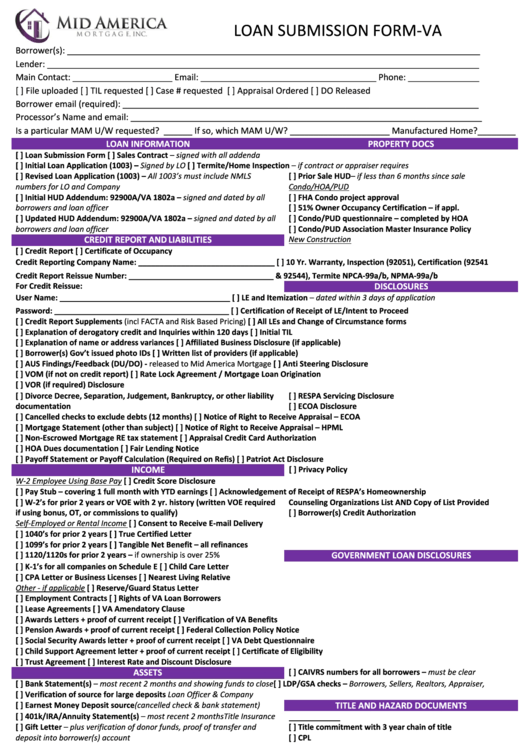

LOAN SUBMISSION FORM-VA

Borrower(s): _______________________________________________________________________________________

Lender: ___________________________________________________________________________________________

Main Contact: _____________________ Email: _____________________________________ Phone: _______________

[ ] File uploaded

[ ] TIL requested

[ ] Case # requested

[ ] Appraisal Ordered

[ ] DO Released

Borrower email (required): ___________________________________________________________________________

Processor’s Name and email: __________________________________________________________________________

Is a particular MAM U/W requested? ______ If so, which MAM U/W? _____________________ Manufactured Home?________

LOAN INFORMATION

PROPERTY DOCS

[ ] Loan Submission Form

[ ] Sales Contract – signed with all addenda

[ ] Initial Loan Application (1003) – Signed by LO

[ ] Termite/Home Inspection – if contract or appraiser requires

[ ] Revised Loan Application (1003) – All 1003’s must include NMLS

[ ] Prior Sale HUD – if less than 6 months since sale

numbers for LO and Company

Condo/HOA/PUD

[ ] Initial HUD Addendum: 92900A/VA 1802a – signed and dated by all

[ ] FHA Condo project approval

borrowers and loan officer

[ ] 51% Owner Occupancy Certification – if appl.

[ ] Updated HUD Addendum: 92900A/VA 1802a – signed and dated by all

[ ] Condo/PUD questionnaire – completed by HOA

borrowers and loan officer

[ ] Condo/PUD Association Master Insurance Policy

CREDIT REPORT AND LIABILITIES

New Construction

[ ] Credit Report

[ ] Certificate of Occupancy

Credit Reporting Company Name: ________________________________

[ ] 10 Yr. Warranty, Inspection (92051), Certification (92541

Credit Report Reissue Number: __________________________________

& 92544), Termite NPCA-99a/b, NPMA-99a/b

For Credit Reissue:

DISCLOSURES

User Name: ________________________________________

[ ] LE and Itemization – dated within 3 days of application

Password: _________________________________________

[ ] Certification of Receipt of LE/Intent to Proceed

[ ] Credit Report Supplements (incl FACTA and Risk Based Pricing)

[ ] All LEs and Change of Circumstance forms

[ ] Explanation of derogatory credit and Inquiries within 120 days

[ ] Initial TIL

[ ] Explanation of name or address variances

[ ] Affiliated Business Disclosure (if applicable)

[ ] Borrower(s) Gov’t issued photo IDs

[ ] Written list of providers (if applicable)

[ ] AUS Findings/Feedback (DU/DO) - released to Mid America Mortgage

[ ] Anti Steering Disclosure

[ ] VOM (if not on credit report)

