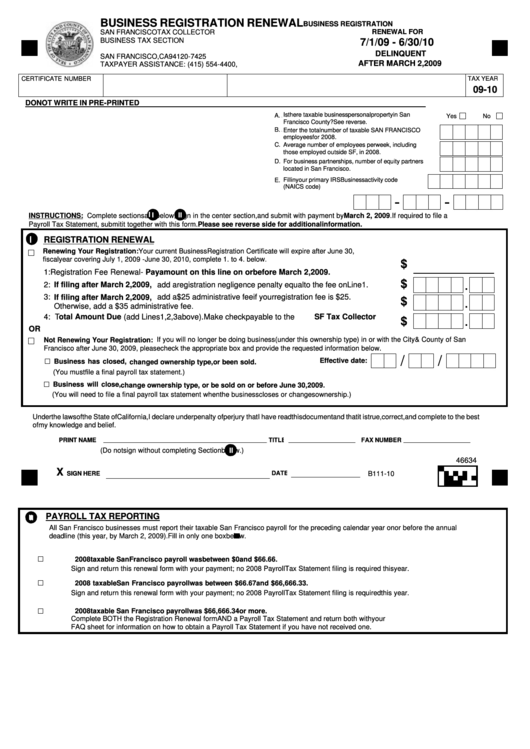

BUSINESS REGISTRATION RENEWAL

BUSINESS REGISTRATION

RENEWAL FOR

SAN FRANCISCO TAX COLLECTOR

BUSINESS TAX SECTION

7/1/09 - 6/30/10

P.O. BOX 7425

DELINQUENT

SAN FRANCISCO, CA 94120-7425

AFTER MARCH 2, 2009

TAXPAYER ASSISTANCE: (415) 554-4400,

CERTIFICATE NUM BER

TAX YEAR

09-10

DO NOT WRITE IN PRE-PRINTED AREAS. USE BLACK INK AND STAY INSIDE BOXES. PLEASE COMPLETE A TO F.

.

Is there taxable business personal property in San

A.

Yes

No

Francisco County? See reverse.

.

B.

Enter the total number of taxable SAN FRANCISCO

employees for 2008.

.

C.

Average number of employees per week, including

those employed outside SF, in 2008.

.

D.

For business partnerships, number of equity partners

located in San Francisco.

.

Fill in your primary IRS Business activity code

E.

(NAICS code). /naics

-

-

F. Contact Number

I

II

I

INSTRUCTIONS: Complete sections

and

below, sign in the center section, and submit with payment by March 2, 2009. If required to file a

Payroll Tax Statement, submit it together with this form. Please see reverse side for additional information.

REGISTRATION RENEWAL

I

I

Renewing Your Registration: Your current Business Registration Certificate will expire after June 30, 2009. To renew the certificate for the

fiscal year covering July 1, 2009 - June 30, 2010, complete 1. to 4. below.

$

1: Registration Fee Renewal - Pay amount on this line on or before March 2, 2009.

$

.

2: If filing after March 2, 2009, add a registration negligence penalty equal to the fee on Line 1.

3: If filing after March 2, 2009, add a $25 administrative fee if your registration fee is $25.

$

.

Otherwise, add a $35 administrative fee.

4: Total Amount Due (add Lines 1, 2, 3 above). Make check payable to the SF Tax Collector

.

$

OR

Not Renewing Your Registration: If you will no longer be doing business (under this ownership type) in or with the City & County of San

Francisco after June 30, 2009, please check the appropriate box and provide the requested information below.

/

/

Effective date:

Business has closed, changed ownership type, or been sold.

(You must file a final payroll tax statement.)

Business will close,

change ownership type, or be sold on or before June 30, 2009.

(You will need to file a final payroll tax statement when the business closes or changes ownership.)

Under the laws of the State of California, I declare under penalty of perjury that I have read this document and that it is true, correct, and complete to the best

of my knowledge and belief.

PRINT NAME

TITLE

FAX NUMBER

(Do not sign without completing Section

II

below.)

46634

X

B111-10

SIGN HERE

DATE

PAYROLL TAX REPORTING

II

II

All San Francisco businesses must report their taxable San Francisco payroll for the preceding calendar year on or before the annual

deadline (this year, by March 2, 2009). Fill in only one box

below.

2008 taxable San Francisco payroll was between $0 and $66.66.

Sign and return this renewal form with your payment; no 2008 Payroll Tax Statement filing is required this year.

2008 taxable San Francisco payroll was between $66.67 and $66,666.33.

Sign and return this renewal form with your payment; no 2008 Payroll Tax Statement filing is required this year.

2008 taxable San Francisco payroll was $66,666.34 or more.

Complete BOTH the Registration Renewal form AND a Payroll Tax Statement and return both with your payment. See the enclosed

FAQ sheet for information on how to obtain a Payroll Tax Statement if you have not received one.

1

1