Instructions For 2008 Wisconsin Form 4-Es - Corporation Estimated Tax

ADVERTISEMENT

Instructions for 2008 Wisconsin Form 4-ES – Corporation Estimated Tax

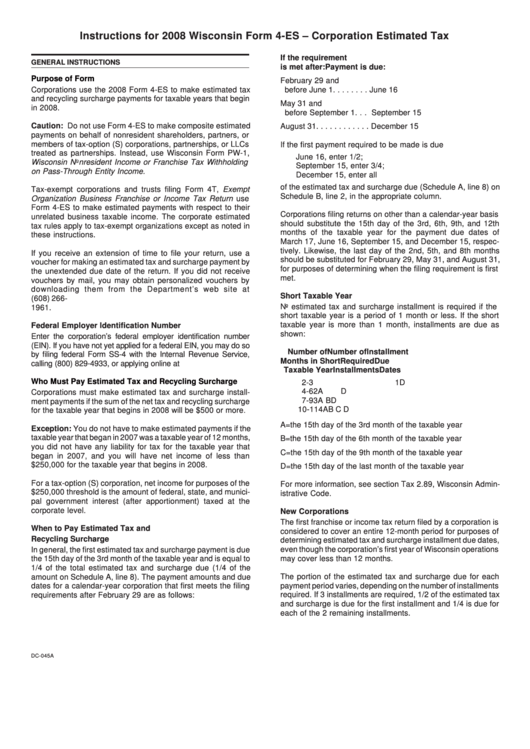

If the requirement

GENERAL INSTRUCTIONS

is met after:

Payment is due:

Purpose of Form

February 29 and

Corporations use the 2008 Form 4-ES to make estimated tax

before June 1 . . . . . . . . June 16

and recycling surcharge payments for taxable years that begin

May 31 and

in 2008.

before September 1 . . . September 15

Caution: Do not use Form 4-ES to make composite estimated

August 31 . . . . . . . . . . . . December 15

payments on behalf of nonresident shareholders, partners, or

members of tax-option (S) corporations, partnerships, or LLCs

If the first payment required to be made is due

treated as partnerships. Instead, use Wisconsin Form PW-1,

June 16, enter 1/2;

Wisconsin Nonresident Income or Franchise Tax Withholding

September 15, enter 3/4;

on Pass-Through Entity Income.

December 15, enter all

of the estimated tax and surcharge due (Schedule A, line 8) on

Tax-exempt corporations and trusts filing Form 4T, Exempt

Schedule B, line 2, in the appropriate column.

Organization Business Franchise or Income Tax Return use

Form 4-ES to make estimated payments with respect to their

Corporations filing returns on other than a calendar-year basis

unrelated business taxable income. The corporate estimated

should substitute the 15th day of the 3rd, 6th, 9th, and 12th

tax rules apply to tax-exempt organizations except as noted in

months of the taxable year for the payment due dates of

these instructions.

March 17, June 16, September 15, and December 15, respec-

tively. Likewise, the last day of the 2nd, 5th, and 8th months

If you receive an extension of time to file your return, use a

should be substituted for February 29, May 31, and August 31,

voucher for making an estimated tax and surcharge payment by

for purposes of determining when the filing requirement is first

the unextended due date of the return. If you did not receive

met.

vouchers by mail, you may obtain personalized vouchers by

downloading them from the Department’s web site at

Short Taxable Year

or by calling (608) 266-

No estimated tax and surcharge installment is required if the

1961.

short taxable year is a period of 1 month or less. If the short

taxable year is more than 1 month, installments are due as

Federal Employer Identification Number

shown:

Enter the corporation’s federal employer identification number

(EIN). If you have not yet applied for a federal EIN, you may do so

Number of

Number of

Installment

by filing federal Form SS-4 with the Internal Revenue Service,

Months in Short

Required

Due

calling (800) 829-4933, or applying online at

Taxable Year

Installments

Dates

Who Must Pay Estimated Tax and Recycling Surcharge

2-3

1

D

4-6

2

A

D

Corporations must make estimated tax and surcharge install-

7-9

3

A B

D

ment payments if the sum of the net tax and recycling surcharge

10-11

4

A B C D

for the taxable year that begins in 2008 will be $500 or more.

A = the 15th day of the 3rd month of the taxable year

Exception: You do not have to make estimated payments if the

taxable year that began in 2007 was a taxable year of 12 months,

B = the 15th day of the 6th month of the taxable year

you did not have any liability for tax for the taxable year that

C = the 15th day of the 9th month of the taxable year

began in 2007, and you will have net income of less than

$250,000 for the taxable year that begins in 2008.

D = the 15th day of the last month of the taxable year

For a tax-option (S) corporation, net income for purposes of the

For more information, see section Tax 2.89, Wisconsin Admin-

$250,000 threshold is the amount of federal, state, and munici-

istrative Code.

pal government interest (after apportionment) taxed at the

corporate level.

New Corporations

The first franchise or income tax return filed by a corporation is

When to Pay Estimated Tax and

considered to cover an entire 12-month period for purposes of

Recycling Surcharge

determining estimated tax and surcharge installment due dates,

even though the corporation’s first year of Wisconsin operations

In general, the first estimated tax and surcharge payment is due

may cover less than 12 months.

the 15th day of the 3rd month of the taxable year and is equal to

1/4 of the total estimated tax and surcharge due (1/4 of the

The portion of the estimated tax and surcharge due for each

amount on Schedule A, line 8). The payment amounts and due

dates for a calendar-year corporation that first meets the filing

payment period varies, depending on the number of installments

required. If 3 installments are required, 1/2 of the estimated tax

requirements after February 29 are as follows:

and surcharge is due for the first installment and 1/4 is due for

each of the 2 remaining installments.

DC-045A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3