[ ] Rate Lock Agreement / Mortgage Loan Origination

[ ] VOR (if required)

Disclosure

[ ] Divorce Decree, Separation, Judgement, Bankruptcy, or other liability

[ ] RESPA Servicing Disclosure

documentation

[ ] ECOA Disclosure

[ ] Cancelled checks to exclude debts (12 months)

[ ] Notice of Right to Receive Appraisal – ECOA

[ ] Mortgage Statement (other than subject)

[ ] Notice of Right to Receive Appraisal – HPML

[ ] Non-Escrowed Mortgage RE tax statement

[ ] Appraisal Credit Card Authorization

[ ] HOA Dues documentation

[ ] Fair Lending Notice

[ ] Payoff Statement or Payoff Calculation (Required on Refis)

[ ] Patriot Act Disclosure

INCOME

[ ] Privacy Policy

W-2 Employee Using Base Pay

[ ] Credit Score Disclosure

[ ] Pay Stub – covering 1 full month with YTD earnings

[ ] Acknowledgement of Receipt of RESPA’s Homeownership

[ ] W-2’s for prior 2 years or VOE with 2 yr. history (written VOE required

Counseling Organizations List AND Copy of List Provided

if using bonus, OT, or commissions to qualify)

[ ] Borrower(s) Credit Authorization

Self-Employed or Rental Income

[ ] Consent to Receive E-mail Delivery

[ ] 1040’s for prior 2 years

[ ] True Certified Letter

[ ] 1099’s for prior 2 years

[ ] Tangible Net Benefit – all refinances

GOVERNMENT LOAN DISCLOSURES

[ ] 1120/1120s for prior 2 years – if ownership is over 25%

[ ] K-1’s for all companies on Schedule E

[ ] Child Care Letter

[ ] CPA Letter or Business Licenses

[ ] Nearest Living Relative

Other - if applicable

[ ] Reserve/Guard Status Letter

[ ] Employment Contracts

[ ] Rights of VA Loan Borrowers

[ ] Lease Agreements

[ ] VA Amendatory Clause

[ ] Awards Letters + proof of current receipt

[ ] Verification of VA Benefits

[ ] Pension Awards + proof of current receipt

[ ] Federal Collection Policy Notice

[ ] Social Security Awards letter + proof of current receipt

[ ] VA Debt Questionnaire

[ ] Child Support Agreement letter + proof of current receipt

[ ] Certificate of Eligibility

[ ] Trust Agreement

[ ] Interest Rate and Discount Disclosure

ASSETS

[ ] CAIVRS numbers for all borrowers – must be clear

[ ] Bank Statement(s) – most recent 2 months and showing funds to close

[ ] LDP/GSA checks – Borrowers, Sellers, Realtors, Appraiser,

[ ] Verification of source for large deposits

Loan Officer & Company

[ ] Earnest Money Deposit source (cancelled check & bank statement)

TITLE AND HAZARD DOCUMENTS

[ ] 401k/IRA/Annuity Statement(s) – most recent 2 months

Title Insurance

[ ] Gift Letter – plus verification of donor funds, proof of transfer and

[ ] Title commitment with 3 year chain of title

deposit into borrower(s) account

[ ] CPL

[ ] NSF fees explanation (if applicable)

[ ] Wire Instructions

[ ] Cancelled checks for any POC items

[ ] Tax Cert

[ ] HUD-1 or contract from sale of previous home – if using proceeds for

Hazard Insurance

down payment

[ ] Hazard Binder with proper coverage & Paid Receipt

[ ] Use of Funds Letter – for any joint account the owner is not a borrower

[ ] Endorsement to Mid America Mortgage or corrected

APPRAISAL

mortgagee clause

[ ] Appraisal – legible photos, addenda, maps, sketch

MISCELLANEOUS

[ ] Appraiser’s license – must be state certified

[ ] Signed 4506-T

[ ] Proof Borrower Received Copy of Appraisal/Valuations

[ ] POA – must be prior approved

1

1