Form C.c.t.d. 12 - Statement Of Gross Transportation Receipts

ADVERTISEMENT

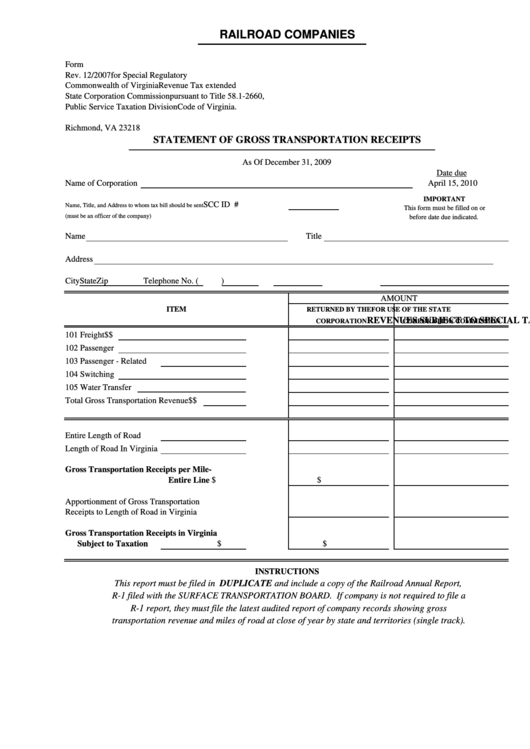

RAILROAD COMPANIES

Form C.C.T.D. 12

This form to be used

Rev. 12/2007

for Special Regulatory

Commonwealth of Virginia

Revenue Tax extended

State Corporation Commission

pursuant to Title 58.1-2660,

Public Service Taxation Division

Code of Virginia.

P.O. Box 1197

Richmond, VA 23218

STATEMENT OF GROSS TRANSPORTATION RECEIPTS

As Of December 31, 2009

Date due

Name of Corporation

April 15, 2010

IMPORTANT

SCC ID #

Name, Title, and Address to whom tax bill should be sent

This form must be filled on or

(must be an officer of the company)

before date due indicated.

Name

Title

Address

City

State

Zip

Telephone No. (

)

AMOUNT

ITEM

RETURNED BY THE

FOR USE OF THE STATE

REVENUES SUBJECT TO SPECIAL TAX

CORPORATION

CORPORATION COMMISSION

101 Freight

$

$

102 Passenger

103 Passenger - Related

104 Switching

105 Water Transfer

Total Gross Transportation Revenue

$

$

Entire Length of Road

Length of Road In Virginia

Gross Transportation Receipts per Mile-

Entire Line

$

$

Apportionment of Gross Transportation

Receipts to Length of Road in Virginia

Gross Transportation Receipts in Virginia

Subject to Taxation

$

$

INSTRUCTIONS

This report must be filed in DUPLICATE and include a copy of the Railroad Annual Report,

R-1 filed with the SURFACE TRANSPORTATION BOARD. If company is not required to file a

R-1 report, they must file the latest audited report of company records showing gross

transportation revenue and miles of road at close of year by state and territories (single track).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2