Instructions For Pt-441 Motor Carriers Property Tax Return

ADVERTISEMENT

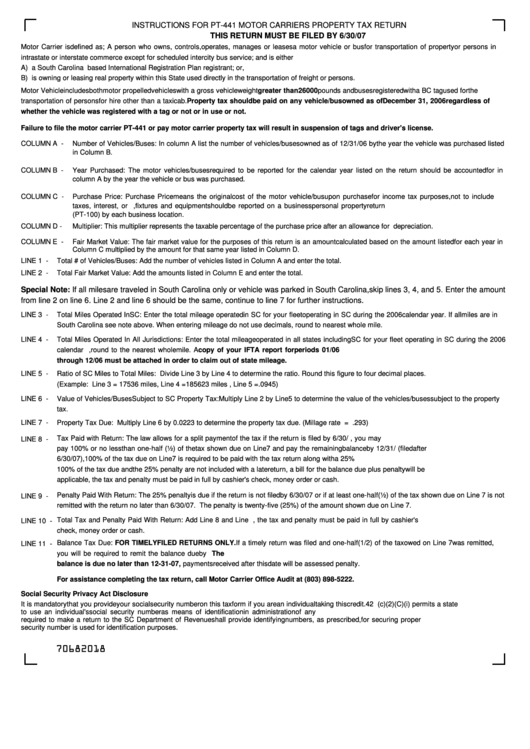

INSTRUCTIONS FOR PT-441 MOTOR CARRIERS PROPERTY TAX RETURN

THIS RETURN MUST BE FILED BY 6/30/07

Motor Carrier is defined as; A person who owns, controls, operates, manages or leases a motor vehicle or bus for transportation of property or persons in

intrastate or interstate commerce except for scheduled intercity bus service; and is either

A) a South Carolina based International Registration Plan registrant; or,

B) is owning or leasing real property within this State used directly in the transportation of freight or persons.

Motor Vehicle includes both motor propelled vehicles with a gross vehicle weight greater than 26000 pounds and buses registered with a BC tag used for the

transportation of persons for hire other than a taxi cab. Property tax should be paid on any vehicle/bus owned as of December 31, 2006 regardless of

whether the vehicle was registered with a tag or not or in use or not.

Failure to file the motor carrier PT-441 or pay motor carrier property tax will result in suspension of tags and driver's license.

COLUMN A -

Number of Vehicles/Buses: In column A list the number of vehicles/buses owned as of 12/31/06 by the year the vehicle was purchased listed

in Column B.

COLUMN B -

Year Purchased: The motor vehicles/buses required to be reported for the calendar year listed on the return should be accounted for in

column A by the year the vehicle or bus was purchased.

COLUMN C -

Purchase Price: Purchase Price means the original cost of the motor vehicle/bus upon purchase for income tax purposes, not to include

taxes, interest, or cab customizing. All other furniture, fixtures and equipment should be reported on a business personal property return

(PT-100) by each business location.

COLUMN D -

Multiplier: This multiplier represents the taxable percentage of the purchase price after an allowance for depreciation.

COLUMN E -

Fair Market Value: The fair market value for the purposes of this return is an amount calculated based on the amount listed for each year in

Column C multiplied by the amount for that same year listed in Column D.

LINE 1 -

Total # of Vehicles/Buses: Add the number of vehicles listed in Column A and enter the total.

LINE 2 -

Total Fair Market Value: Add the amounts listed in Column E and enter the total.

Special Note: If all miles are traveled in South Carolina only or vehicle was parked in South Carolina, skip lines 3, 4, and 5. Enter the amount

from line 2 on line 6. Line 2 and line 6 should be the same, continue to line 7 for further instructions.

LINE 3 -

Total Miles Operated In SC: Enter the total mileage operated in SC for your fleet operating in SC during the 2006 calendar year. If all miles are in

South Carolina see note above. When entering mileage do not use decimals, round to nearest whole mile.

LINE 4 -

Total Miles Operated In All Jurisdictions: Enter the total mileage operated in all states including SC for your fleet operating in SC during the 2006

calendar year. When entering mileage do not use decimals, round to the nearest whole mile. A copy of your IFTA report for periods 01/06

through 12/06 must be attached in order to claim out of state mileage.

LINE 5 -

Ratio of SC Miles to Total Miles: Divide Line 3 by Line 4 to determine the ratio. Round this figure to four decimal places.

(Example: Line 3 = 17536 miles, Line 4 =185623 miles , Line 5 =.0945)

LINE 6 -

Value of Vehicles/Buses Subject to SC Property Tax: Multiply Line 2 by Line 5 to determine the value of the vehicles/buses subject to the property

tax.

LINE 7 -

Property Tax Due: Multiply Line 6 by 0.0223 to determine the property tax due. (Millage rate = .293)

Tax Paid with Return: The law allows for a split payment of the tax if the return is filed by 6/30/07. If the return is timely filed by 6/30/07, you may

LINE 8 -

pay 100% or no less than one-half (½) of the tax shown due on Line 7 and pay the remaining balance by 12/31/07. If the return is late (filed after

6/30/07), 100% of the tax due on Line 7 is required to be paid with the tax return along with a 25% penalty. See Line 9 for penalty information. If

100% of the tax due and the 25% penalty are not included with a late return, a bill for the balance due plus penalty will be issued. When penalty is

applicable, the tax and penalty must be paid in full by cashier's check, money order or cash.

Penalty Paid With Return: The 25% penalty is due if the return is not filed by 6/30/07 or if at least one-half (½) of the tax shown due on Line 7 is not

LINE 9 -

remitted with the return no later than 6/30/07. The penalty is twenty-five (25%) of the amount shown due on Line 7.

Total Tax and Penalty Paid With Return: Add Line 8 and Line 9. When penalty is applicable, the tax and penalty must be paid in full by cashier's

LINE 10 -

check, money order or cash.

Balance Tax Due: FOR TIMELY FILED RETURNS ONLY. If a timely return was filed and one-half (1/2) of the tax owed on Line 7 was remitted,

LINE 11 -

you will be required to remit the balance due by 12-31-07. Subtract Line 8 from Line 7 and enter the remaining amount due on Line 11. The

balance is due no later than 12-31-07, payments received after this date will be assessed penalty.

For assistance completing the tax return, call Motor Carrier Office Audit at (803) 898-5222.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taking this credit. 42 U.S.C 405(c)(2)(C)(i) permits a state

to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person

required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social

security number is used for identification purposes.

70682018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3