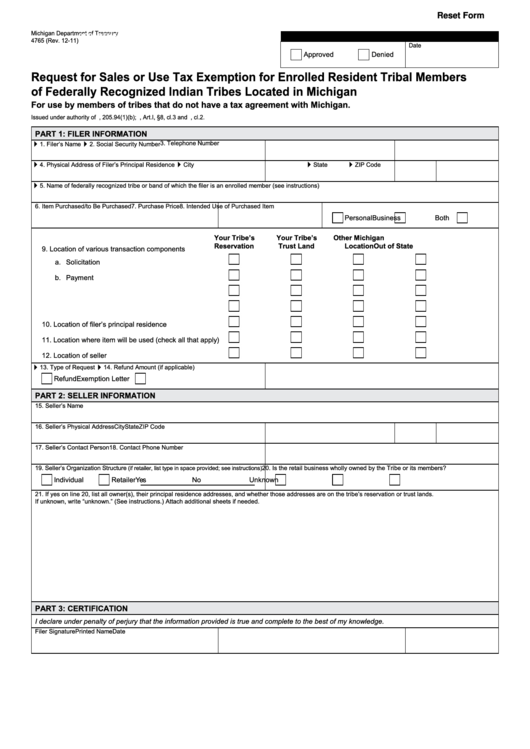

Reset Form

Michigan Department of Treasury

Department of treasury use only

4765 (Rev. 12-11)

Date

Approved

Denied

request for sales or use tax exemption for enrolled resident tribal members

of federally recognized Indian tribes located in michigan

for use by members of tribes that do not have a tax agreement with michigan.

Issued under authority of M.C.L., 205.94(1)(b); U.S. Const., Art.I, §8, cl.3 and Art.VI, cl.2.

part 1: fIler InformatIon

3. Telephone Number

4

1. Filer’s Name

4

2. Social Security Number

4

4. Physical Address of Filer’s Principal Residence

4

City

4

State

4

ZIP Code

4

5. Name of federally recognized tribe or band of which the filer is an enrolled member (see instructions)

6. Item Purchased/to Be Purchased

7. Purchase Price

8. Intended Use of Purchased Item

Personal

Business

Both

your tribe’s

your tribe’s

other michigan

reservation

trust land

location

out of state

9. Location of various transaction components

a. Solicitation ................................................................

.......................

.......................

.......................

b. Payment ...................................................................

.......................

.......................

.......................

c. Signing of Contract ...................................................

.......................

.......................

.......................

d. Exchange of Possession ..........................................

.......................

.......................

.......................

10. Location of filer’s principal residence ..............................

.......................

.......................

.......................

11. Location where item will be used (check all that apply) ....

.......................

.......................

.......................

12. Location of seller .............................................................

.......................

.......................

.......................

4

4

13. Type of Request

14. Refund Amount (if applicable)

Refund

Exemption Letter

part 2: seller InformatIon

15. Seller’s Name

16. Seller’s Physical Address

City

State

ZIP Code

17. Seller’s Contact Person

18. Contact Phone Number

19. Seller’s Organization Structure

20. Is the retail business wholly owned by the Tribe or its members?

(if retailer, list type in space provided; see instructions)

Individual

Retailer

Yes

No

Unknown

21. If yes on line 20, list all owner(s), their principal residence addresses, and whether those addresses are on the tribe’s reservation or trust lands.

If unknown, write “unknown.” (See instructions.) Attach additional sheets if needed.

part 3: CertIfICatIon

I declare under penalty of perjury that the information provided is true and complete to the best of my knowledge.

Filer Signature

Printed Name

Date

1

1 2

2