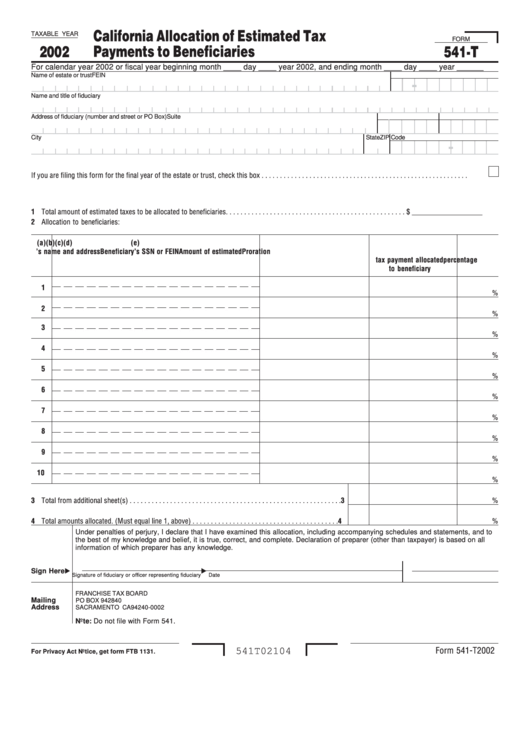

Form 541-T - California Allocation Of Estimated Tax Payments To Beneficiaries - 2002

ADVERTISEMENT

California Allocation of Estimated Tax

TAXABLE YEAR

FORM

2002

Payments to Beneficiaries

541-T

For calendar year 2002 or fiscal year beginning month ____ day ____ year 2002, and ending month ____ day ____ year ______

Name of estate or trust

FEIN

-

Name and title of fiduciary

Address of fiduciary (number and street or PO Box)

Suite no.

PMB no.

City

State

ZIP Code

-

If you are filing this form for the final year of the estate or trust, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 Total amount of estimated taxes to be allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________

2 Allocation to beneficiaries:

(a)

(b)

(c)

(d)

(e)

No.

Beneficiary’s name and address

Beneficiary’s SSN or FEIN

Amount of estimated

Proration

tax payment allocated

percentage

to beneficiary

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

10

%

3 Total from additional sheet(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

%

4 Total amounts allocated. (Must equal line 1, above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

%

Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to

the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all

information of which preparer has any knowledge.

Sign Here

Signature of fiduciary or officer representing fiduciary

Date

FRANCHISE TAX BOARD

Mailing

PO BOX 942840

Address

SACRAMENTO CA 94240-0002

Note: Do not file with Form 541.

Form 541-T 2002

541T02104

For Privacy Act Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1