Instructions For Form St-810.2 - Quarterly Schedule A For Part-Quarterly Filers - New York Department Of Taxation And Finance

ADVERTISEMENT

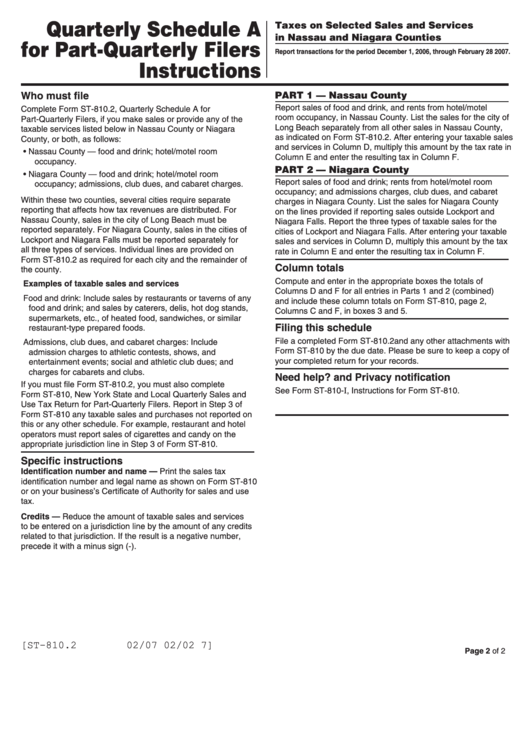

Quarterly Schedule A

Taxes on Selected Sales and Services

in Nassau and Niagara Counties

for Part-Quarterly Filers

Report transactions for the period December 1, 2006, through February 28 2007.

Instructions

PART 1 — Nassau County

Who must file

Report sales of food and drink, and rents from hotel/motel

Complete Form ST-810.2, Quarterly Schedule A for

room occupancy, in Nassau County. List the sales for the city of

Part-Quarterly Filers, if you make sales or provide any of the

Long Beach separately from all other sales in Nassau County,

taxable services listed below in Nassau County or Niagara

as indicated on Form ST-810.2. After entering your taxable sales

County, or both, as follows:

and services in Column D, multiply this amount by the tax rate in

• Nassau County — food and drink; hotel/motel room

Column E and enter the resulting tax in Column F.

occupancy.

PART 2 — Niagara County

• Niagara County — food and drink; hotel/motel room

Report sales of food and drink; rents from hotel/motel room

occupancy; admissions, club dues, and cabaret charges.

occupancy; and admissions charges, club dues, and cabaret

Within these two counties, several cities require separate

charges in Niagara County. List the sales for Niagara County

reporting that affects how tax revenues are distributed. For

on the lines provided if reporting sales outside Lockport and

Nassau County, sales in the city of Long Beach must be

Niagara Falls. Report the three types of taxable sales for the

reported separately. For Niagara County, sales in the cities of

cities of Lockport and Niagara Falls. After entering your taxable

Lockport and Niagara Falls must be reported separately for

sales and services in Column D, multiply this amount by the tax

all three types of services. Individual lines are provided on

rate in Column E and enter the resulting tax in Column F.

Form ST-810.2 as required for each city and the remainder of

Column totals

the county.

Compute and enter in the appropriate boxes the totals of

Examples of taxable sales and services

Columns D and F for all entries in Parts 1 and 2 (combined)

Food and drink: Include sales by restaurants or taverns of any

and include these column totals on Form ST-810, page 2,

food and drink; and sales by caterers, delis, hot dog stands,

Columns C and F, in boxes 3 and 5.

supermarkets, etc., of heated food, sandwiches, or similar

Filing this schedule

restaurant-type prepared foods.

File a completed Form ST-810.2 and any other attachments with

Admissions, club dues, and cabaret charges: Include

Form ST-810 by the due date. Please be sure to keep a copy of

admission charges to athletic contests, shows, and

your completed return for your records.

entertainment events; social and athletic club dues; and

charges for cabarets and clubs.

Need help? and Privacy notification

If you must file Form ST-810.2, you must also complete

See Form ST-810-

I

, Instructions for Form ST-810.

Form ST-810, New York State and Local Quarterly Sales and

Use Tax Return for Part-Quarterly Filers. Report in Step 3 of

Form ST-810 any taxable sales and purchases not reported on

this or any other schedule. For example, restaurant and hotel

operators must report sales of cigarettes and candy on the

appropriate jurisdiction line in Step 3 of Form ST-810.

Specific instructions

Identification number and name — Print the sales tax

identification number and legal name as shown on Form ST-810

or on your business’s Certificate of Authority for sales and use

tax.

Credits — Reduce the amount of taxable sales and services

to be entered on a jurisdiction line by the amount of any credits

related to that jurisdiction. If the result is a negative number,

precede it with a minus sign (-).

[ST-810.2

02/07 02/02 7]

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1