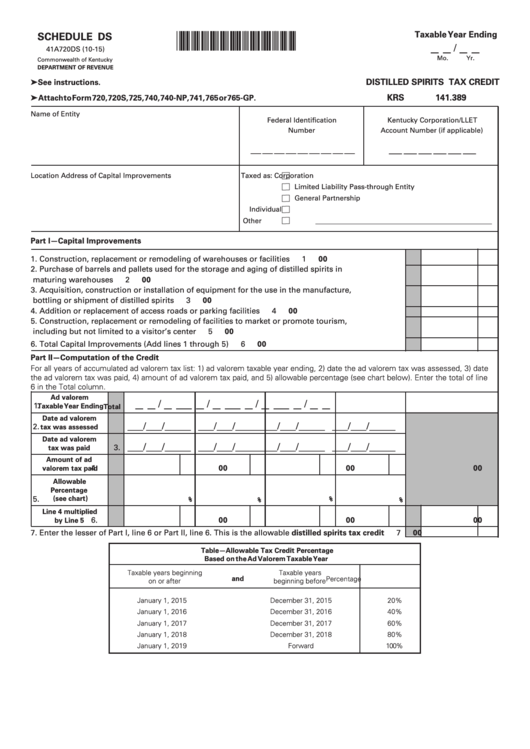

Taxable Year Ending

SCHEDULE DS

*1500030237*

_ _

_ _

/

41A720DS (10-15)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

DISTILLED SPIRITS TAX CREDIT

➤ See instructions.

KRS 141.389

➤ Attach to Form 720, 720S, 725, 740, 740-NP , 741, 765 or 765-GP .

Name of Entity

Federal Identification

Kentucky Corporation/LLET

Number

Account Number (if applicable)

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Location Address of Capital Improvements

Taxed as:

Corporation

Limited Liability Pass-through Entity

General Partnership

Individual

Other

Part I—Capital Improvements

1. Construction, replacement or remodeling of warehouses or facilities ................................................

1

00

2. Purchase of barrels and pallets used for the storage and aging of distilled spirits in

maturing warehouses ..............................................................................................................................

2

00

3. Acquisition, construction or installation of equipment for the use in the manufacture,

bottling or shipment of distilled spirits ...................................................................................................

3

00

4. Addition or replacement of access roads or parking facilities ..............................................................

4

00

5. Construction, replacement or remodeling of facilities to market or promote tourism,

including but not limited to a visitor’s center .........................................................................................

5

00

6. Total Capital Improvements (Add lines 1 through 5) .............................................................................

6

00

Part II—Computation of the Credit

For all years of accumulated ad valorem tax list: 1) ad valorem taxable year ending, 2) date the ad valorem tax was assessed, 3) date

the ad valorem tax was paid, 4) amount of ad valorem tax paid, and 5) allowable percentage (see chart below). Enter the total of line

6 in the Total column.

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

Ad valorem

/

/

/

/

1.

Taxable Year Ending

Total

Date ad valorem

___/___/_____ ___/___/_____ ___/___/_____ ___/___/_____

2.

tax was assessed

Date ad valorem

___/___/_____ ___/___/_____ ___/___/_____ ___/___/_____

3.

tax was paid

Amount of ad

4.

00

00

00

00

valorem tax paid

Allowable

Percentage

(see chart)

5.

%

%

%

%

Line 4 multiplied

6.

00

00

00

00

6

00

by Line 5

7. Enter the lesser of Part I, line 6 or Part II, line 6. This is the allowable distilled spirits tax credit ......

7

00

Table—Allowable Tax Credit Percentage

Based on the Ad Valorem Taxable Year

Taxable years beginning

Taxable years

and

Percentage

on or after

beginning before

January 1, 2015

December 31, 2015

20%

January 1, 2016

December 31, 2016

40%

January 1, 2017

December 31, 2017

60%

January 1, 2018

December 31, 2018

80%

January 1, 2019

Forward

100%

1

1