Form 511 - Schedule E - Credit For Tax Paid To Another State - 2000

ADVERTISEMENT

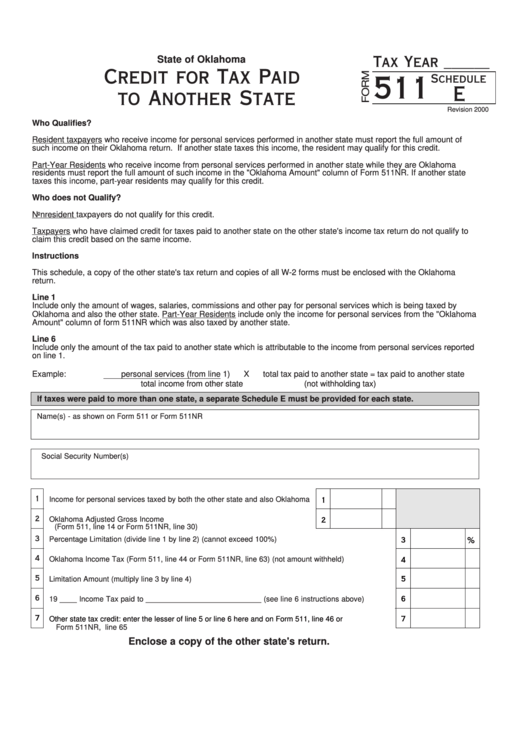

State of Oklahoma

Tax Year ______

Credit for Tax Paid

Schedule

511

E

to Another State

Revision 2000

Who Qualifies?

Resident taxpayers who receive income for personal services performed in another state must report the full amount of

such income on their Oklahoma return. If another state taxes this income, the resident may qualify for this credit.

Part-Year Residents who receive income from personal services performed in another state while they are Oklahoma

residents must report the full amount of such income in the "Oklahoma Amount" column of Form 511NR. If another state

taxes this income, part-year residents may qualify for this credit.

Who does not Qualify?

Nonresident taxpayers do not qualify for this credit.

Taxpayers who have claimed credit for taxes paid to another state on the other state's income tax return do not qualify to

claim this credit based on the same income.

Instructions

This schedule, a copy of the other state's tax return and copies of all W-2 forms must be enclosed with the Oklahoma

return.

Line 1

Include only the amount of wages, salaries, commissions and other pay for personal services which is being taxed by

Oklahoma and also the other state. Part-Year Residents include only the income for personal services from the "Oklahoma

Amount" column of form 511NR which was also taxed by another state.

Line 6

Include only the amount of the tax paid to another state which is attributable to the income from personal services reported

on line 1.

Example:

personal services (from line 1)

X

total tax paid to another state = tax paid to another state

total income from other state

(not withholding tax)

If taxes were paid to more than one state, a separate Schedule E must be provided for each state.

Name(s) - as shown on Form 511 or Form 511NR

Social Security Number(s)

1

Income for personal services taxed by both the other state and also Oklahoma

1

2

Oklahoma Adjusted Gross Income

.............................................................................

2

(Form 511, line 14 or Form 511NR, line 30)

3

Percentage Limitation (divide line 1 by line 2) (cannot exceed 100%)

.............................................................

3

%

4

Oklahoma Income Tax (Form 511, line 44 or Form 511NR, line 63) (not amount withheld)

.........................

4

5

Limitation Amount (multiply line 3 by line 4)

.............................................................................................................

5

6

19 ____ Income Tax paid to ___________________________ (see line 6 instructions above)

............

6

7

Other state tax credit: enter the lesser of line 5 or line 6 here and on Form 511, line 46 or

7

Form 511NR, line 65

...................................................................................................................................................

Enclose a copy of the other state's return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1