Form Otr-308 - Application For Specific Exemption From D.c. Sales And Use Tax

ADVERTISEMENT

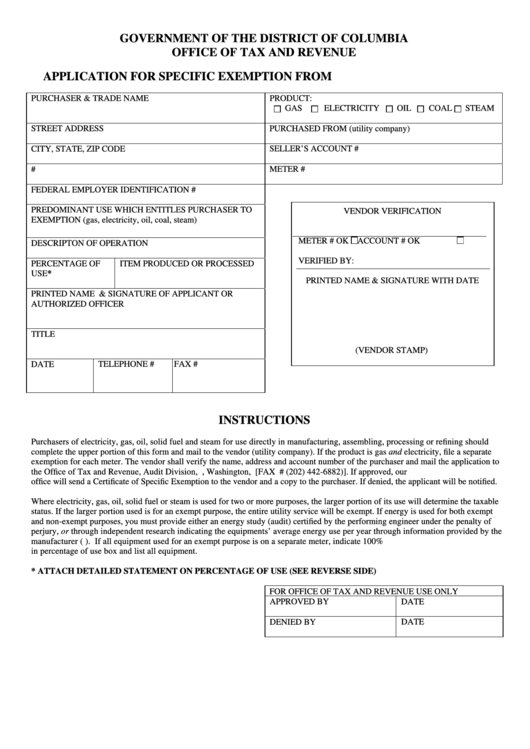

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF TAX AND REVENUE

APPLICATION FOR SPECIFIC EXEMPTION FROM D.C. SALES AND USE TAX

PURCHASER & TRADE NAME

PRODUCT:

GAS

ELECTRICITY

OIL

COAL

STEAM

STREET ADDRESS

PURCHASED FROM (utility company)

CITY, STATE, ZIP CODE

SELLER’S ACCOUNT #

D.C. SALES TAX REGISTRATION #

METER #

FEDERAL EMPLOYER IDENTIFICATION #

PREDOMINANT USE WHICH ENTITLES PURCHASER TO

VENDOR VERIFICATION

EXEMPTION (gas, electricity, oil, coal, steam)

METER # OK

ACCOUNT # OK

DESCRIPTON OF OPERATION

VERIFIED BY:

PERCENTAGE OF

ITEM PRODUCED OR PROCESSED

USE*

PRINTED NAME & SIGNATURE WITH DATE

PRINTED NAME & SIGNATURE OF APPLICANT OR

AUTHORIZED OFFICER

TITLE

(VENDOR STAMP)

DATE

TELEPHONE #

FAX #

INSTRUCTIONS

Purchasers of electricity, gas, oil, solid fuel and steam for use directly in manufacturing, assembling, processing or refining should

complete the upper portion of this form and mail to the vendor (utility company). If the product is gas and electricity, file a separate

exemption for each meter. The vendor shall verify the name, address and account number of the purchaser and mail the application to

the Office of Tax and Revenue, Audit Division, P.O. Box 556, Washington, D.C.20044 [FAX # (202) 442-6882)]. If approved, our

office will send a Certificate of Specific Exemption to the vendor and a copy to the purchaser. If denied, the applicant will be notified.

Where electricity, gas, oil, solid fuel or steam is used for two or more purposes, the larger portion of its use will determine the taxable

status. If the larger portion used is for an exempt purpose, the entire utility service will be exempt. If energy is used for both exempt

and non-exempt purposes, you must provide either an energy study (audit) certified by the performing engineer under the penalty of

perjury, or through independent research indicating the equipments’ average energy use per year through information provided by the

manufacturer (i.e. labels affixed to the equipment). If all equipment used for an exempt purpose is on a separate meter, indicate 100%

in percentage of use box and list all equipment.

* ATTACH DETAILED STATEMENT ON PERCENTAGE OF USE (SEE REVERSE SIDE)

FOR OFFICE OF TAX AND REVENUE USE ONLY

APPROVED BY

DATE

DENIED BY

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2