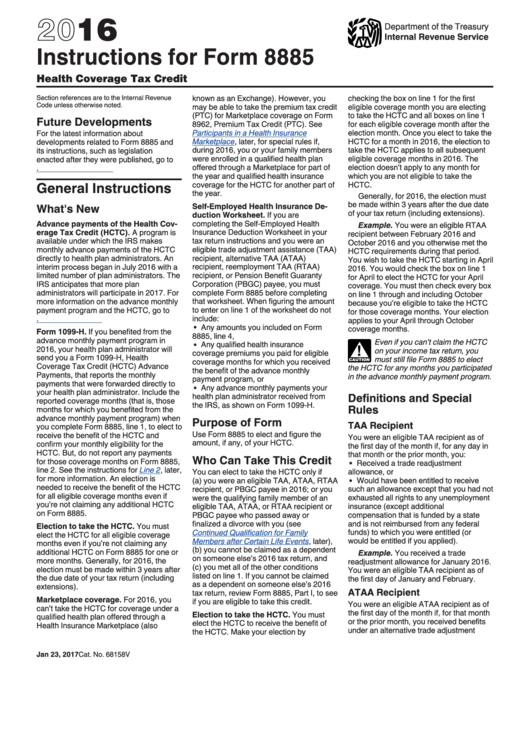

Instructions For Form 8885 - Health Coverage Tax Credit - Internal Revenue Service - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8885

Health Coverage Tax Credit

known as an Exchange). However, you

checking the box on line 1 for the first

Section references are to the Internal Revenue

Code unless otherwise noted.

may be able to take the premium tax credit

eligible coverage month you are electing

(PTC) for Marketplace coverage on Form

to take the HCTC and all boxes on line 1

Future Developments

8962, Premium Tax Credit (PTC). See

for each eligible coverage month after the

Participants in a Health Insurance

election month. Once you elect to take the

For the latest information about

Marketplace, later, for special rules if,

HCTC for a month in 2016, the election to

developments related to Form 8885 and

during 2016, you or your family members

take the HCTC applies to all subsequent

its instructions, such as legislation

were enrolled in a qualified health plan

eligible coverage months in 2016. The

enacted after they were published, go to

offered through a Marketplace for part of

election doesn’t apply to any month for

the year and qualified health insurance

which you are not eligible to take the

General Instructions

coverage for the HCTC for another part of

HCTC.

the year.

Generally, for 2016, the election must

be made within 3 years after the due date

What's New

SelfEmployed Health Insurance De

of your tax return (including extensions).

duction Worksheet. If you are

completing the Self-Employed Health

Advance payments of the Health Cov

Example. You were an eligible RTAA

erage Tax Credit (HCTC). A program is

Insurance Deduction Worksheet in your

recipient between February 2016 and

tax return instructions and you were an

available under which the IRS makes

October 2016 and you otherwise met the

monthly advance payments of the HCTC

eligible trade adjustment assistance (TAA)

HCTC requirements during that period.

directly to health plan administrators. An

recipient, alternative TAA (ATAA)

You wish to take the HCTC starting in April

interim process began in July 2016 with a

recipient, reemployment TAA (RTAA)

2016. You would check the box on line 1

limited number of plan administrators. The

recipient, or Pension Benefit Guaranty

for April to elect the HCTC for your April

IRS anticipates that more plan

Corporation (PBGC) payee, you must

coverage. You must then check every box

administrators will participate in 2017. For

complete Form 8885 before completing

on line 1 through and including October

more information on the advance monthly

that worksheet. When figuring the amount

because you’re eligible to take the HCTC

payment program and the HCTC, go to

to enter on line 1 of the worksheet do not

for those coverage months. Your election

include:

applies to your April through October

Any amounts you included on Form

coverage months.

Form 1099H. If you benefited from the

8885, line 4,

advance monthly payment program in

Even if you can’t claim the HCTC

Any qualified health insurance

2016, your health plan administrator will

on your income tax return, you

!

coverage premiums you paid for eligible

send you a Form 1099-H, Health

must still file Form 8885 to elect

coverage months for which you received

CAUTION

Coverage Tax Credit (HCTC) Advance

the HCTC for any months you participated

the benefit of the advance monthly

Payments, that reports the monthly

in the advance monthly payment program.

payment program, or

payments that were forwarded directly to

Any advance monthly payments your

your health plan administrator. Include the

Definitions and Special

health plan administrator received from

reported coverage months (that is, those

the IRS, as shown on Form 1099-H.

Rules

months for which you benefited from the

advance monthly payment program) when

Purpose of Form

TAA Recipient

you complete Form 8885, line 1, to elect to

Use Form 8885 to elect and figure the

receive the benefit of the HCTC and

You were an eligible TAA recipient as of

amount, if any, of your HCTC.

confirm your monthly eligibility for the

the first day of the month if, for any day in

HCTC. But, do not report any payments

that month or the prior month, you:

Who Can Take This Credit

for those coverage months on Form 8885,

Received a trade readjustment

line 2. See the instructions for

Line

2, later,

You can elect to take the HCTC only if

allowance, or

for more information. An election is

Would have been entitled to receive

(a) you were an eligible TAA, ATAA, RTAA

needed to receive the benefit of the HCTC

recipient, or PBGC payee in 2016; or you

such an allowance except that you had not

for all eligible coverage months even if

exhausted all rights to any unemployment

were the qualifying family member of an

you’re not claiming any additional HCTC

eligible TAA, ATAA, or RTAA recipient or

insurance (except additional

on Form 8885.

compensation that is funded by a state

PBGC payee who passed away or

finalized a divorce with you (see

and is not reimbursed from any federal

Election to take the HCTC. You must

funds) to which you were entitled (or

Continued Qualification for Family

elect the HCTC for all eligible coverage

Members after Certain Life

Events, later),

would be entitled if you applied).

months even if you’re not claiming any

(b) you cannot be claimed as a dependent

additional HCTC on Form 8885 for one or

Example. You received a trade

on someone else’s 2016 tax return, and

more months. Generally, for 2016, the

readjustment allowance for January 2016.

(c) you met all of the other conditions

election must be made within 3 years after

You were an eligible TAA recipient as of

listed on line 1. If you cannot be claimed

the due date of your tax return (including

the first day of January and February.

as a dependent on someone else’s 2016

extensions).

ATAA Recipient

tax return, review Form 8885, Part I, to see

Marketplace coverage. For 2016, you

if you are eligible to take this credit.

You were an eligible ATAA recipient as of

can’t take the HCTC for coverage under a

the first day of the month if, for that month

Election to take the HCTC. You must

qualified health plan offered through a

or the prior month, you received benefits

elect the HCTC to receive the benefit of

Health Insurance Marketplace (also

under an alternative trade adjustment

the HCTC. Make your election by

Jan 23, 2017

Cat. No. 68158V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5