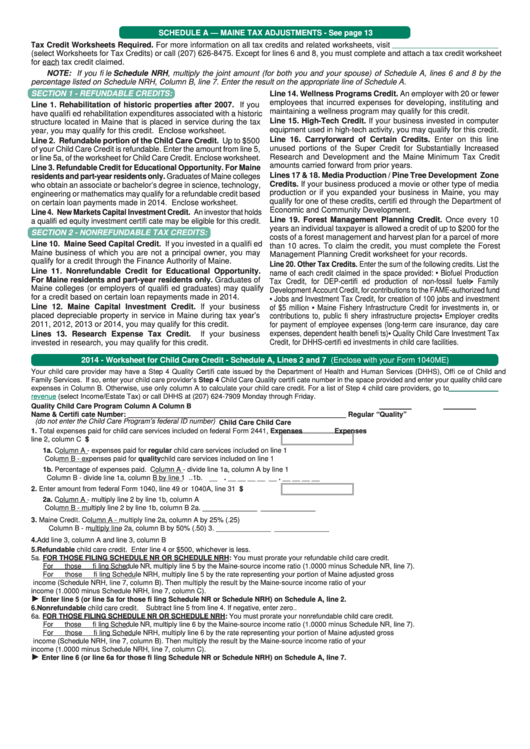

SCHEDULE A — MAINE TAX ADJUSTMENTS - See page 13

Tax Credit Worksheets Required. For more information on all tax credits and related worksheets, visit

(select Worksheets for Tax Credits) or call (207) 626-8475. Except for lines 6 and 8, you must complete and attach a tax credit worksheet

for each tax credit claimed.

NOTE: If you fi le Schedule NRH, multiply the joint amount (for both you and your spouse) of Schedule A, lines 6 and 8 by the

percentage listed on Schedule NRH, Column B, line 7. Enter the result on the appropriate line of Schedule A.

SECTION 1 - REFUNDABLE CREDITS:

Line 14. Wellness Programs Credit. An employer with 20 or fewer

employees that incurred expenses for developing, instituting and

Line 1. Rehabilitation of historic properties after 2007. If you

maintaining a wellness program may qualify for this credit.

have qualifi ed rehabilitation expenditures associated with a historic

Line 15. High-Tech Credit. If your business invested in computer

structure located in Maine that is placed in service during the tax

equipment used in high-tech activity, you may qualify for this credit.

year, you may qualify for this credit. Enclose worksheet.

Line 16. Carryforward of Certain Credits. Enter on this line

Line 2. Refundable portion of the Child Care Credit. Up to $500

unused portions of the Super Credit for Substantially Increased

of your Child Care Credit is refundable. Enter the amount from line 5,

Research and Development and the Maine Minimum Tax Credit

or line 5a, of the worksheet for Child Care Credit. Enclose worksheet.

amounts carried forward from prior years.

Line 3. Refundable Credit for Educational Opportunity. For Maine

Lines 17 & 18. Media Production / Pine Tree Development Zone

residents and part-year residents only. Graduates of Maine colleges

Credits. If your business produced a movie or other type of media

who obtain an associate or bachelor’s degree in science, technology,

production or if you expanded your business in Maine, you may

engineering or mathematics may qualify for a refundable credit based

qualify for one of these credits, certifi ed through the Department of

on certain loan payments made in 2014. Enclose worksheet.

Economic and Community Development.

Line 4. New Markets Capital Investment Credit. An investor that holds

Line 19. Forest Management Planning Credit. Once every 10

a qualifi ed equity investment certifi cate may be eligible for this credit.

years an individual taxpayer is allowed a credit of up to $200 for the

SECTION 2 - NONREFUNDABLE TAX CREDITS:

costs of a forest management and harvest plan for a parcel of more

Line 10. Maine Seed Capital Credit. If you invested in a qualifi ed

than 10 acres. To claim the credit, you must complete the Forest

Maine business of which you are not a principal owner, you may

Management Planning Credit worksheet for your records.

qualify for a credit through the Finance Authority of Maine.

