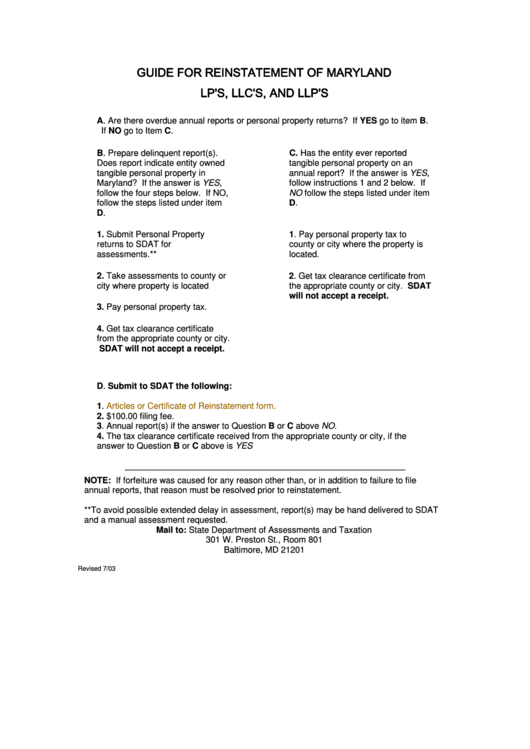

Guide For Reinstatement Of Maryland Lp'S, Llc'S, And Llp'S

ADVERTISEMENT

A. Are there overdue annual reports or personal property returns? If YES go to item B.

If NO go to Item C.

B. Prepare delinquent report(s).

C. Has the entity ever reported

Does report indicate entity owned

tangible personal property on an

tangible personal property in

annual report? If the answer is YES,

Maryland? If the answer is YES,

follow instructions 1 and 2 below. If

follow the four steps below. If NO,

NO follow the steps listed under item

follow the steps listed under item

D.

D.

1. Submit Personal Property

1. Pay personal property tax to

returns to SDAT for

county or city where the property is

assessments.**

located.

2. Take assessments to county or

2. Get tax clearance certificate from

city where property is located

the appropriate county or city. SDAT

will not accept a receipt.

3. Pay personal property tax.

4. Get tax clearance certificate

from the appropriate county or city.

SDAT will not accept a receipt.

D. Submit to SDAT the following:

1.

Articles or Certificate of Reinstatement form.

2. $100.00 filing fee.

3. Annual report(s) if the answer to Question B or C above NO.

4. The tax clearance certificate received from the appropriate county or city, if the

answer to Question B or C above is YES

NOTE: If forfeiture was caused for any reason other than, or in addition to failure to file

annual reports, that reason must be resolved prior to reinstatement.

**To avoid possible extended delay in assessment, report(s) may be hand delivered to SDAT

and a manual assessment requested.

Mail to: State Department of Assessments and Taxation

301 W. Preston St., Room 801

Baltimore, MD 21201

Revised 7/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1