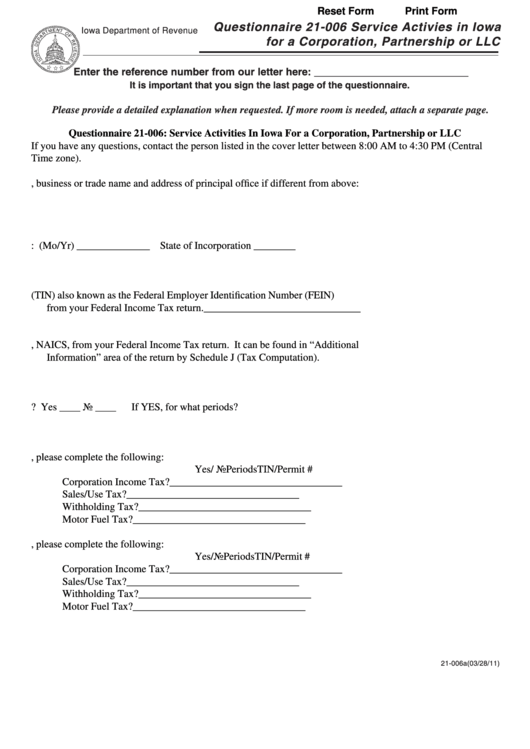

Reset Form

Print Form

Questionnaire 21-006 Service Activies in Iowa

Iowa Department of Revenue

for a Corporation, Partnership or LLC

Enter the reference number from our letter here: ___________________________

It is important that you sign the last page of the questionnaire.

Please provide a detailed explanation when requested. If more room is needed, attach a separate page.

Questionnaire 21-006: Service Activities In Iowa For a Corporation, Partnership or LLC

If you have any questions, contact the person listed in the cover letter between 8:00 AM to 4:30 PM (Central

Time zone).

1. Exact corporation, business or trade name and address of principal office if different from above:

2. Date of Original Formation: (Mo/Yr) ______________ State of Incorporation ________

3. Taxpayer Identification Number (TIN) also known as the Federal Employer Identification Number (FEIN)

from your Federal Income Tax return.______________________________

4. Business Activity Code, NAICS, from your Federal Income Tax return. It can be found in “Additional

Information” area of the return by Schedule J (Tax Computation).

5. Have you ever had an election as an S Corp.? Yes ____ No ____

If YES, for what periods?

6. If you have ever filed returns with this Department, please complete the following:

Yes/ No

Periods

TIN/Permit #

Corporation Income Tax?

______

____________

_______________

Sales/Use Tax?

______

____________

_______________

Withholding Tax?

______

____________

_______________

Motor Fuel Tax?

______

____________

_______________

7. If an affiliated company does or did file an Iowa return, please complete the following:

Yes/No

Periods

TIN/Permit #

Corporation Income Tax?

______

____________

_______________

Sales/Use Tax?

______

____________

_______________

Withholding Tax?

______

____________

_______________

Motor Fuel Tax?

______

____________

_______________

21-006a(03/28/11)

1

1 2

2 3

3 4

4 5

5