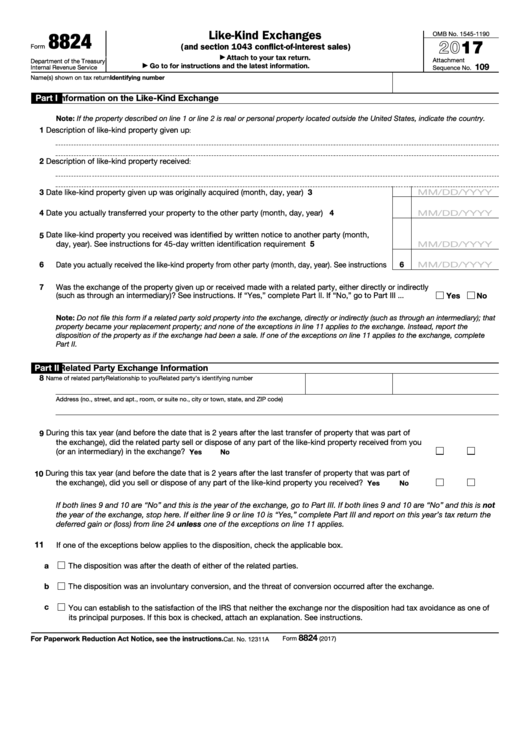

8824

Like-Kind Exchanges

OMB No. 1545-1190

2017

(and section 1043 conflict-of-interest sales)

Form

Attach to your tax return.

▶

Attachment

Department of the Treasury

Go to for instructions and the latest information.

109

▶

Internal Revenue Service

Sequence No.

Identifying number

Name(s) shown on tax return

Part I

Information on the Like-Kind Exchange

Note: If the property described on line 1 or line 2 is real or personal property located outside the United States, indicate the country.

1

Description of like-kind property given up

:

2

Description of like-kind property received

:

3

3

Date like-kind property given up was originally acquired (month, day, year) .

.

.

.

.

.

MM/DD/YYYY

4

Date you actually transferred your property to the other party (month, day, year)

.

.

.

.

4

MM/DD/YYYY

Date like-kind property you received was identified by written notice to another party (month,

5

day, year). See instructions for 45-day written identification requirement .

.

.

.

.

.

.

5

MM/DD/YYYY

6

Date you actually received the like-kind property from other party (month, day, year). See instructions

6

MM/DD/YYYY

7

Was the exchange of the property given up or received made with a related party, either directly or indirectly

(such as through an intermediary)? See instructions. If “Yes,” complete Part II. If “No,” go to Part III

.

.

.

Yes

No

Note: Do not file this form if a related party sold property into the exchange, directly or indirectly (such as through an intermediary); that

property became your replacement property; and none of the exceptions in line 11 applies to the exchange. Instead, report the

disposition of the property as if the exchange had been a sale. If one of the exceptions on line 11 applies to the exchange, complete

Part II.

Part II

Related Party Exchange Information

8

Name of related party

Relationship to you

Related party’s identifying number

Address (no., street, and apt., room, or suite no., city or town, state, and ZIP code)

During this tax year (and before the date that is 2 years after the last transfer of property that was part of

9

the exchange), did the related party sell or dispose of any part of the like-kind property received from you

(or an intermediary) in the exchange?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

During this tax year (and before the date that is 2 years after the last transfer of property that was part of

10

the exchange), did you sell or dispose of any part of the like-kind property you received?

.

.

.

.

.

.

Yes

No

If both lines 9 and 10 are “No” and this is the year of the exchange, go to Part III. If both lines 9 and 10 are “No” and this is not

the year of the exchange, stop here. If either line 9 or line 10 is “Yes,” complete Part III and report on this year’s tax return the

deferred gain or (loss) from line 24 unless one of the exceptions on line 11 applies.

11

If one of the exceptions below applies to the disposition, check the applicable box.

a

The disposition was after the death of either of the related parties.

b

The disposition was an involuntary conversion, and the threat of conversion occurred after the exchange.

c

You can establish to the satisfaction of the IRS that neither the exchange nor the disposition had tax avoidance as one of

its principal purposes. If this box is checked, attach an explanation. See instructions.

8824

For Paperwork Reduction Act Notice, see the instructions.

Form

(2017)

Cat. No. 12311A

1

1 2

2