Line 20. Other Tax Credits. Enter the sum of the following credits. List the

Line 11. Nonrefundable Credit for Educational Opportunity.

name of each credit claimed in the space provided: • Biofuel Production

For Maine residents and part-year residents only. Graduates of

Tax Credit, for DEP-certifi ed production of non-fossil fuels • Family

Maine colleges (or employers of qualifi ed graduates) may qualify

Development Account Credit, for contributions to the FAME-authorized fund

for a credit based on certain loan repayments made in 2014.

• Jobs and Investment Tax Credit, for creation of 100 jobs and investment

Line 12. Maine Capital Investment Credit. If your business

of $5 million • Maine Fishery Infrastructure Credit for investments in, or

placed depreciable property in service in Maine during tax year’s

contributions to, public fi shery infrastructure projects • Employer credits

2011, 2012, 2013 or 2014, you may qualify for this credit.

for payment of employee expenses (long-term care insurance, day care

expenses, dependent health benefi ts) • Quality Child Care Investment Tax

Lines 13. Research Expense Tax Credit.

If your business

Credit, for DHHS-certifi ed investments in child care facilities.

invested in research, you may qualify for this credit.

2014 - Worksheet for Child Care Credit - Schedule A, Lines 2 and 7 (Enclose with your Form 1040ME)

Your child care provider may have a Step 4 Quality Certifi cate issued by the Department of Health and Human Services (DHHS), Offi ce of Child and

Family Services. If so, enter your child care provider’s Step 4 Child Care Quality certifi cate number in the space provided and enter your quality child care

expenses in Column B. Otherwise, use only column A to calculate your child care credit. For a list of Step 4 child care providers, go to

revenue

(select Income/Estate Tax) or call DHHS at (207) 624-7909 Monday through Friday.

Quality Child Care Program

Column A

Column B

Name & Certifi cate Number: ________________________________________________________

Regular

“Quality”

(do not enter the Child Care Program’s federal ID number)

Child Care

Child Care

1. Total expenses paid for child care services included on federal Form 2441,

Expenses

Expenses

line 2, column C ............................................................................................. 1. $

1a. Column A - expenses paid for regular child care services included on line 1

Column B - expenses paid for quality child care services included on line 1 ................................... 1a. ______________

______________

1b. Percentage of expenses paid. Column A - divide line 1a, column A by line 1

Column B - divide line 1a, column B by line 1 .................................. 1b. __ . __ __ __ __

__ . __ __ __ __

2. Enter amount from federal Form 1040, line 49 or 1040A, line 31 ................. 2. $

2a. Column A - multiply line 2 by line 1b, column A

Column B - multiply line 2 by line 1b, column B

2a. ______________

______________

3. Maine Credit. Column A - multiply line 2a, column A by 25% (.25)

Column B - multiply line 2a, column B by 50% (.50)

3. ______________

______________

4. Add line 3, column A and line 3, column B .................................................................................................................. 4. _________________

5. Refundable child care credit. Enter line 4 or $500, whichever is less. ..................................................................... 5. _________________

5a. FOR THOSE FILING SCHEDULE NR OR SCHEDULE NRH: You must prorate your refundable child care credit.

For those fi ling Schedule NR, multiply line 5 by the Maine-source income ratio (1.0000 minus Schedule NR, line 7).

For those fi ling Schedule NRH, multiply line 5 by the rate representing your portion of Maine adjusted gross

income (Schedule NRH, line 7, column B). Then multiply the result by the Maine-source income ratio of your

income (1.0000 minus Schedule NRH, line 7, column C). ........................................................................................ 5a. _________________

►

Enter line 5 (or line 5a for those fi ling Schedule NR or Schedule NRH) on Schedule A, line 2.

6. Nonrefundable child care credit. Subtract line 5 from line 4. If negative, enter zero.. .................................................. 6. _________________

6a. FOR THOSE FILING SCHEDULE NR OR SCHEDULE NRH: You must prorate your nonrefundable child care credit.

For those fi ling Schedule NR, multiply line 6 by the Maine-source income ratio (1.0000 minus Schedule NR, line 7).

For those fi ling Schedule NRH, multiply line 6 by the rate representing your portion of Maine adjusted gross

income (Schedule NRH, line 7, column B). Then multiply the result by the Maine-source income ratio of your

income (1.0000 minus Schedule NRH, line 7, column C). ........................................................................................ 6a. _________________

►

Enter line 6 (or line 6a for those fi ling Schedule NR or Schedule NRH) on Schedule A, line 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5