Form 518 - Registration For Michigan Taxes

ADVERTISEMENT

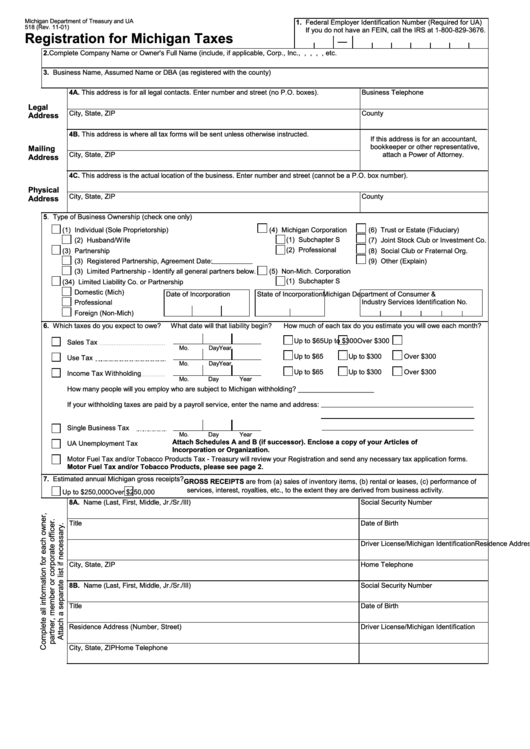

Michigan Department of Treasury and UA

1. Federal Employer Identification Number (Required for UA)

518 (Rev. 11-01)

If you do not have an FEIN, call the IRS at 1-800-829-3676.

Registration for Michigan Taxes

2. Complete Company Name or Owner's Full Name (include, if applicable, Corp., Inc., P.C., L.C., L.L.C., L.L.P., etc.

3. Business Name, Assumed Name or DBA (as registered with the county)

4A. This address is for all legal contacts. Enter number and street (no P.O. boxes).

Business Telephone

Legal

City, State, ZIP

County

Address

4B. This address is where all tax forms will be sent unless otherwise instructed.

If this address is for an accountant,

bookkeeper or other representative,

Mailing

City, State, ZIP

attach a Power of Attorney.

Address

4C. This address is the actual location of the business. Enter number and street (cannot be a P.O. box number).

Physical

City, State, ZIP

County

Address

5. Type of Business Ownership (check one only)

(1) Individual (Sole Proprietorship)

(4) Michigan Corporation

(6) Trust or Estate (Fiduciary)

(1) Subchapter S

(2) Husband/Wife

(7) Joint Stock Club or Investment Co.

(2) Professional

(3) Partnership

(8) Social Club or Fraternal Org.

(3) Registered Partnership, Agreement Date:

(9) Other (Explain)

(3) Limited Partnership - Identify all general partners below.

(5) Non-Mich. Corporation

(1) Subchapter S

(34) Limited Liability Co. or Partnership

Domestic (Mich)

Date of Incorporation

State of Incorporation

Michigan Department of Consumer &

Industry Services Identification No.

Professional

Mo.

Day

Year

Foreign (Non-Mich)

6. Which taxes do you expect to owe?

What date will that liability begin?

How much of each tax do you estimate you will owe each month?

Up to $65

Up to $300

Over $300

Sales Tax

Mo.

Day

Year

Up to $65

Up to $300

Over $300

Use Tax

Mo.

Day

Year

Up to $65

Up to $300

Over $300

Income Tax Withholding

Mo.

Day

Year

How many people will you employ who are subject to Michigan withholding? ____________________

If your withholding taxes are paid by a payroll service, enter the name and address:

Single Business Tax

Mo.

Day

Year

Attach Schedules A and B (if successor). Enclose a copy of your Articles of

UA Unemployment Tax

Incorporation or Organization.

Motor Fuel Tax and/or Tobacco Products Tax - Treasury will review your Registration and send any necessary tax application forms.

Motor Fuel Tax and/or Tobacco Products, please see page 2.

7. Estimated annual Michigan gross receipts? GROSS RECEIPTS are from (a) sales of inventory items, (b) rental or leases, (c) performance of

services, interest, royalties, etc., to the extent they are derived from business activity.

Up to $250,000

Over $250,000

8A. Name (Last, First, Middle, Jr./Sr./III)

Social Security Number

Title

Date of Birth

Residence Address (Number, Street)

Driver License/Michigan Identification

City, State, ZIP

Home Telephone

8B. Name (Last, First, Middle, Jr./Sr./III)

Social Security Number

Title

Date of Birth

Residence Address (Number, Street)

Driver License/Michigan Identification

City, State, ZIP

Home Telephone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5