Reset Form

Michigan Department of Treasury

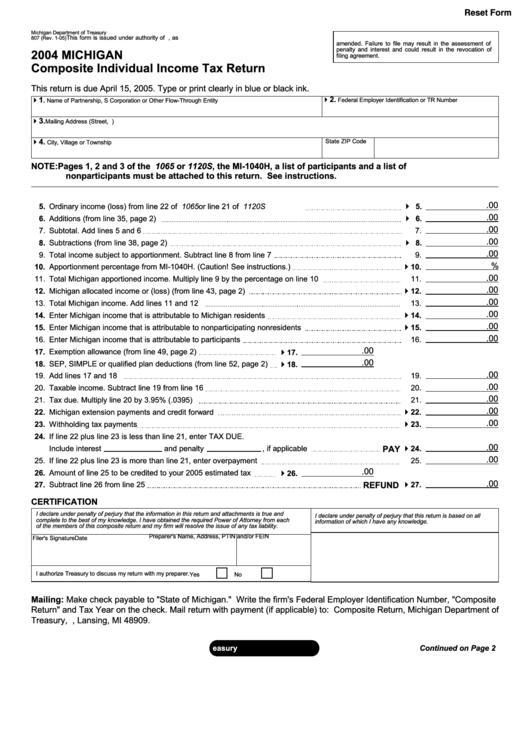

This form is issued under authority of P.A. 281 of 1967, as

807 (Rev. 1-05)

amended. Failure to file may result in the assessment of

penalty and interest and could result in the revocation of

2004 MICHIGAN

filing agreement.

Composite Individual Income Tax Return

This return is due April 15, 2005. Type or print clearly in blue or black ink.

42.

41

Federal Employer Identification or TR Number

. Name of Partnership, S Corporation or Other Flow-Through Entity

43.

Mailing Address (Street, P.O. Box or Rural Route No.)

44.

State

ZIP Code

City, Village or Township

NOTE: Pages 1, 2 and 3 of the U.S. 1065 or 1120S, the MI-1040H, a list of participants and a list of

nonparticipants must be attached to this return. See instructions.

4

.00

5.

Ordinary income (loss) from line 22 of U.S. 1065 or line 21 of U.S. 1120S

5.

.00

4

6.

Additions (from line 35, page 2)

6.

.00

7.

Subtotal. Add lines 5 and 6

7.

.00

4

8.

Subtractions (from line 38, page 2)

8.

.00

9.

Total income subject to apportionment. Subtract line 8 from line 7

9.

%

4

10.

Apportionment percentage from MI-1040H. (Caution! See instructions.)

10.

.00

11.

Total Michigan apportioned income. Multiply line 9 by the percentage on line 10

11.

.00

4

12.

Michigan allocated income or (loss) (from line 43, page 2)

12.

.00

13.

Total Michigan income. Add lines 11 and 12

13.

.00

4

14.

Enter Michigan income that is attributable to Michigan residents

14.

.00

4

15.

Enter Michigan income that is attributable to nonparticipating nonresidents

15.

.00

16.

Enter Michigan income that is attributable to participants

16.

.00

17.

Exemption allowance (from line 49, page 2)

4

17.

.00

4

18.

SEP, SIMPLE or qualified plan deductions (from line 52, page 2)

18.

.00

19.

Add lines 17 and 18

19.

.00

20.

Taxable income. Subtract line 19 from line 16

20.

.00

21.

Tax due. Multiply line 20 by 3.95% (.0395)

21.

.00

4

22.

Michigan extension payments and credit forward

22.

.00

4

23.

Withholding tax payments

23.

24.

If line 22 plus line 23 is less than line 21, enter TAX DUE.

.00

4

Include interest

and penalty

, if applicable

PAY

24.

.00

25.

If line 22 plus line 23 is more than line 21, enter overpayment

25.

.00

4

26.

Amount of line 25 to be credited to your 2005 estimated tax

26.

.00

4

27.

Subtract line 26 from line 25

REFUND

27.

CERTIFICATION

I declare under penalty of perjury that the information in this return and attachments is true and

I declare under penalty of perjury that this return is based on all

complete to the best of my knowledge. I have obtained the required Power of Attorney from each

information of which I have any knowledge.

of the members of this composite return and my firm will resolve the issue of any tax liability.

Preparer's Name, Address, PTIN and/or FEIN

Filer's Signature

Date

I authorize Treasury to discuss my return with my preparer.

Yes

No

Mailing: Make check payable to "State of Michigan." Write the firm's Federal Employer Identification Number, "Composite

Return" and Tax Year on the check. Mail return with payment (if applicable) to: Composite Return, Michigan Department of

Treasury, P.O. Box 30058, Lansing, MI 48909.

Continued on Page 2

1

1 2

2