Form It-20s - Indiana S Corporation Income Tax Return - 2003

ADVERTISEMENT

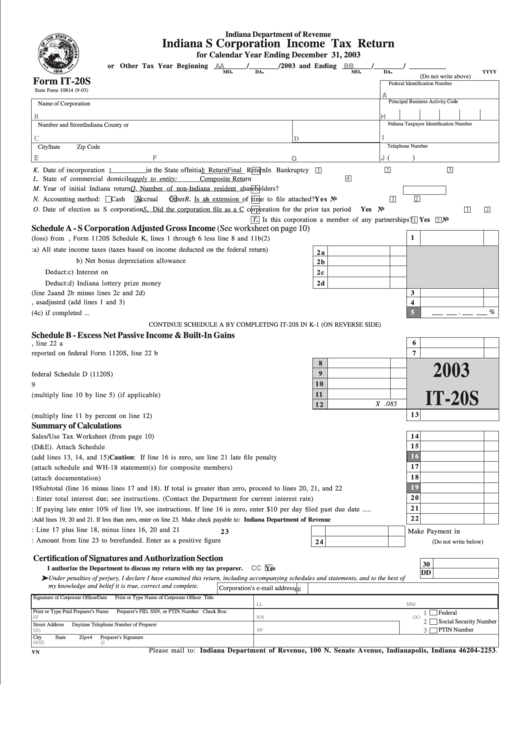

Indiana Department of Revenue

Indiana S Corporation Income Tax Return

for Calendar Year Ending December 31, 2003

or

Other Tax Year Beginning

AA

_________/________/2003 and Ending

BB

________/________/ __________

.

.

.

.

MO

DA

MO

DA

YYYY

(Do not write above)

Form IT-20S

Federal Identification Number

State Form 10814 (9-03)

A

Principal Business Activity Code

Name of Corporation

B

H

Indiana Taxpayer Identification Number

Number and Street

Indiana County or O.O.S.

I

C

D

Telephone Number

City

State

Zip Code

E

F

J

(

)

G

K. Date of incorporation

in the State of

P. Check all that

Initial Return

Final Return

3

In Bankruptcy

1

1

2

2

4

L. State of commercial domicile

apply to entity:

Composite Return

M. Year of initial Indiana return

Q. Number of non-Indiana resident shareholders?

N. Accounting method:

Cash

Accrual

3

Other

R. Is an extension of time to file attached?

Y e s

No

1

2

1

2

O. Date of election as S corporation

S. Did the corporation file as a C corporation for the prior tax period

1

Yes

2

No

T. Is this corporation a member of any partnerships?

Yes

No

1

2

Schedule A - S Corporation Adjusted Gross Income (See worksheet on page 10)

1

1. Total net income (loss) from U.S. Corporation return, Form 1120S Schedule K, lines 1 through 6 less line 8 and 11b(2)

2. Add back: a) All state income taxes (taxes based on income deducted on the federal return)

2 a

b) Net bonus depreciation allowance .....................................................................

2b

Deduct:

c) Interest on U.S. Government obligations ........................................................

2c

Deduct:

d) Indiana lottery prize money ..............................................................................

2d

3. Total state modifications (line 2a and 2b minus lines 2c and 2d) ...............................................................................................

3

4. Total S corporation income, as adjusted (add lines 1 and 3) .......................................................................................................

4

___ ___ . ___ ___ %

5

5. Enter average percentage for Indiana apportioned adjusted gross income from IT-20S Schedule E line (4c) if completed ...

CONTINUE SCHEDULE A BY COMPLETING IT-20S IN K-1 (ON REVERSE SIDE)

Schedule B - Excess Net Passive Income & Built-In Gains

6

6. Excessive net passive income tax as reported on federal Form 1120S, line 22 a ......................................................................

7. Tax from federal Schedule D as reported on federal Form 1120S, line 22 b ...............................................................................

7

8

8. Excess net passive income from federal worksheet ................................................................

2003

9

9. Built-in gains from federal Schedule D (1120S) .......................................................................

1 0

10. Add the amounts on lines 8 and 9 .............................................................................................

IT-20S

11

11. Taxable income apportioned to Indiana (multiply line 10 by line 5) (if applicable) ..........

X .085

1 2

12. Corporate adjusted gross income tax rate .................................................................................

1 3

13. Total income tax from Schedule B (multiply line 11 by percent on line 12) .............................................................................

Summary of Calculations

1 4

14. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet (from page 10) .................................................

1 5

15. Total composite tax from completed Schedule IT-20COMP (D&E). Attach Schedule ............................................................

1 6

16. Total tax (add lines 13, 14, and 15) Caution: If line 16 is zero, see line 21 late file penalty ...............................................

1 7

17. Total composite tax return credits (attach schedule and WH-18 statement(s) for composite members) ..............................

1 8

18. Other credits belonging to the corporation (attach documentation) ...........................................................................................

1 9

1 9 Subtotal (line 16 minus lines 17 and 18). If total is greater than zero, proceed to lines 20, 21, and 22 ................................

2 0

20. Interest: Enter total interest due; see instructions. (Contact the Department for current interest rate) ...............................

2 1

21. Penalty: If paying late enter 10% of line 19, see instructions. If line 16 is zero, enter $10 per day filed past due date .....

2 2

22. Total Amount Due:

Add lines 19, 20 and 21. If less than zero, enter on line 23. Make check payable to: Indiana Department of Revenue

23. Overpayment: Line 17 plus line 18, minus lines 16, 20 and 21 ............................................

Make Payment in U.S. Funds

2 3

24. Refund: Amount from line 23 to be refunded. Enter as a positive figure .............................

2 4

(Do not write below)

Certification of Signatures and Authorization Section

30

CC

I authorize the Department to discuss my return with my tax preparer.

Yes

DD

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief it is true, correct and complete.

Corporation's e-mail address

EE

Signature of Corporate Officer

Date

Print or Type Name of Corporate Officer

Title

LL

MM

Print or Type Paid Preparer's Name

Preparer's FID, SSN, or PTIN Number

Check Box:

1

Federal I.D. Number

OO

FF

NN

2

Social Security Number

Street Address

Daytime Telephone Number of Preparer

PTIN Number

3

GG

PP

City

State

Zip+4

Preparer's Signature

HH

II

JJ

Please mail to: Indiana Department of Revenue, 100 N. Senate Avenue, Indianapolis, Indiana 46204-2253.

VN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1