Form C.c.t.d. 10 - Regulatory Revenue Tax On Common Carriers By Motor Vehicle Report

ADVERTISEMENT

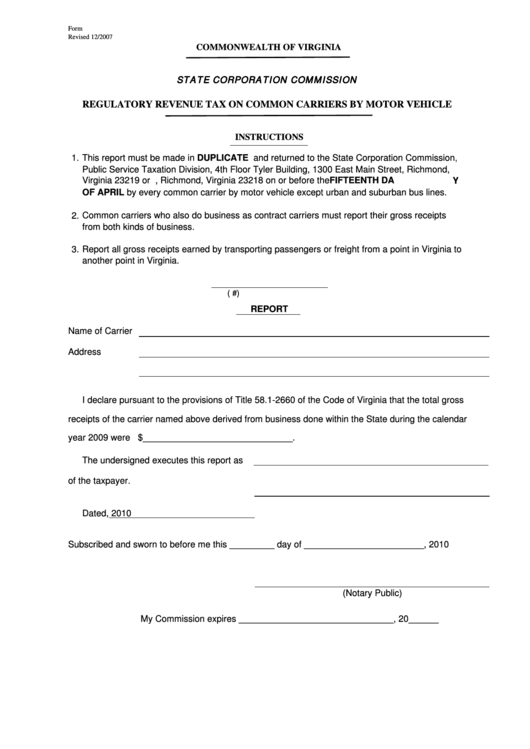

Form C.C.T.D. 10

Revised 12/2007

COMMONWEALTH OF VIRGINIA

STATE CORPORATION COMMISSION

REGULATORY REVENUE TAX ON COMMON CARRIERS BY MOTOR VEHICLE

INSTRUCTIONS

1.

This report must be made in DUPLICATE and returned to the State Corporation Commission,

Public Service Taxation Division, 4th Floor Tyler Building, 1300 East Main Street, Richmond,

Virginia 23219 or P.O. Box 1197, Richmond, Virginia 23218 on or before the FIFTEENTH DAY

OF APRIL by every common carrier by motor vehicle except urban and suburban bus lines.

2.

Common carriers who also do business as contract carriers must report their gross receipts

from both kinds of business.

Report all gross receipts earned by transporting passengers or freight from a point in Virginia to

3.

another point in Virginia.

(S.C.C. Company ID #)

REPORT

Name of Carrier

Address

I declare pursuant to the provisions of Title 58.1-2660 of the Code of Virginia that the total gross

receipts of the carrier named above derived from business done within the State during the calendar

year 2009 were $______________________________.

The undersigned executes this report as

of the taxpayer.

Dated

, 2010

Subscribed and sworn to before me this _________ day of ________________________, 2010

(Notary Public)

My Commission expires _______________________________, 20______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1